A year ago, I was bullish on this group of stocks.

Today, I'm just as bullish... And by the end of today's issue, you will be, too. Here's why...

On April 24, 2019, I wrote to Health & Wealth Bulletin subscribers about how a certain group of stocks should go higher because of basic economics. Here's what I said at the time:

Let's have a quick and easy Economics 101 lesson...

When demand exceeds supply, prices rise to bring the relationship back into equilibrium. There are very few times when you see an imbalance in a supply and demand relationship.

Since we have a free market in the U.S., supply should typically always meet demand. After all, if there's demand that's not being met, some entrepreneur will find a way to satisfy it. But we're not seeing that today in one industry.

We saw that the economics didn't look right years ago and we've been writing about it since then. It's created a buying opportunity...

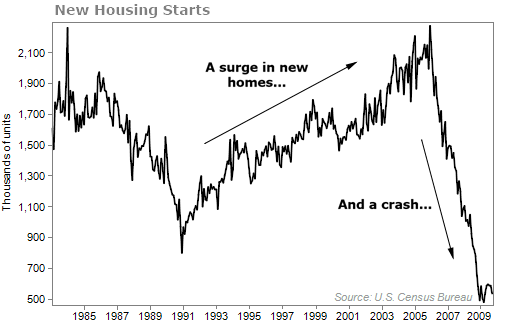

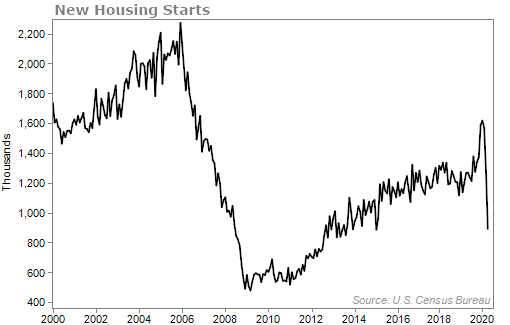

There was a homebuilding boom in 2000 to 2005 because demand for homes was through the roof. Everyone needed to have that new five-bedroom house, so housing starts – an indicator that reflects how many new homes are being built – skyrocketed...

Then the housing market collapsed. And we saw new home construction crash during the recession.

But the economy slowly began to recover after 2010. Unemployment began to drop. Wages slowly started to increase. Consumers started to gain confidence. They started spending again. And they were ready to buy new homes...

The only problem is that homebuilders didn't build enough homes...

Even though housing starts gradually increased, demand far exceeds supply.

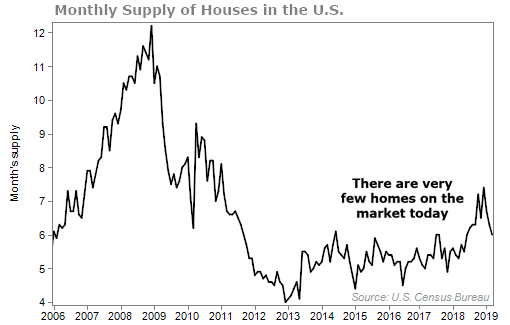

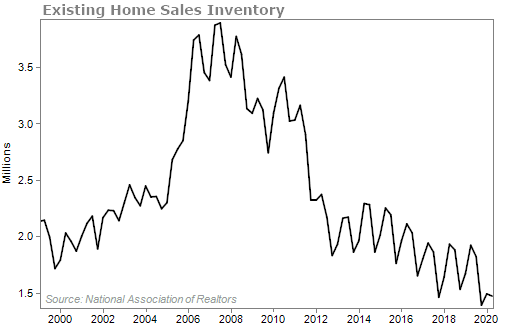

The problem isn't that there aren't enough people selling homes to match the number of buyers... It's for lack of inventory.

The chart below shows the ratio of houses for sale versus houses sold. When the ratio is low, it tells us that buyers have few homes to choose from...

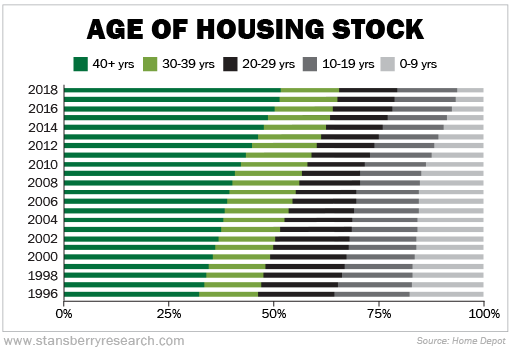

The homes that are on the market are extremely old, too. According to the National Association of Home Builders, the median age of owner-occupied homes in the U.S. is more than 35 years. More than half of all homes were built before 1980 and 38% were built before 1970.

When potential home buyers – that have benefited from a growing economy and a raging bull market – are looking for new homes, a 30- or 40-year-old house isn't first on their list. They want something new – a house that doesn't need constant maintenance and repairs.

The point is that there are too few homes buyers want on the market today. More homes need to be built... Period.

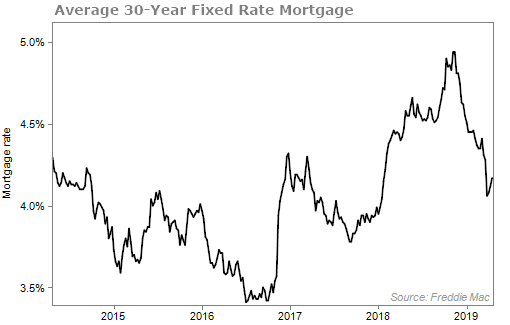

Another positive for the housing market is mortgage rates. Mortgage rates have dropped in recent months, which makes homes more affordable to buy.

Just a few months ago, rates were close to 5%. While a 1% difference may not seem like much, it can add more than $100 to a standard monthly loan payment (assuming a 20% down payment on a $300,000 home). Over the course of 30 years, that's tens of thousands of dollars.

Again, we've been talking about this situation since 2017. The story just made sense to us.

Remember, that was written over a year ago. A lot has changed since then... with one of the sharpest economic downturns ever, thanks to the coronavirus.

So let's check in on the supply and demand equation for housing today...

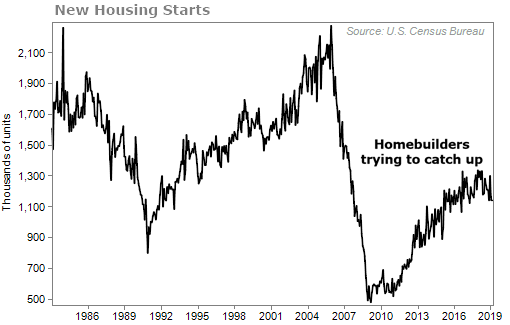

First, housing starts. Thanks to the economic shutdowns the last few months, there haven't been many new homes built. New housing starts has crashed as a result...

Next, consider the supply of homes on the market. U.S. existing home sales inventory is currently near an all-time low...

Also, just for a visual, you can see how the houses that are on the market are getting older...

Finally, let's look at mortgage rates. They were hovering around 4% back in April 2019. Since then, although many thought it wasn't possible, they've become even lower...

Low rates are here to stay... for at least the next couple years. That will encourage many folks to buy homes.

Demand for housing should remain steady.

Add all of this up and you have a healthy housing market. In fact, you could argue the setup today in housing is even more attractive than it has been for the past few years.

Tonight at 8 p.m. Eastern time, Dr. Steve Sjuggerud is hosting a free online event to talk about the opportunity in real estate. My team and I certainly believe that real estate could be a real moneymaker over the next few years and so does Steve.

I hope after today's issue, you do as well. Tonight's event is something that you do not want to miss.

What We're Reading...

- This investment is too good to pass up.

- Something different: When the stock market is this overvalued, it is usually lower 12 months later.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 24, 2020