"You can find good reasons to scuttle your equities in every morning paper and on every broadcast of the nightly news."

So said legendary investor Peter Lynch, who managed the best-performing mutual fund in the world.

Lynch had a short but very successful 14-year Wall Street career. But he's usually forgotten as one of the great thinkers of the market. Part of that is due to his lack of "doom and gloom" leanings. In his own words, Lynch was the "Will Rogers of equities, the man who never saw a stock he didn't like."

That attitude led Lynch's Fidelity Magellan Fund to return 29% a year from 1977 to 1990... more than doubling the performance of the S&P 500.

Many serious investors tend to scorn those who run their portfolios with Lynch's brand of optimism. But optimism has been the most successful strategy for long-term success.

Lynch's fund succeeded through two recessions in 1980 and 1981, the astronomical Volcker's interest rates of 20%, and the Black Monday crash of 1987.

Read that list again if you're considering getting out of your investments today.

The simple truth is that markets and economies are strong, resilient institutions... And since businesses tend to grow, so do financial assets.

Skepticism is healthy. Unbridled optimism can drive you to long-shot growth companies with sky-high valuations or lead you to concentrate too much wealth in an investment that you believe to be a sure thing.

But an unshakeable sense of impending doom doesn't serve anyone well.

Let's look at a few of the most common "existential threats" to the market that are scaring investors...

Again... right now, we aren't particularly worried about threats to the market. As Lynch said, at any time, you can find a number of bearish indicators to argue the case for a collapse.

Recently, folks were up in arms about an earnings recession. That recently turned around. We now have earnings growth. The earnings for the S&P 500 are up 7.8% over last year.

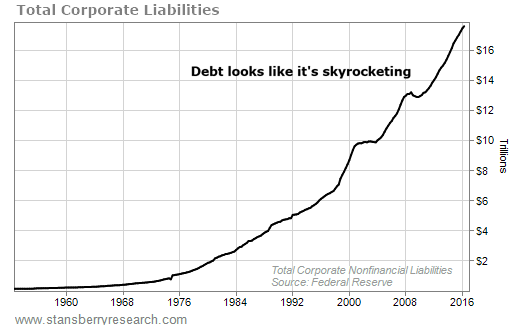

Folks also love to focus on the amount of debt in the system. After all, as you can see in this chart, it has climbed almost nonstop...

But is it fair to compare the total stock of outstanding debt from 1960 to the numbers today? Of course not. The world is much bigger now. It's inevitable that the level of debt would expand.

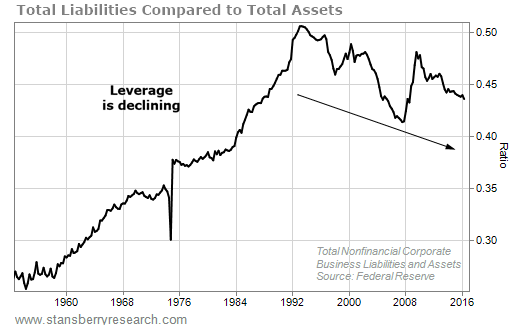

That's why you should always compare debt with assets, as you can see in the chart below...

On this measure, it appears that the lessons of the financial crisis have been learned. The deleveraging continues, despite historically low interest rates.

And you can look at recent history to find more "disasters" that failed to materialize. Not long ago, folks considered "Peak Oil" and prices north of $250 a barrel an inevitability. That was a bust.

And other trends that seem certain have a limited time horizon. For instance, demographic shifts will undoubtedly drive health care spending higher, but after a few decades, the effects will peter out.

And remember a few months ago when folks were predicting that a Trump presidency would crash the market? See how that turned out...

So rather than try and weigh the evidence of one potential future against each other, we prepare for both.

For example, in my monthly newsletters, my team and I focus on profitable businesses with productive assets. We take reasonable position sizes. We hold multiple asset classes intentionally – things like stocks and bonds, preferreds, munis, and international businesses. If an asset returns steady income with a margin of safety, it will serve us well as investors.

And recently... I've decided that I'm going to go a step further...

I'm going to make it even more foolproof to get income in retirement. I want to show you exactly how many shares to buy of each position... what price to pay... and of course when to sell, and where to put the proceeds, too.

If you're interested, please set aside about an hour tomorrow night. I'll be live, on air, with my friends and partners, Porter Stansberry and Steve Sjuggerud. We're going to reveal a brand-new way of putting our research to work.

I'll also discuss how to position your portfolio as the bull market starts to get long in the tooth.

To get a VIP text reminder for this live seminar, click here. And get your questions ready... I'll be answering them, live.

What We're Reading...

- The history of the "peak oil" theory.

- Something different: National Geographic's list of the best trips to take in 2017 has us wanting to hop on a plane.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

Baltimore, Maryland

January 11, 2017