Doc's note: It's something I've told readers for years... No one will care about your health and wealth as much as you do. That's why I spend my time trying to empower you to make the best decisions for yourself.

That's why today I'm sharing an essay from my friend Joel Litman, founder and chief investment strategist at our corporate affiliate Altimetry (originally published in February). Joel details a story of the government failing to protect average folks from fraud. And he explains how to spot red flags at companies... before you give them your money.

The "Rattlesnake King" paid $20 for his sins...

Cowboy Clark Stanley's fame as a snake-oil salesman had been steadily building in the late 19th century.

In 1893, Stanley was invited to the Chicago World's Columbian Exposition to showcase the miracle cure that had made him famous. He claimed his elixir could heal various maladies – from rheumatism and pains to sprains and burns.

Stanley had been selling his snake oil for years in roving performances across the U.S. frontier. With a giant pot of water simmering onstage, he'd proceed to take rattlesnake after rattlesnake out of his burlap sack. He'd cut each one open and throw it into the vat.

He'd been making a pretty penny... and making a name for himself.

After the world heard about Stanley at the fair in Chicago, his opportunities truly took off. Orders for his cure-all elixir flew in.

There was just one problem...

Stanley's oil was worthless. And it wasn't even snake oil.

Almost 25 years later, U.S. authorities finally tested Stanley's concoction...

Instead of finding rattlesnake oil, they found mineral oil, beef fat, chili peppers, and turpentine.

Stanley was selling a "cure all" that didn't cure anything. Even worse, he was lying about what was actually in his product.

The authorities had him dead to rights. So you might assume they threw the book at him for his decades of misdeeds. Not so fast...

Instead, they fined him $20. That's the equivalent of around $465 in today's money – or a measly 40 bottles of his so-called snake oil.

In other words, the little guy couldn't trust regulators for protection back then. And unfortunately, as we'll explain today, not much has changed...

When it comes to investing in tiny companies, the government isn't going to look out for you. And some of these businesses could do a lot of damage to unsuspecting investors' portfolios if they don't know what to look for.

A lot more fraud is out there than you think...

A recent study in the Review of Accounting Studies shows how common fraud, misstatements, and accounting discrepancies are.

The analysis found that around 10% of large public companies commit securities fraud in any given year. And fraud destroys an estimated 1.6% of total equity value annually. That was $830 billion in 2021.

Now, defining fraud can be tricky. And the study takes a rather loose view of it.

The authors aren't necessarily talking about legal fraud. They aren't alleging crimes. Instead, the study considers it "fraud" when a company misrepresents any figures to the public. That can include misstatements and restated financials.

These don't always turn out to be truly "fraudulent" in the end. So the estimated percentage from the study is likely a bit high. Even so, investors need to be alert and aware.

Plus, this study specifically focused on public companies with more than $750 million in assets. The truth is, a lot of public companies aren't that big.

And in our experience, the smaller companies are often just as risky...

The oversight boards that keep public companies in line usually focus on the big fish. That means if you want to invest in smaller companies, you need to do your own research.

Each quarter in our Microcap Confidential advisory, we publish a Do Not Buy List for subscribers. And even for our monthly recommendations, we do a deep, fundamental forensics analysis with every microcap to accurately analyze the company's risks.

Before accounting, it's most important to pay attention to the key "players" involved in a company. We look at the quality of the auditor... whether any executives have a history of trouble with regulators (what we call "bad actors")... and questionable headquarters locations.

Believe it or not, some companies will even make up corporate addresses. We once found a company where the address pointed to a trailer in an executive's backyard.

These can be giveaways that companies are at higher risk of fraud. At the very least, they probably aren't acting in the interest of shareholders.

It's also important to look for delinquent filings and other red flags...

Things like high management turnover or constant promotions can signal that a company engages in misleading activity.

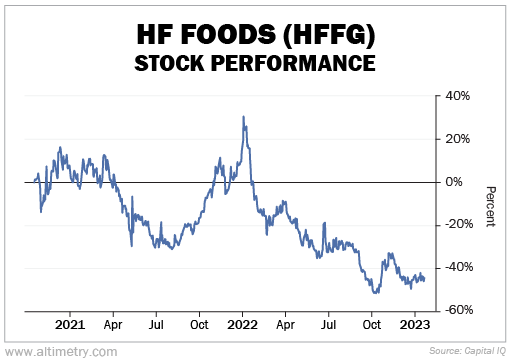

That's what we found with food distributor HF Foods (HFFG) in a recent Do Not Buy List.

When we added HF Foods to our Do Not Buy List in October 2020, we mentioned that its auditor had a history of audit deficiencies. We suggested that it could cause issues down the road.

Then, in 2022, the company received two separate noncompliance letters from the Nasdaq and was threatened with delisting.

Shares are down more than 44% since we added it to our Do Not Buy List. Take a look...

Another company we recently highlighted was NaturalShrimp (SHMP)...

We first introduced our subscribers to the "aqua tech" company in March 2022. At the time, we saw several pressing issues...

For instance, NaturalShrimp has been around for 20 years. And yet, 2022 was the first time the company booked revenue since 2015.

Plus, its auditor has a history of audit deficiencies. That's a red flag to us. NaturalShrimp has been delinquent with its U.S. Securities and Exchange Commission ("SEC") filings 16 times since 2010.

Late last year, NaturalShrimp announced that Yotta Acquisition, a special purpose acquisition company, would acquire the business so it can be listed on the Nasdaq. This is a clever workaround to getting listed on a good exchange, rather than "over the counter."

This will not solve any of its existing issues.

The company has already struggled with delaying its SEC filings. And it has bad actors in its management team, among other issues.

Since we added NaturalShrimp to the Do Not Buy List last March, its stock has fallen by more than 60%. Take a look...

Looking into these two companies really shows how these metrics are things that you can look out for and always double-check before you jump into a business.

In short, when researching a company, it's important to do your homework...

This is especially the case with smaller companies, since they're less regulated. However, companies of all sizes are susceptible to the issues we discussed today.

Before making an investment, make sure you know the company's key players. That includes its auditors, its board members, and its management team.

These are the folks steering the ship. You want to make sure they'll take it in the right direction.

When it comes down to it, the only person who will look out for your money is you. Don't blindly trust that management or the government is looking out for your interests as an investor.

Do your own research. And make sure you're confident in a company before putting your money to work.

Regards,

Joel Litman

Editor's note: This Wednesday, Joel is stepping forward to reveal a red flag signaling a huge event that's scheduled to hit U.S. stocks in the coming weeks. According to Joel, abnormally large gains – and losses – are set to follow. If you want to learn how to prepare for what's coming, click here to reserve your spot.