Doc's note: Longtime readers know I'm a newsletter junkie. In fact, I'm one of the biggest readers I know. I plow through more than a dozen advisories every month. But if there's anyone who might read as much as me, it's Berna Barshay.

And in today's issue, Berna explains how reading can lead you to big investment opportunities...

They say a woman's work is never done...

While I agree that's true, I'd add that a stock analyst's job is never done, either.

I can never seem to reach the end of my "to do" list because there's always another stock to look at.

Great analysts are notorious for suffering from "FOMO" – or the fear of missing out. No matter how many things we get right or how well our picks perform, we're haunted by the one that got away: the stock that ran away from you before you got around to digging in on it.

Another reason I feel like I'm never truly done is that there's always something else to read...

I subscribe to dozens of newspapers, magazines, trade rags, and newsletters... And I frequent a ton of news websites. I'll never finish reading everything that's in my backlog already, yet I'm always adding more to the list.

I've found a service called Pocket that is a lifesaver. When I come across an interesting article about a company, trend, or industry that I think could be relevant to an existing investment or help me uncover a new one, I usually save it to Pocket, so I can read it later.

I'll admit that no matter how much time I have, I'll never get to the bottom of my Pocket list. I have hundreds, if not thousands, of articles saved there. Some at the bottom of the pile are surely stale and irrelevant by now, but my FOMO tells me I'm going to miss a great investing opportunity one day because of an article I just never got to... I have to accept that as an occupational hazard.

Apparently, I read a lot. In December, Pocket told me I was in the top 5% of readers on the site...

By the time a stock is highlighted on the front page of the Wall Street Journal, you're probably late to the trade...

You also may have heard of the "Businessweek cover curse," the phenomenon in which the magazine – along with its peers Forbes and Fortune – are thought to be contrary indicators.

This idea came about after an infamous 1979 Businessweek cover story titled "The Death of Equities." The cover coincided with the near trough for stocks and the beginning of a nearly two-decade bull market.

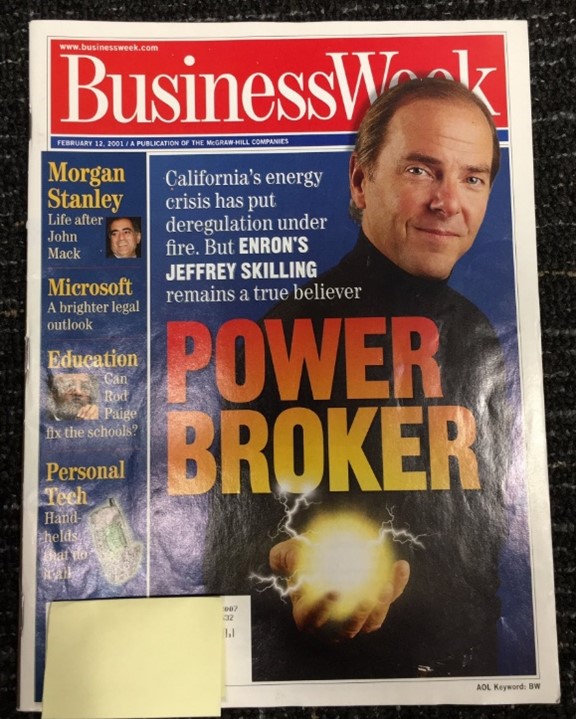

Many companies have been lauded on the cover of one of these magazines, only to see their fortunes quickly fade. One example that comes to mind involves this cover piece featuring Enron CEO Jeffery Skilling in February 2001...

Source: Twitter.com/rocket_jenross

By the end of the year, Enron was in bankruptcy.

No doubt, believing everything you read in the popular business press can often lead you astray in your investing...

But reading a lot can help you find great investments. And getting great leads from your reading requires that you mix it up in terms of the sources you regularly peruse.

While I spend a lot of time reading all the classics – like the Wall Street Journal, Barron's, and my Bloomberg terminal – I spend an equal amount of time reading trade journals, less-trafficked business websites, blogs, and "FinTwit" (financial Twitter).

For every industry I cover, I have some "go tos" that help me identify trends and sometimes even investments. For retail, apparel, and footwear, my go-to sources are Women's Wear Daily and the Business of Fashion website. For media and entertainment, I read Variety, Deadline, and Rolling Stone. For tech, I read a lot of blogs, but also websites like Protocol and The Verge.

A great idea or thesis-making piece of information can come from anywhere, and often where you least expect it...

In 2006, the biggest winner at my fund – which made up more than 50% of profits that year – was a massive short position in an online gaming company based in the U.K. called PartyGaming. This short position was largely inspired by a random tidbit in a newspaper article.

At the time, a bunch of online poker sites were doing big business in the U.S., despite being illegal. Prosecutors were just looking the other way, and Wall Street analysts assumed that hands-off attitude toward enforcement would continue.

An article about politics briefly mentioned a speech by then-Senate Majority Leader Bill Frist, in which he made some negative comments about the perils of the unregulated online gaming industry. At the time, Frist was expected to run for president in the next election.

Those throwaway lines, in an article mostly about something else, made me realize that a giant risk could be looming – one that analysts and investors were overlooking entirely.

A few months later, buried in a bill about port security, Congress passed a law explicitly making online betting illegal in the U.S. A few days later, PartyGaming suspended its U.S. operations. The stock fell around 60% that day and drifted even lower from there.

Going into the last weekend before the Congressional recess – when the SAFE Port Act ultimately got voted on – I had sized up my short position to be 10% of my fund. It was the biggest bet of my career, and it paid off big time... and fast.

My favorite story about making money because of something I read involves my husband...

For the better part of three decades, one of my guilty pleasures has been flipping through the pages of Entertainment Weekly. My then-boyfriend – who had never opened a People magazine – relentlessly mocked me for my lowbrow reading habit.

In March 2011, I read an article in Entertainment Weekly about the casting of a little-known actress named Jennifer Lawrence as the lead in studio Lionsgate's (LGF-A) upcoming film The Hunger Games, an adaptation of the wildly popular book by the same title. The casting piqued my interest since I had just seen Lawrence in the 2010 film Winter's Bone and thought she was terrific in it.

I had seen lots of teenagers walking around with The Hunger Games books, so shortly after reading the article about Lawrence, I bought a copy out of curiosity.

My friends will all verify that I am a slow reader of fiction – but I tore through that book in a single weekend. It was a page-turner that featured a resourceful, gritty, athletic, and sympathetic heroine... just like the one Lawrence had played and gotten an Oscar nomination for in Winter's Bone. The college theater minor in me thought the casting was brilliant.

Lionsgate was a stock I had known well in the past...

I had owned it for about three years – and enjoyed a good return – following its 2003 acquisition of Artisan Entertainment.

By 2011, I hadn't owned it in more than five years. But my fascination with The Hunger Games and my enthusiasm about Lawrence's casting prodded me to do my homework and try to figure out what the films, if successful, could mean for Lionsgate's share price.

Lionsgate was a small enough company that one powerful franchise could send the stock soaring.

I determined that sell-side analysts had meaningfully underestimated the potential of the Hunger Games franchise, and I bought LGF-A shares in the second half of 2011. I was confident that the franchise would be a big boost, and that the company would be better understood by the market after the May 2012 release date of the first film.

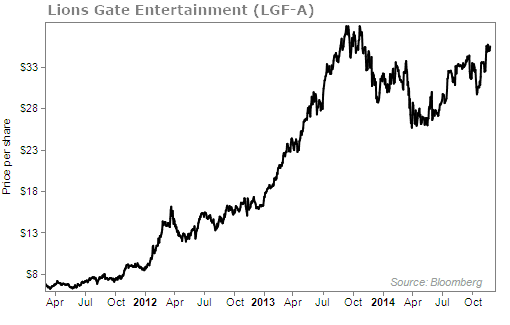

It worked out... The chart below shows the stock's performance from around the time I read the article in Entertainment Weekly through the release of the third of four films in the Hunger Games series...

My guilty-pleasure reading turned out to be highly profitable. As an added bonus, I will forever be able to enjoy my Entertainment Weekly free of mocking, thanks to my husband's appreciation of the high return I got out of Lionsgate, inspired by reading that article.

Inspiration can come from the unlikeliest of places when looking for great investments...

Careful reading with an open mind and a healthy dose of imagination can often be as productive as the footnotes to a corporate filing.

If Entertainment Weekly and Business of Fashion aren't your thing... you can look for clues in publications that align more with your interests. Your next investing home run might be buried in the pages (or websites) of Car and Driver, Popular Mechanics, or GQ.

Regards,

Berna Barshay

Editor's note: Last week, Berna revealed how a "hidden" corner of the market could hand you a long string of double- and triple-digit gains. She also released details on how you can start accelerating your wealth and supercharge your portfolio.