The market is fresh off new highs. Yet the economy is still a mess. Does that mean stocks are in bubble territory?

There's no official definition of a market bubble. People love to throw around the term when a market or a stock is a little overvalued. But we prefer to reserve it for the full-on frenzies... the times when the market has lost its mind.

To be more specific... Stocks are in a bubble when there's no possible future that can support their current valuations.

In other words, does even the most optimistic scenario justify the price you see today?

(In July, my senior analyst Matt Weinschenk talked about bubbles and this definition on Stansberry's Education Center video series. You can watch here.)

Here's an example...

When Uber Technologies (UBER) prepared to launch its initial public offering, some people said it (and other tech stocks) were in a bubble. The company lost tons of money... around $8 billion per year. But it had a market cap around $70 billion. Even its revenue was only about $14 billion, meaning it traded around 5 times sales.

Could Uber ever grow big and profitable enough to support that?

Some investors believed Uber had big potential... It wasn't just going to be a taxicab service – it was going to be the only transportation company in the country. It would use driverless cars to deliver people, meals, and goods. No one would own a car. We'd all just Uber around.

Now, that wasn't too likely. But if it were to happen, Uber could be a trillion-dollar company. If you consider it had a 5% chance of doing that... then that would make it worth $50 billion today.

The excitement about Uber's future has since cooled. And few think it will turn into that sort of behemoth. But at least there was a chance.

So by that logic, Uber wasn't in a bubble. It sure looked overvalued. We didn't think it would achieve those goals and didn't like it as an investment. But at least there was some path to it fulfilling its price. And since its IPO, its share price has been mostly flat.

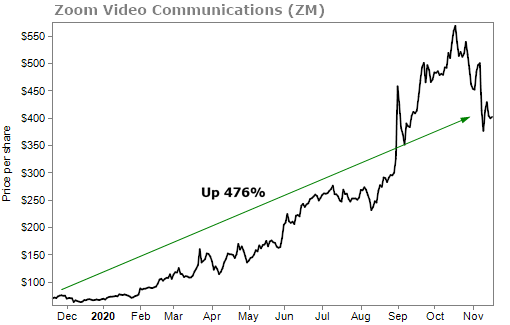

Now let's look at Zoom Video Communications (ZM).

It's been on a rocket ride over the past 12 months. Even with the recent drop because of the positive vaccine news, shares are still up 476%...

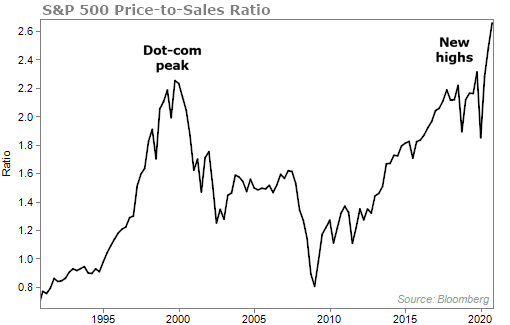

We can forget profits and just look at revenue. Today, Zoom trades at 83 times sales. A mature company trades somewhere between 2 and 4 times sales. The S&P 500 Index, even at its rich valuations today, trades at nearly 2.7 times sales.

Here's the price-to-sales ratios of some well-known businesses to help you get a sense of things...

|

Stock |

Price-to-Sales Ratio |

|---|---|

|

Visa (V) |

17.5 |

|

Microsoft (MSFT) |

11.1 |

|

Apple (AAPL) |

7.5 |

|

3M (MMM) |

3.2 |

|

AT&T (T) |

1.2 |

It used to be that 10 times sales was considered a "nosebleed" valuation (as in, very high). But with the new crop of tech stocks, that seems to be closer to the norm. With Zoom at 83 times sales, it's priced 8 times higher than that lofty level.

Can Zoom grow into that valuation?

Zoom's sales have totaled $1.3 billion over the last year. But let's be generous and consider that it brought in $663 million in the last quarter. Multiply that by four and we'll give it revenue at an annual rate of $2.6 billion.

The goal here would be for Zoom to mature and eventually trade for 5 times sales. To justify its current $110 billion market cap, sales need to grow to $23 billion – that's nearly 10 times higher from here.

Will people spend $23 billion every year on Zoom's video conferences? The company's management believes the total addressable market ("TAM") is $43 billion. That sounds extraordinarily high to us (and management always fluffs up the TAM for a growth company).

At that size, it means video conferencing will bring in about as much revenue as Starbucks (SBUX) or Kraft Heinz (KHC). And even if it does, Zoom would have to own more than half the market to capture $23 billion of that $43 billion.

Not to mention that this pandemic won't last forever. At some point in the future, many companies will return to the office and many families will be allowed to travel and see each other again.

In total, we think Zoom's market value is pushing the limit... not just for what it's worth today. But for what it could ever be worth.

Zoom is in a bubble. Its investors are behaving irrationally. Does that mean you run screaming, and keep your capital safe somewhere else?

The thing is, Zoom is worth about $110 billion today. It was probably in a bubble at $100 billion and $80 billion as well. Just because we can spot the bubble, that doesn't mean we know when it's going to pop.

Legendary investor George Soros has famously profited from situations like this. "When I see a bubble forming," he once said, "I rush in to buy, adding fuel to the fire."

Trading stocks in bubbles is a hard game to play. Many stocks are bubbling... and you know they are going to crash.

Even if Zoom or its fellow tech stocks do eventually justify their valuations, they will have big drawdowns along the way. Nothing goes straight up. And with valuations like these, when the stocks lose momentum, they can fall 50% or 60% in a hurry.

Putting a small amount into stocks like these as a speculation can be rewarding. It can also be remarkably stressful.

At the same time, we would never short a growth stock like Zoom in a bubble. It could easily double or triple again from here before the market comes to its senses.

Trying to figure what happens next to manage your portfolio is like trying to ride a wave that's just too big... The glory of "the big one" doesn't justify getting dragged out to sea.

The broader market is not in a full-blown bubble yet... but there's definitely individual well-known stocks that are. Remember, you'll spot a bubble when there's no possible future that can support a stock's valuation. Be careful when you see one.

However, valuations aren't the only concern in today's market. There's a major problem that few investors are paying attention to...

According to my colleague Mike DiBiase, there's a massive crash coming.

This crash (in an $11 trillion market) will be devastating for many, but the world's wealthiest and smartest investors are ready to make a killing when everyone else is losing money.

Mike believes this crash will create a slew of 100%-plus opportunities... backed by legal protections that stocks can only dream of. And he's urging folks to start preparing now.

What We're Reading...

- Here's how a single speech by Bill Gates inspired the founding of Zoom.

- Pfizer says final data analysis shows COVID-19 vaccine is 95% effective.

- Something different: Buying a baby on Nairobi's black market.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 18, 2020