The next time you see a janitor mopping floors or cleaning windows, you might be looking at a multimillionaire.

That is, if he or she has followed Ronald Read's playbook...

Unlike a lot of multimillionaires, Read came from humble beginnings. He grew up in a poor farming household in Vermont, where he walked or hitchhiked four miles every day to his small school. He later served in the U.S. Army during World War II.

After the war, Read found steady work at a gas station, then at JC Penney as a janitor.

Read was a frugal man. He liked to save each and every penny he earned. He used safety pins to hold his coat together, rather than buying a new one. His last car was an aging Toyota Yaris, which he'd bought secondhand. And he would often park a few blocks from where he wanted to go because he didn't want to waste any of his change in the parking meter.

His rare indulgence was eating breakfast at a local coffee shop. One time, he went to pay his bill only to find that someone else had bought it for him... under the assumption Read couldn't afford it.

He was one of the least flashy multimillionaires you would have ever met.

Folks close to Read knew he had an interest in the stock market and religiously read the Wall Street Journal. But even with that knowledge, one look at his jobs, his clothes, his car, or his house... and no one would guess he was one of the richest people in town.

When Read died at the age of 92 in June 2014, the retired janitor had an estate valued at roughly $8 million...

Read donated $1.2 million of that to a local library. And $4.8 million went to Brattleboro Memorial Hospital, a place where he would regularly get breakfast.

Read didn't have a high income, but he was an avid investor. And it's important to emphasize investor – rather than trader – because when he bought a stock, he owned it for many years... and even many decades.

He followed Warren Buffett's approach to investing: buying great businesses and holding them for a long time. After all, the best stocks are the ones you never want to sell.

Read would typically buy stocks that he knew and could understand – something we think every investor should do. No less important, Read owned stocks that paid big dividends and would often grow their annual payments. Think of stocks like Procter & Gamble (PG), Colgate-Palmolive (CL), and Johnson & Johnson (JNJ).

There is nothing sexy about these stocks. Their revenue growth won't wow you. But their brands are strong and have stood the test of time.

The formula for wealth isn't complicated. By living below his means, saving, and investing, Read was able to turn a modest income into millions of dollars. But it takes discipline and patience.

The greatest thing on Read's side was time... time for the stocks he owned to appreciate, and time to let the dividends roll in and turn right back into even more stock.

He didn't amass his fortune overnight on a few penny stocks. It took years.

The most important thing we can learn from Read's story is that time is an investor's best friend. Even with a small amount of money, through investing, you can become wealthy.

Over time, a few hundred dollars can turn into a few thousand... No less important, it will teach the young recipient of the portfolio about the power of saving and investing. There's no better education than watching a portfolio grow over time.

The Power of Compound Investing

It works like this... Let's say you own a stock that pays a dividend. When the company gives you your first dividend payment – instead of using it to buy a new game or spend it on food – you buy more shares of the company's stock.

That's it. As simple as that sounds, it's an incredibly powerful tool when you put it to work.

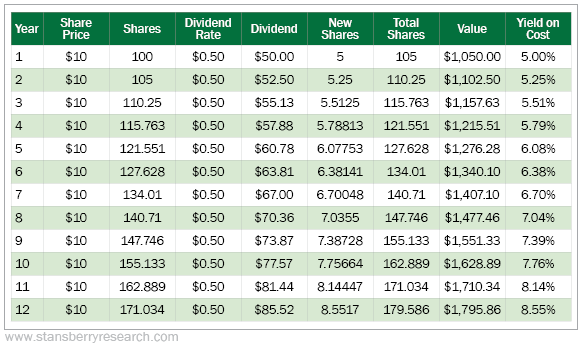

For example, let's say you own a stock that pays a safe, rich 5% yield. (We'll use round numbers to keep the math in this example simple.) You buy 100 shares for $10 each. We'll assume the share price and the dividend stay fixed at $10 and 5%, respectively.

At the end of the first year, you'll receive $50 in dividends (5%). You take that payment and buy five more shares... This increases your position to 105 shares. In year two, you earn $52.50 in dividends. You reinvest this, too, adding another 5.25 shares to your position.

You now own 110.25 shares. Repeat this process for 12 years and in the 12th year, you'll make $85.52 in dividends. That's an 8.55% dividend yield off your initial $1,000 investment.

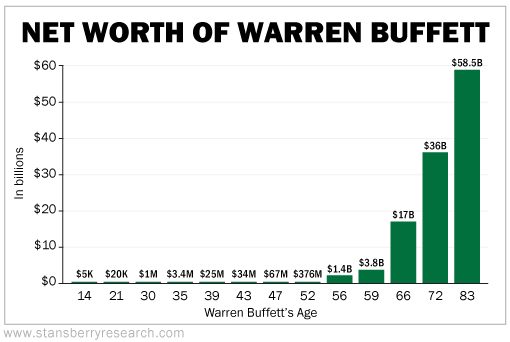

This is what accountants call "compound" investing. Your dividends turn into more stock. This extra stock then produces dividends of its own. That bigger dividend becomes even more stock, and so on... Compounding interest or dividends is one of the strongest ways to build wealth in finance. Warren Buffett built his fortune by compounding dividends.

Even with stocks that don't pay a dividend, you can get a related compounding benefit as the share price rises. If a stock grows in value by 5% each year, each 5% gain represents more and more dollars every year. Over time, your investment will more than double in value every 15 years.

You can see how Buffett's wealth has grown steadily over time thanks to the power of compounding...

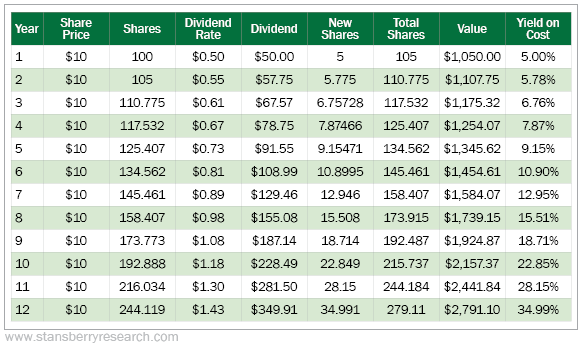

But we're not finished yet... The real magic in compounding happens when you pick stocks that pay larger dividends each year. And companies that have a track record of upping their dividend payments every year are the ones we often like to own.

Imagine a dividend that grows by 10% each year. Your position compounds at twice the speed. The 5% dividend yield turns into a 35% "yield on cost" (as it's called) in the 12th year.

Compounding is a beautiful thing. It lets money keep building money.

That's why this secret is so powerful. By plowing your earnings back into your portfolio, you can get your money to start working for itself and amass a fortune from your initial investments.

The sooner you start, the better.

Once you've spent decades building your retirement nest egg, you need to make sure it's protected.

If you haven't already, I urge you to watch my Retirement Wake-Up Call. During the event, I explained the catalyst for the biggest retirement crisis in financial history that's headed our way... the lie wealth professionals push on individual investors like you... and the No. 1 way to protect your wealth today.

Click here to watch it all now before we take it offline.

What We're Reading...

- Warren Buffett's valuable lessons to learn from the pandemic.

- Something different: The U.S. island with a 17th century dialect.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 1, 2021