Most people think they need to take wild risks to win big in the stock market...

They think 1,000%-plus gains are only possible if you get in early on some new startup that's set to change the world.

Investing doesn't have to be that hard.

Speculations are fun. They can pay off handsomely. But they can also blow up in your face, losing all your money.

If you've been following my work for long, you'll know I tend to stay away from these all-or-nothing investments. Instead, I focus on cash flows, valuations, and strength in the underlying business.

By doing exactly that – and with a little bit of patience – it has led my Retirement Millionaire subscribers to book a 1,185% gain.

Let's rewind back to November 2010. No one wanted to buy stocks at the time. Their wounds were still too fresh from the financial crisis. But I knew it was the exact time to buy... You've probably heard that the best time to buy is when there's blood in the streets.

Microsoft (MSFT) was a steady, dependable cash cow at a cheap valuation. It was boring... And that's exactly what I was looking for.

In the interim, Microsoft bagged its scattered CEO Steve Ballmer, replaced him with a visionary in Satya Nadella, and made an incredible shift into a high-growth cloud business that has reinvigorated the firm.

I've been so bullish on Microsoft over the years that I even re-recommended shares in 2019. Since that re-recommendation, the stock is up 120%, compared with just 52% for the S&P 500 Index.

One week ago, we decided to sell one-half of our Microsoft position. This locked in a 1,185% gain. In total, we held shares for nearly 13 years.

That return comes out to nearly 24% a year with dividends reinvested. Compare that with the benchmark S&P 500, which has returned just 13% a year in the same span.

So why sell now? Well, Microsoft has gotten a big bump lately thanks to no other than artificial-intelligence ("AI")-obsessed traders. Here's what we wrote in the latest issue of Retirement Millionaire...

Now, Microsoft appears to be entering a third era... one of artificial intelligence.

We don't know what will happen with AI as it pertains to Microsoft. The software giant has a key relationship with OpenAI – the privately held leader in large language models.

We see a lot of hype in the prices of AI-related stocks. And we worry that will deflate.

At the same time, even if some of the AI dreams don't come to fruition, we're fairly certain that the technology – implemented on even a fraction of its apparent potential – will lead to lots of computing power being employed by Microsoft's cloud data centers. That could be a big boon for its business.

The problem for me was that Microsoft's valuation became a bit too stretched with all the AI hype. Microsoft's valuation was driven up to $2.4 trillion, which is 11 times sales and 33 times earnings.

In the end, we knew there's big potential here... but also risk given the valuation.

By selling half of the position now, we locked in a massive gain but still keep some exposure to the potential upside in AI... plus still own shares of a great underlying business.

We're holding on to the other half with the hope to sell for even more if AI really does take off.

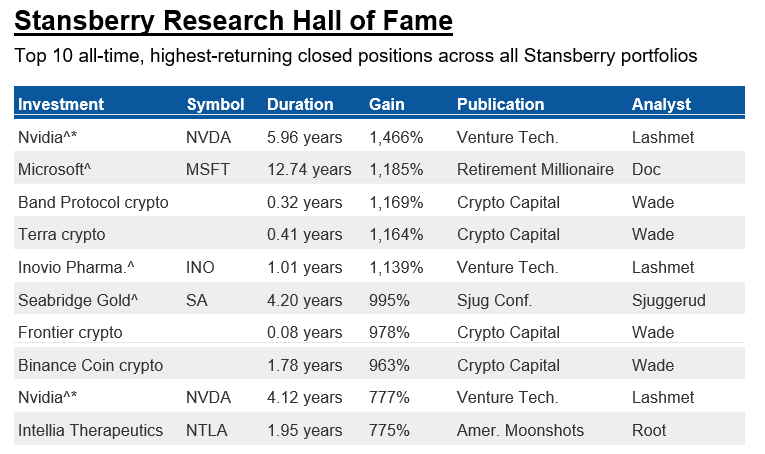

With a gain of 1,185%, I landed on the Stansberry Research Hall of Fame. This gain is only second to Stansberry Venture Technology editor Dave Lashmet, who booked a 1,466% gain on Nvidia (NVDA) a while back.

Looking around the Stansberry Research Hall of Fame list, you'll notice a lot of investments tied to cryptocurrencies, technology and biotechnology stocks, and even gold. Microsoft appears to be the outlier...

If you want to earn big returns in the market, sure you can hit on a crypto or a speculative biotech. But the easier way to do it is to buy great companies at reasonable valuations and hold on for a long time.

That's what we did with Microsoft.

The best investors know how to buy when no one else is buying. And they know hold to hold on to a great business all throughout different kinds of market environments.

What We're Reading...

- Something different: Which is the best position to sleep in?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 16, 2023