Economists are convinced that we're heading into a recession... And they think that means we could be in this bear market for much longer.

I (Jeff Havenstein) am not so sure.

It's not that I don't think we will see a recession... And I agree that we absolutely could. Gun to my head, it's probably the most likely outcome. (Although, I'm less sure today about a recession than I was a few months ago. It's looking more and more like we'll be in for a "soft landing.")

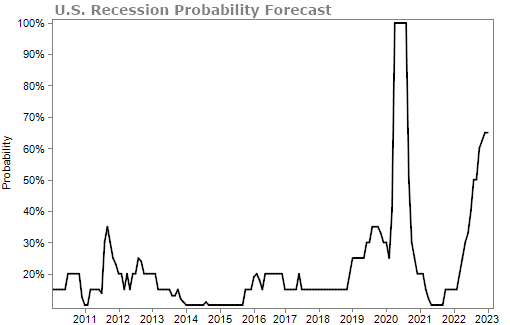

About 65% of economic forecasters now predict we'll see a recession in the next year, according to data compiled by Bloomberg...

But that doesn't really matter for the markets.

The economy and the markets don't move in tandem. And a lot of market watchers don't understand this...

You don't want to buy stocks when the economy bottoms. And you don't want to sell stocks when the economy is at its peak.

Last month, I wrote an essay to you called "This Is What the Best Investors Focus On." And the best investors don't focus on what the market or a particular company is doing today... They focus on what is going to happen.

Markets are priced on expectations.

We've seen that recently with fourth-quarter earnings... Shareholders care more about guidance (what management predicts will happen with their company) than they do actual earnings and revenue numbers.

My colleague and my publisher's director of research, Matt Weinschenk, wrote about this in last month's issue of Stansberry Portfolio Solutions. He has allowed me to share some of that issue with you today...

See, the market leads the economy. Stocks are priced on expectations. So a bottom in the market will come before a bottom in the economy.

Here's a stylized chart of how you should think about it...

Unlike the economy, the market doesn't move because of stats or figures. It moves because the great mass of investors has willed it to.

Think about where we may be in the chart above... We're not at the economy bottom just yet. There's likely some more pain ahead as inflation is still elevated.

But we could be close to a market bottom since everyone agrees we'll see a recession.

As Matt concluded...

If you accept that we are heading into a recession, you'll want to act before it has fully played out. The market's feeling will turn ahead of the economic data.

I'm not calling for a market bottom today. I'm not calling for it this month. Predicting exact market movements is a futile exercise...

But I will say that, based on expectations, it's time to start thinking about buying your favorite stocks.

Don't let recession fears keep you sitting on the sidelines. Again, markets are already pricing in a recession... Any positive news could start a rally in stocks, even if the economy has not bottomed yet.

My colleague Dr. Steve Sjuggerud also thinks the markets could be in for a big change.

Last night, he hosted a special event to share the full details of his latest prediction. In short, Steve and his team believe a massive reset is about to hit Wall Street... It's the first time he has done an event like this in nearly two years.

If you haven't already watched it, be sure to check it out here.

And just for tuning in, you'll also get the names and tickers of two stock ideas, completely free. One is a company set to soar. The other is a popular one you should avoid at all costs.

What We're Reading...

- Something different: Russia recommends investors convert FX bonds amid asset freeze.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

February 1, 2023