If you believe the headlines, we haven't had to worry about inflation for years. But we know that's not 100% accurate...

While we haven't seen a broad rise in inflation, we have seen a rising cost in some of the biggest expenses in our lives. I'm talking about housing, health care, and education.

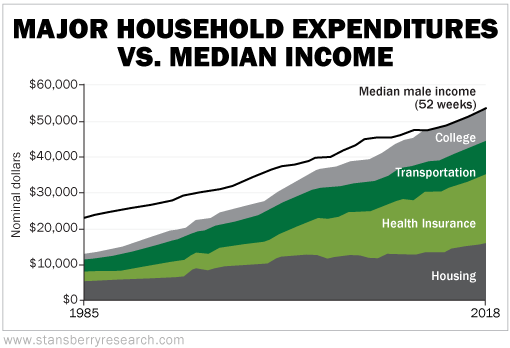

The chart below shows that in 1985, the typical worker could cover a family of four's major expenditures (housing, health care, transportation, and education) on 30 weeks of salary.

By 2018, it took 53 weeks. And of course, that's a problem because there are only 52 weeks in a year...

The crazy part is that these costs have skyrocketed even when we haven't seen a broader rise in prices for most of the past decade. The Federal Reserve has even said that it's worried inflation will remain too low.

No one is considering that inflation will kick in shortly.

But think about how much your rent, your health care, and your child's tuition will surge if we see inflation rise in the next year or two... which we think is very likely.

With nearly 80% of American workers living paycheck to paycheck and with 40% of older Americans relying solely on Social Security, it could lead to many folks not being able to afford the cost of living.

Trust us, you need to pay attention to inflation.

If you're unfamiliar, inflation is a rise in the price of goods and services. When there is inflation, your purchasing power falls dramatically. It affects everything from the price you pay for a gallon of milk to the cost to fill up your car.

To understand why inflation will rise over the next year or two, you have to understand what drives inflation.

In short, it's wages.

Wages are by far the biggest indicator and driver of inflation. Headlines often point to rising commodity costs like oil, but that's a mistake. Oil accounts for only 4% of the economy. And when its price rises enough to really pinch consumers, they cut back, and prices fall.

Food prices are a much better example when examining inflation... You may think the price of wheat matters to the price of bread. A $1.37 loaf of bread contains about six and a half cents of wheat. If wheat prices double overnight, the price of bread rises less than 5%. What costs a lot more is the salaries for the baker, the driver, the grocer, the farmer, and all the managers, administrators, and executives at the companies that employ them. About 80% of the cost of our food comes from labor.

We think wages will rise because of the labor market. And that's because this is perhaps the tightest labor market in history.

Frankly, there aren't enough workers to fill open roles. Businesses are having a tough time hiring qualified people. As you can see, pretty much anyone who wants a job can get one...

It's a unique time in history.

And a tight labor market equals wage growth, right?

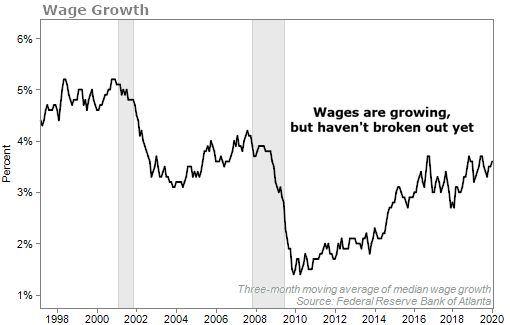

Not exactly. Wages have been growing, but not as fast as they should be given how strong the labor market is. Growth has yet to break out...

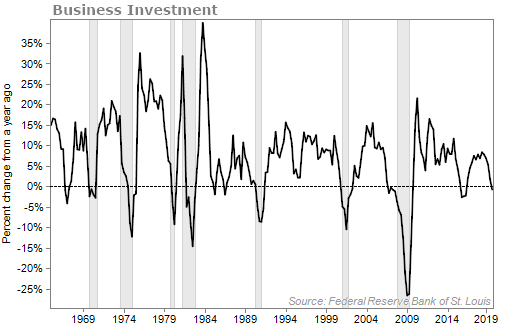

One of the many reasons is because businesses haven't been willing to spend.

There's been too much uncertainty in the economy. There's been the trade war... signs of slowing global growth... and now a widespread panic because of the coronavirus.

Businesses have been fine with not giving their employees raises because they want to be certain the good times will continue before they shell out more money. They've been cautious with their money.

You can see the fall in business spending over the past few months...

Businesses have been raking in all-time profits recently, and many are sitting on huge piles of cash. Soon, they'll have to start paying their employees more if they want to retain them.

As more evidence that the labor market is getting tighter, the "quit rate" has hit levels not seen since 2001. Most people only quit jobs when they've got a better, higher-paying one lined up...

We should see a spike in wage growth shortly. That means inflation could absolutely take off.

Now you may be wondering what role the government will play... And you might think that the Federal Reserve will step in to stop inflation. But that's not the case.

They'll be too late to act. Or they might not even act at all.

To combat inflation, the Fed would need to raise interest rates. With increased interest rates, fewer people would be able to borrow money. This would result in consumers having less to spend and would drive down prices.

But the Fed will be hesitant about raising interest rates. It raised rates back in late 2015 and soon realized it raised them too fast and too high.

After the Fed raised rates, it reversed course quickly and started lowering interest rates last year.

It won't make the same mistake of raising rates too quickly again.

Plus there's pressure on the Fed from the White House not to raise rates. The president has bashed the Fed because it hasn't lowered rates even further. (President Donald Trump has tweeted about the Fed roughly 100 times since nominating current Fed Chairman Jerome Powell.)

We think we'll likely see the Fed lower rates before it raises them.

That means there's not much that will stop inflation...

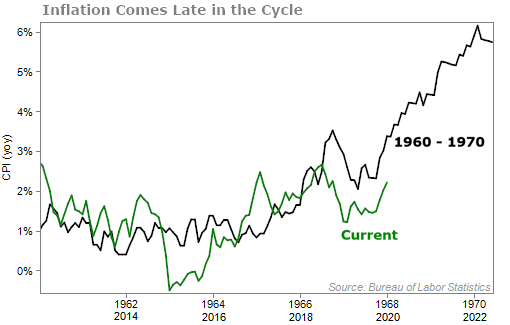

And we usually see inflation come at the end of an economic cycle. As an example, this economic expansion has run from 2009 through 2020 – over a decade. If you compare it with a previous long-lived expansion that ran through the 1960s, you can see that inflation didn't start until the end of the run...

If we can learn anything from history, it's that inflation can go much higher form here... in a relatively short amount of time. That's especially true since no one is worried about it today.

There are a few things you need do to prepare for what's coming. First, you should own precious metals. It stands to reason that when the value of money declines (the essence of inflation), the value of a hard asset like gold will rise.

You'll also want to own other hard assets like real estate. The price of homes may seem expensive today... but we think they can go much higher from here.

Last, you'll also want to own something that is protected against inflation like Treasury Inflation-Protected Securities ("TIPS"). A popular TIPS fund to buy is the iShares TIPS Bond Fund (TIP).

Protection against inflation is cheap... and that's because no one is scared of it. Now is the time to prepare yourselves before it's too late.

What We're Reading...

- Fed holds rates steady, affirms commitment to higher inflation.

- Good news, America, your paycheck should grow this year.

- Something different: Don't let this scam FedEx text fool you.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 26, 2020