Doc's note: Today I'm sharing an essay from Jeff Havenstein. Jeff recently got his MBA from Old Dominion University and works as a junior analyst for my newsletters, Retirement Millionaire, Retirement Trader, and Income Intelligence. Today, he shares one of his favorite unconventional market indicators... his friend John.

Today, everyone is talking about the midterms... especially the names of the winners (and losers).

But I want you to focus on one person – John.

John knows nothing about the stock market. And he's clueless about economics. He couldn't tell you the difference between a U.S. Treasury note and a call option... But when I (Jeff) want to predict what the market will do in the next few months, I turn to John.

Let me explain...

John and I have been close friends for about a decade. John's a smart guy and currently works for a software company in San Francisco. I live in Baltimore, so I don't get to see him as much as I'd like. But we talk frequently.

When we talk, we talk about how our jobs are going, how each other's families are doing, sports... you name it. The part I look forward to the most, however, is when John wants to talk about stocks.

John owns only one stock. He owns shares of the software company he works for through his employee stock purchase plan.

All the research in the world may not be as a strong of a predictor of the market as a five-minute conversation with John.

[optin_form id="73"]

But before I get into the insights I received from John last week, a quick story...

It was December 14, 2017. I made the trip all the way from Baltimore to San Francisco to spend a few days with John. We planned to do all the touristy stuff like go to the Golden Gate Bridge, see the sea lions at Fisherman's Wharf, and take the ferry to Alcatraz.

As soon as John picked me up from the airport, I expected us to talk all about our plans and to catch up a bit. And we did... for about five minutes.

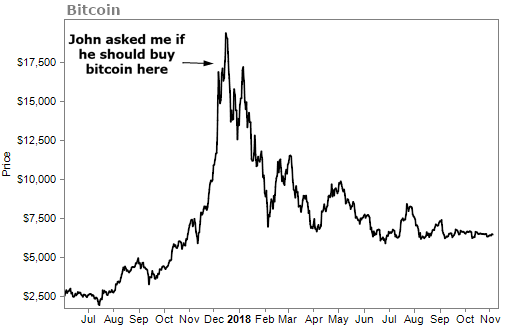

Then John asked me if he should buy bitcoin. He was chomping at the bit to buy. He and his girlfriend were debating whether to put about a couple thousand bucks into it.

Just to remind you... John didn't know anything about investing and neither did his girlfriend. (She once called me and asked if I could help her with her 401(k). She had it for years and had no idea what she was invested in. It turns out she was in the riskiest program with aggressive growth stocks when she wanted to be in the conservative program. Whoops.)

It's safe to say that neither of them are bitcoin experts. I asked John a simple question, "John, do you know what bitcoin actually is?" His response, "Well, uh, yeah. It's a new currency. Kind of like a stock. And it's making a lot of people a lot of money."

At that moment in time, I knew bitcoin was doomed. I wish I could make the timing of this up, but two days later, bitcoin peaked...

You see, John is my gauge for what the everyday, sometimes uninformed investor is thinking. When John wants to buy, I'm terrified. When he wants to sell, there's hope.

Doc has talked about this in the past. He uses gossip from cocktail parties to give himself a sense of what investors are thinking. And if there's a strong opinion, Doc likes to do the opposite. It's the same with John.

And just so you know, I ended up convincing John not to buy bitcoin at the time.

(If you're reading this, John, you're welcome.)

So far, John's been a reliable market indicator. He's not a one-hit wonder. Thanks to our conversations over the past six months or so, it seemed more and more likely to me that we'd experience a market correction.

Remember, John only owns the stock of a small software company in San Francisco. It doesn't pay a dividend and the company doesn't make a profit yet. John's thoughts on the market are only based on this stock... which I think is a perfect representation of average investors. Who doesn't love high-flying tech stocks?

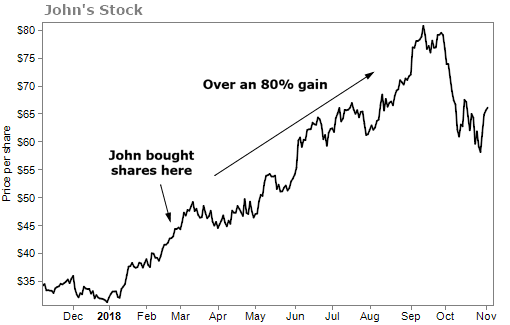

His employee stock purchase plan started in March of this year and he owns his company's stock for about $40 per share.

Ever since he became a shareholder, he'd send me regular updates.

In May, he said, "The stock is already at $45 per share. I'm up 12%!" In June... "Should I increase the percentage of my paycheck to purchase more stock through my program?" And in early September... "Have you seen the share price yet? It's up to $75 per share!"

As you can see below, he had good reason to be excited. In just six months, the stock was up over 80%...

Since John is my proxy to how the herd thinks, I was nervous. If John was willing to increase his paycheck contributions to buy more stock, then I couldn't imagine the risks other investors were taking. In my eyes, it was only a matter of time before we saw a market downturn. This brings us to what's happened in the past few weeks.

Ever since the S&P has fallen by nearly 10% from its peak, John's tone has changed. His stock has fallen by about 20%, so he's still sitting on a healthy gain. But instead of his prior excitement, he's now worried.

Just last week, he sent me this message: "Hey, I'm considering selling my stock. What do you think?" And he was asking me this when he understood he'd have to pay more in taxes if he sold now. That's how scared he was.

Everyday investors are just as scared as him after this recent sell-off.

Which leads me to believe stocks can go higher from here...

But I'm still cautiously optimistic. Like the January correction, this October pullback may just be a bump in the road as the bull market keeps ripping higher.

If the market does rebound to new highs from here, John and other investors may forget this ever happened and jump right back into risky behavior. But as of now, John is giving us a signal to own stocks... But make sure you're properly diversified. If you missed last week's issue about diversifying between different asset classes, click here to read it.

What We're Reading...

- 10 years after the crisis, some investors are still scared of stocks.

- Something different: Parents eat Halloween candy laced with meth.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein and Dr. David Eifrig

November 7, 2018