Doc's note: Longtime readers know I usually feature essays from guest contributors on Mondays.

Instead, today I'm sharing an excerpt from a recent issue of my trading newsletter, Retirement Trader. In it, I told subscribers to ignore chatter and detailed the type of company to look for to grow your wealth safely and steadily.

And if you want to see how Retirement Trader helped a retired New York police chief make $1,000 in just a few minutes, click here.

Just remember... you never have to make a bet...

Most days, the market can seem pretty confusing. The mainstream financial media is jammed full of pundits, all espousing their next great predictions on the market.

But the reality is, their job is to fill the airtime between commercial breaks. Getting a call right is just a happy accident.

Most of those people really have no more idea of what is going to happen in the markets than their viewers.

Tomorrow's move could easily be up or down.

When things get confusing, that's the time to remember... You're not obligated to make any moves. You never have to force yourself into any opinions.

Don't let the constant chatter make you feel like you have to leap into the market with big, bold bets. If you don't like what's happening or find yourself confused by contradictory opinions, you can always steer clear of the stocks that are magnets.

Electric-car maker Tesla comes to mind...

There are so many passionate bulls and bears on this stock that the amount of analysis written for it far outstrips any sort of unique insights that you could have.

The good news is you don't have to bet on (or against) Tesla. We don't know what's going to happen to it... and we don't care.

In fact, out of the roughly 3,000 publicly traded stocks of any size, we don't care about... well, at least 2,950.

Individual investors don't need an opinion on WeWork, Uber Technologies (UBER), Netflix (NFLX), or any other business you feel like you don't understand.

Today, the market feels a little strange to us. The S&P 500 is hitting new highs, but potential risks loom on the horizon.

And the business world feels less predictable.

By that we mean that new companies can get big, faster. Technology allows competition to cycle through quicker. And many stalwarts are under pressure from well-funded upstarts.

We're not recommending you stay on the sidelines... but given the market's unpredictability these days, we are recommending a defensive trade today.

Now, "defensive" in the investment context usually refers to businesses that have less exposure to a slowing economy. Sectors such as health care and utilities typically earn that title.

But that's not what we mean.

Rather, we want to place a trade that's unlikely to surprise us. We don't want to guess at Netflix's subscriber growth or try to figure out if the U.S. Food and Drug Administration ("FDA") will approve a certain drug.

Today we want to ask, "What's the most predictable stock we can find?"

For most traders, that question isn't very appealing. If a stock is very predictable and steady, you can't make much of a return on it. Regular traders want stocks that go up.

In Retirement Trader, we don't need that... We can use options to make money on a stock that doesn't move.

Let's take a look at a recent example...

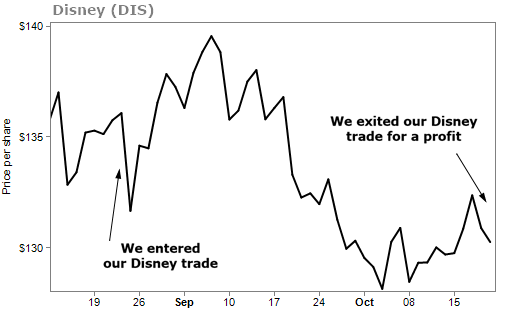

In August, I recommended a trade on media conglomerate Disney (DIS). Disney cranks out blockbuster movies like the current Star Wars franchise. It makes television shows for ABC. It produces sports content for its ESPN network. And that's just skimming the surface.

At the time, Disney was preparing for the launch of its new streaming service, Disney+. So I told readers it was time to take advantage of the buzz and sell options on Disney...

As you can see, in the two months we were in the position, Disney shares fell... but we were able to close the position for a 13% gain.

That's the power of my Retirement Trader strategy: we can make money if a stock rises... stays flat... or falls.

Recently, I sat down with a retired New York police chief to show him how he could make $1,000 in just a few minutes. He had never directly touched the stock market. I walked him through a trade and explained the details of what makes my method so different from – and much less risky than – what most people do with their own money.

And now, I want to show you how to instantly collect hundreds of dollars at a time – using publicly traded companies – in a way that's safe enough for a retirement account.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig