Lots of stock market analysts love predictions. They claim they can see what's coming around the corner based on any number of models, charts, and indicators.

The truth is, predicting this market freefall would have been nearly impossible.

Even if you were working at the Wuhan seafood market, where many believe the COVID-19 disease originated, and you knew the exact effects from the virus... you still wouldn't have been able to predict that global markets would be crushed because of it.

Unlike other bear markets, there were few warnings signs. Normally we look at various indicators like the labor market, consumer confidence, and business spending to get a feel for where the markets might be heading. But this was completely different.

There was no rush into risky tech stocks when that's all anyone talked about. We didn't see families with little income buy homes they couldn't afford...

This bear market is new. It was unexpected.

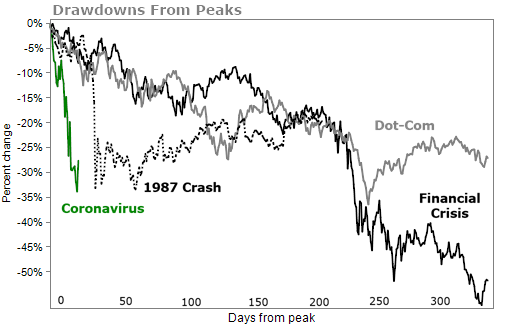

And it has moved much faster and more violently than anything we've experienced from recent crashes.

In terms of drawdowns from market peaks, this market drop has been worse than the 1987 crash, where I had a firsthand seat on the trading desk at Goldman Sachs...

While investment analysts always like to look back and say they knew this type of market collapse was coming, there were very few chances to get ahead of this.

And if you did and nailed the timing to sell, it was probably not because you were some market wizard or because you spent days analyzing the virus itself... You probably did it illegally.

On Monday, the Securities and Exchange Commission ("SEC") issued a warning against trading on nonpublic information related to COVID-19.

And that makes sense. Unless you had inside information about how rapidly the virus was spreading or information that the government would close down businesses across the country, how else would you be able to gain an edge?

The SEC issued its warning days after news of recent stock sales by the CEO of the New York Stock Exchange, Jeff Sprecher, and his wife, Senator Kelly Loeffler. There have also been three other senators that have come into question about the timing of their selling. From a recent CNBC report...

Sprecher and Loeffler's trades, involving sales of up to $3 million worth of securities, came in the weeks before stock market indexes dramatically fell in value due to the coronavirus pandemic, and on the heels of a private, all-senators briefing on the virus outbreak from Trump administration health officials that Loeffler attended on Jan. 24.

In addition to Loeffler's move, recently disclosed stock sales by three other senators, Richard Burr (R-NC), James Inhoffe (R-OK) and Diane Feinstein (D-CA) have come under scrutiny and criticism because they occurred after that coronavirus briefing.

It's important to note that neither Sprecher, Loeffler, nor the three other senators have been accused of wrongdoing by the SEC. But still, the timing has raised some eyebrows.

As I told you last week, I've had most of my own money in cash. And I've had a few people ask me how I could have seen this coming...

The truth is that I didn't see this coming. I just knew we were late in the cycle. I knew business debt was piling up, stocks were expensive, and investors were beginning to make dangerous gambles. So I didn't want the majority of my money in the markets given the risks that I saw.

Even with all the connections I have in both the medical and financial worlds, predicting this without inside information would have been nearly impossible.

And besides, I've had most of my portfolio in cash for about a year now. My decision to go to cash had nothing to do with a prediction of some pandemic. I just felt it was time to make sure my capital was safe.

If you've taken my advice over the past few months, you've done the same. You're holding plenty of cash. You own some chaos hedges like gold. And you own your highest conviction stocks (unless you sold already because you hit your trailing stops.)

So what's next?

Well, next is the opportunity to buy incredible companies for much less than they are worth. I personally don't think the time to buy is today... but I will admit that we're closer to a bottom than not.

My friend and colleague Porter Stansberry also thinks the opportunity to buy is near. He has put together a list of some of the best businesses in the world that he believes you can buy and hold for the rest of your life, without staying up at night worrying about the next market crash. It's a list of "forever" stocks that you'll never need to sell.

That's why at 3 p.m. Eastern time on Thursday afternoon, Porter will share all his thoughts about the recent market moves and what he expects to come next. He'll also share with viewers what he's doing with $1 million of his own money right now...

It's a can't-miss event. You can sign up for free here.

What We're Reading...

- SEC warns on coronavirus insider trading after stock sales by NYSE chair, his wife Senator Loeffler, three other senators.

- Something different: Tokyo Games delayed to 2021, easing athletes' angst.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 25, 2020