Christie's Auction House, it turns out, had a rat.

Christopher Davidge, the CEO of the art auction house, took the only path he saw that would keep him out of jail. He went to the authorities.

At issue was a price-fixing scheme – a cartel – that had lasted for seven years and funneled untold millions from the pockets of rich art collectors to the accounts of the wealthy auction houses.

For decades, competition between Christie's and rival Sotheby's had been fierce, each vying for the best artwork to bolster its auctions and collect the most fees.

In 1993, Davidge and Sotheby's CEO Diana Brooks – along with the chairmen of the two companies, Anthony Tennant and A. Alfred Taubman – were tired of competing.

Instead, they held secret meetings to establish fixed fees.

When a customer sold a piece of art through the auction house, they'd pay a fee. And like anyone else, they preferred to pay as little as possible.

Instead of engaging in an endless price war, Christie's and Sotheby's formed a cartel to agree on an artificially elevated price. The scheme worked for seven years.

But it eventually broke down, as most cartels do. Not only is it illegal, but it's hard to keep up a price-fixing scheme. If the industry agrees to a set price, one participant can attract extra business and make a lot of extra money by just lowering its price a small amount. And before long, one of the cartel members will give in to temptation.

Or sometimes the scheme can attract the scrutiny of regulators... That's what happened to Christie's. Davidge was leaving the firm, and he decided he didn't want to carry the risk and guilt with him to his next job. The chairmen, Tennant and Taubman, had kept good records of their illegal activities – the best criminals do.

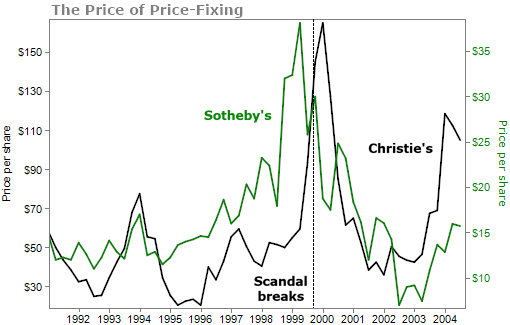

Davidge dumped it all into the lap of investigators in exchange for leniency. The businesses paid out half a billion dollars in civil settlements. Taubman and Brooks went to jail. And you can see what the scandal did to the companies' shares...

Despite the risks (and questionable ethics)... you can see the appeal of trying to set your prices. Most of the time, businesses must compete on quality and price. And except for a few businesses with strong brands or no competition, companies take what the market gives them.

This leads to a cyclical flow of high and low prices. When you can spot these cycles, they make for outstanding trades. If you can buy when supply is tight and prices are high, you position yourself to win.

There's a handful of industries that follow regular, recurring cycles of this competition.

The airline industry has traditionally been one of them. When the economy gets hot, people start traveling more and paying more for tickets. The airlines start chasing more dollars and expanding the number of flights they offer. Then, prices come crashing down.

Another cyclical industry is oil. When oil supplies are low, prices are high... And producers plow money into exploring and drilling. That process increases production and drives oil prices down. Everyone goes bust. The drilling party stops. Eventually, though, that lack of drilling leads to lower supply... And prices rise.

These businesses would love to find ways to smooth out these cycles. Oil, for one, has established an international pricing cartel known as OPEC. The managers of airlines have likewise promised investors that they'll be "disciplined" with their expansions, and they have been so far.

For investors, the trick will always be timing. If you can watch these cycles, you can invest in the boom and dodge the bust. You'll never get the tops and bottoms exactly right. But it's not hard to see when prices are rising or falling if you know where to look.

If you've been following Health & Wealth Bulletin for long, you'll know we talk about the oil market regularly. We last wrote about the industry setup in January, which you can read here.

In short, supply of oil is tight. Oil-services firm Baker Hughes tells us that the rig count – the number of rotary rigs that are active and drilling for oil – is still well below levels before the pandemic. On the other side of the equation, demand for oil is strong. The economy remains resilient, with plenty of folks traveling.

Despite this setup, we still haven't seen oil prices significantly jump. But history tells us that prices still have room to run higher... We're far away from the "bust" part of this cycle.

As we've been writing over the past 12 months or so, investors need to have some exposure to the oil industry.

There are plenty of gains to come.

Aside from oil, we suggest you listen to our colleague Marc Chaikin about opportunities for profit. He has just come out with a new, urgent prediction about the stock market... He believes you have just days left to prepare for a sudden change in the market that could double your money, without putting a cent into AI stocks, the Magnificent Seven, or any other popular stock you'd hear about on TV.

If you haven't heard Marc's presentation, we suggest you click here to tune in.

What We're Reading...

- Something different: Citigroup CEO Jane Fraser says low-income consumers have turned far more cautious with spending.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 8, 2024