Doc's note: This week, I want to help you start 2019 off right... So I'm sharing three things you need to do now to help achieve your goals of better health and wealth. And today, I'll show you how to protect your portfolio in this uncertain market.

I'll bet you've made this mistake. And I'll also bet that your kids... and grandkids... are making it right now.

I've seen it time and time again. It's one of the quickest ways to lose money in the market.

You put a few hundred bucks into a couple of tech stocks that you think are a lock to soar. Next thing you know, the tech sector takes a nosedive... And you're left with double-digit losses in a matter of months.

Here's how you can avoid that happening to you...

We've talked before about protecting your portfolio by using trailing stops, position sizing, and owning sleep well at night ("SWAN") stocks . And there's another part of portfolio protection that practically no one is talking about...

This might seem like common sense, but many folks get excited about a certain area of the market and completely forget about the others. If you don't properly diversify your portfolio by owning multiple sectors, you WILL lose money.

Having multiple sectors represented in your portfolio will greatly lower your risk.

In 1999, Standard & Poor's and Morgan Stanley Capital International created a stock classification system. They called this system the "Global Industry Classification Standard." It originally divided the economy into 10 sectors.

Here's a list of the 10 sectors and popular companies in each sector:

| Sector | Well-known Companies |

| Consumer Discretionary | |

| Consumer Staples | |

| Energy | |

| Financials | |

| Health Care | |

| Industrials | |

| Information Technology | |

| Materials | |

| Telecommunication Services | |

| Utilities |

We all know which sectors are attractive and which ones aren't. Scroll through any financial website and you'll see at least three ads claiming that they have the next "hot tech stock" or the next McDonald's restaurant.

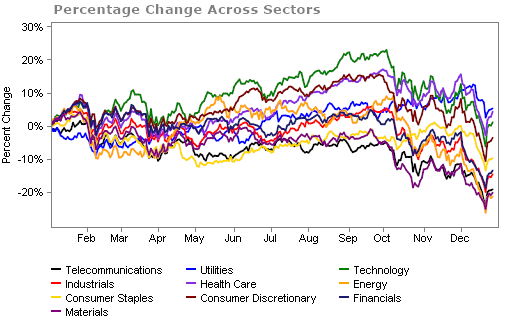

The graph below shows how each sector has performed over the past year...

Energy, telecommunications, and materials suffered the most losses in 2018, down about 20%. Defensive plays such as health care and utilities led the way with returns around 5%. The only other sector to post a positive gain was technology, but it just barely broke even.

It's been a disappointing year for stocks but the fact is if you've invested in just about anything you've made a good amount of money in the past several years. We've enjoyed the gains from the longest bull market in history. It's hard to think about those gains however, as stocks ended 2018 on a sour note...

In December, the S&P 500 Index fell more than 10%.

Turn on CNN or any other news channel and you'll hear the bears claiming doomsday is coming. Just this morning, I've seen headlines claiming we're headed into another recession.

Now, I don't believe a market crash will happen tomorrow, corrections – which are any 10%-plus declines in the market – are a normal and healthy part of a market cycle. But, as longtime readers know, I've started getting cautious.

Diversifying across different sectors will help protect you during market downturns.

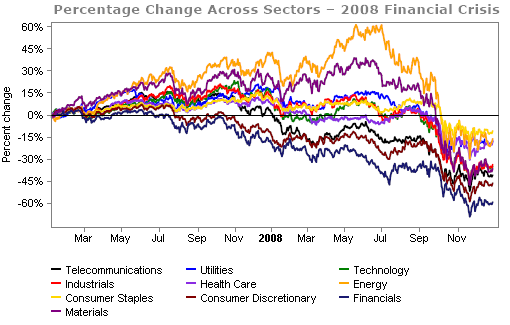

Take one of the worst crashes in history as an example – the 2008 financial crisis. As you'll see below, being solely in one sector can ruin a portfolio...

Financial, consumer discretionary, and information technology stocks were the hardest hit during the crisis. Anyone heavily invested in one of these sectors lost 40% to 50% of their portfolio. But if you simply owned a portfolio balanced over all 10 sectors, you could have saved 25%.

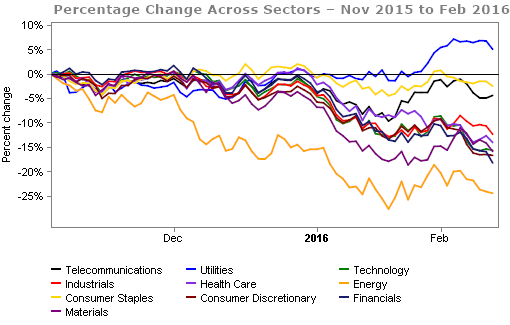

The financial crisis is an extreme example – it was one of the worst crashes of all time. But the same logic applies to a normal market correction. Let's look at a "regular" market correction...

This was during a normal, healthy market correction of 13%. Corrections like this occur often... Excluding the dot-com bust and the 2008 financial crisis, the market has posted a 10%-plus decline 12 times since 1987. The average drawdown was 14.8%. Each correction is different, and it's usually a different sector that incurs the most loss. In this particular correction, energy stocks dipped 20% while utilities were up above 5%.

That's why I always recommend proper asset allocation. If you use this opportunity to diversify not only across asset classes, but sectors as well... Your portfolio will thank you.

What We're Reading...

- Something different: What the government shutdown means for you.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 2, 2019