My mother-in-law called me a few days ago and sounded worried...

She wanted to talk stocks... which is something she rarely brings up with me. She figured that most everyone talks to me about the markets because of my job.

She first asked me what she should do with her IRA. Like lots of people, over the past year, she has seen money disappear from it.

What's worse, she's only one year away from retirement. So her concern is understandable, especially with life even more expensive for the foreseeable future.

She said, "I'm tired of losing money." And she asked me if she should sell all of the holdings in her account or keep holding.

I (Jeff Havenstein) think a lot of investors are feeling the same way as my mother-in-law. They are tired of seeing money evaporate from their account.

At this point, investors figure their money is safer in cash or being used to pay off their car. This was my mother-in-law's plan.

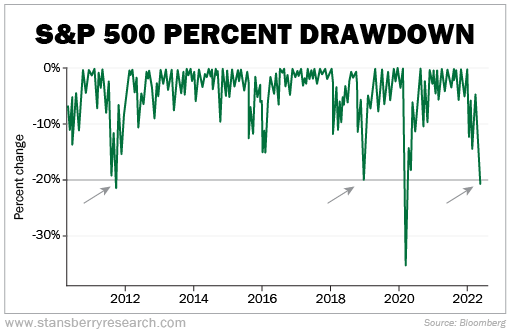

Since markets have shown no sign of recovery, it's natural to think we're headed for a nasty bear market. A lot of folks I know are bracing for more selling – even though markets are already down 18% this year.

If we fall another 10% or 15% from here, this sell-off would be just as bad as the COVID-19 plunge in 2020 (though not as quick of a drop).

I'm writing to you today because I don't believe that will happen.

While I'm not oblivious that markets can fall further from here, I am optimistic over the next six months to a year. And the reason is simple...

Investors are far too bearish.

Today, I'm going to show you a few charts that prove my point. Then you'll understand just how extreme sentiment is today... and how that can lead to a sharp reversal in the markets.

First, I want to talk about why markets make big moves. They aren't that hard to figure out. As Doc told his Retirement Trader subscribers about two months ago...

It's as simple as this: When times are good and people are buying stocks, stocks can move much higher. New highs tempt other folks to get in on the action, and their cash floods the market – driving prices higher and causing the cycle to repeat.

This can go on for a long time... But the music eventually stops. And it stops when no new buyers are left. This is when sentiment is at a peak.

With no one to prop up prices, stocks can only go down. Think back to the dot-com bust and you'll know what we're talking about.

The opposite is also true...

When everyone is selling, they move to cash and markets tank. Eventually, there's no one left to sell and fear is widespread.

When this happens, so much cash is sitting on the sidelines, earning nothing, that investors have to use it somewhere. Folks start to buy stocks again, and the market reverses.

We're obviously in the later stage. Fear is abundant, and folks have been indiscriminately selling. They have their portfolios parked in cash.

Let's look at the most recent results from the Bank of America Global Fund Manager Survey to see this extreme level of bearishness.

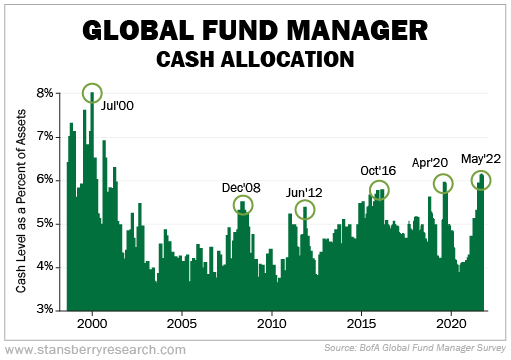

Global fund managers are holding more cash than the 5.4% allocation logged in 2008 during the financial crisis.

Today's level is the highest cash allocation since the 9/11 attacks. Take a look...

Again, when there's a lot of cash sitting around, earning nothing, investors have to use it somewhere. The fund managers' clients demand returns. So all that cash eventually gets thrown back into stocks.

We're getting close to that.

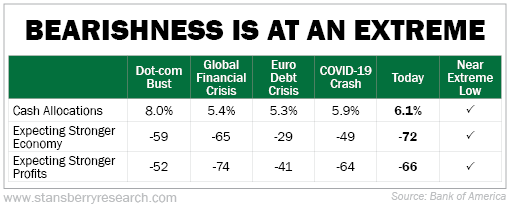

Also, let's look at fund managers' expectations for a stronger economy and stronger profits. Like cash allocations, they are also near historic, extreme lows...

Fund managers have become very pessimistic. I'd argue too pessimistic...

We were overdue for a market correction. Stocks needed a breather after a 27% run in 2021. Growth stocks especially needed a reset after many nonprofit high-fliers were trading for absurd valuations.

As Doc has written many times before market corrections happen... Could this turn into a bear market? Of course, it could.

But recession probabilities are still low. Morgan Stanley's recession model only puts the odds at 35%. That means there's a 65% probability of no recession.

And without a recession, it's unlikely that this correction will turn into a severe bear market.

We've seen this many times before. Buyers usually step in before a correction becomes a bear market. The most recent example was at the end of 2018, when the S&P 500 fell 19.8%. It also happened in 2011...

As I told my mother-in-law, do not sell today. It's a classic example of panic selling.

I believe we are very close to a bottom... And I am looking for opportunities to buy great stocks for cheap prices.

What We're Reading...

- Investors rush to cash as growth optimism hits record low.

- The beginning of the end of the stock market's correction could be near.

- Something different: Netflix doesn't have a 'natural investor base' right now.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

May 25, 2022