In 2013, you could find a few perpetual worriers about how high the markets had gotten. There's always a perma-bear to warn you about a coming crash.

Today, that fear is far more widespread. My phone won't stop ringing with friends asking me how to protect their money. In the last couple weeks, it's really ramped up... a full-on assault on my phone.

By now, people have bought into our argument that the economy is healthy and moving higher. You can't really deny it anymore. But everyone has overshot the landing. They worry that the economy is too hot, and we're in a boom time that will inevitably lead to a bust.

Please, take a moment to enjoy the fun – and profitable – part of the investing cycle. It'll be good for your health.

Let me also assuage some fears by checking the data to show why this economic recovery – still proceeding 10 years after the Great Recession – doesn't have to wear out just yet...

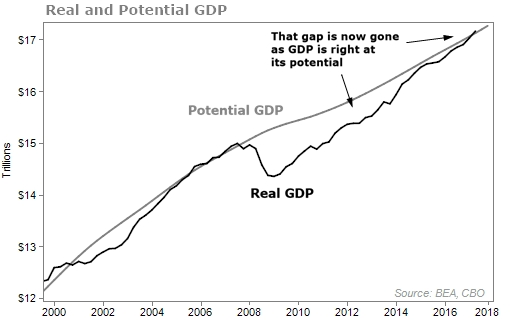

Let's start with gross domestic product (GDP), the broadest measure of the economy.

Yes, things have picked up. We've got healthy growth in the neighborhood of 3%. But that's just getting us back to normal.

People don't appreciate just how deep the Great Recession after the financial crisis was. And they don't appreciate that the recovery has been very slow.

Potential GDP is a measure of what our economy should be producing if it stays on track. It considers population growth and what the U.S. economy could produce if everyone is productively employed.

In 2013, we still had a long way to go to hit potential GDP. But you can see now that the gap is gone...

What this tells us is that we're not in an unsustainable boom or a wild frenzy. We're just now getting to where we should be.

GDP is right in line with its potential, not way above as some would think. This isn't a sign of an economy on the brink of collapse.

In simple terms, we're right where we should be. We could see multiple years of expansion from here before the economy gets ahead of itself.

Like many of you, I sometimes get a feeling we're due for a market correction. We could see a 5% to 10% pullback at any time. In fact, we should see a 5% soon. I'm shocked that it hasn't happened yet.

[optin_form id="73"]

But I want my readers to use facts, not gut feelings, to make decisions about how to grow their wealth...

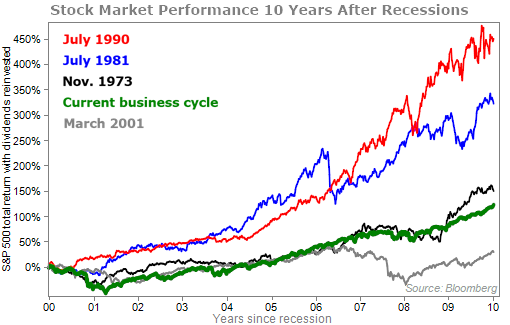

The stock market today is at all-time highs. And it sure feels like its run a long way. But based on how the market reacts after past recessions, this market recovery is below average.

Here's a chart of stock market performance for the 10 years after previous recessions...

The stock market surge we've seen is nothing new.

It's natural to look at the stock market's 183% rise from 2009 and think stocks have to fall. But it doesn't make sense. It's not stock returns or prices that should cause investors to lose sleep at night. It's valuations.

There's no denying that valuations are high, but not as high as the market's performance may have you think.

For 2009 – the market low – the S&P 500 earned $58.94 per share and traded at 18.9 times earnings. For 2017, it earned $119 and traded at 22.5 times earnings.

That means while valuations have risen by 19%, the underlying earnings have risen 102%. That accounts for much more of the move that stocks have made higher.

That's why the 183% return since 2009 may be an amazing performance. But one can argue that it's justified. It's earnings, not just expectations.

We don't have a crystal ball. And all bull markets die eventually. But it happens because of the underlying conditions of the economy and markets, not the turning of a calendar page.

But now is the time to start preparing your portfolio for any corrections that could happen.

Last week, Porter Stansberry, Steve Sjuggerud, and I talked about what we see happening in the stock market right now. We also each gave our "big calls" for 2018 and detailed how we're preparing our portfolios for the future.

If you missed the presentation, you can watch it here.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 31, 2018