It's the No. 1 question we're seeing right now...

How do I time the top of the market?

Readers want to know if it's time to put more money into stocks or if it's time to take it all out.

It all comes down to one thing: Patience.

Think about the last time you had to wait in line...

Like when you got stuck in terrible stop-and-go traffic. Maybe you took the next exit to find another route home... only to encounter more delays that cost you even more time.

This is a classic case of human behavior called "action bias." We're not programmed to sit and wait. We want to act... to take the next exit... to do anything but stand still.

It's at the heart of investing as well. Sometimes the hardest thing to do with your investments is nothing.

One of the main drivers of action bias is something called "notional losses," or paper losses. Basically, at some point when our portfolio loses too much, we get scared and start selling. Think of it as our "breaking point." We can only sit still for so long. We don't want to wait for a correction or study up on cyclical activity. We see our stocks "slipping into the red" and we panic.

Resisting this urge to act helps in the long run. But that doesn't mean you should never sell, especially if you're retired or nearing retirement. You don't want to be stuck "holding the bag" when the market crashes.

So you end up with a major choice with your investments... When is it right to sit and wait and when is it right to sell?

And more importantly, is it time to buy more if the market is already on an upswing?

That's exactly what my friend and colleague Steve Sjuggerud will explain in a special presentation next Wednesday.

You see, we've seen dips and corrections in this bull market before. And it didn't scare us off... It made us more eager to see the gains to come.

If you remember January 2016, the markets had a rocky start to the year. As I wrote then:

I know a lot of people are worried about their portfolio. Almost every stock in the S&P 500 is down. At yesterday's close, just 27 stocks in the S&P 500 were in the green.

And plenty of folks are wondering how they can still safely collect the income they need this year.

It's impossible to know whether this is the beginning of a bear market or just a temporary sell-off before this bull market climbs even higher. So right now, it's essential that you position your portfolio to do well in any type of market.

What's more, volatility isn't always a signal that the end is nigh. In fact, I love market volatility.

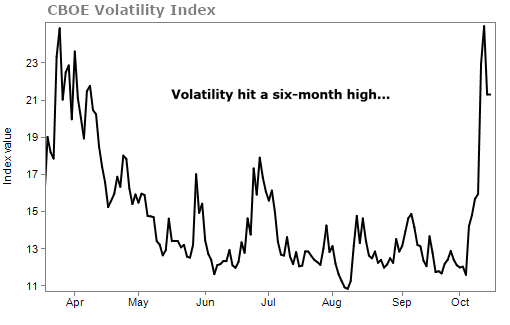

Longtime Retirement Trader subscribers know I look at the volatility in options using the Volatility Index ("VIX") because it acts like a fear indicator. High volatility often points to fear in the market, while low volatility can mean that the market is growing more confident.

Last week, the VIX hit the highest level we've seen since April...

But more important... it was nearly double this back in early February when it spiked over 40. And guess what... it recovered. We went on to see the longest-running bull market in history (and it's still going).

So don't let volatility scare you. Keeping a well-balanced portfolio and managing your risk will protect you in the coming months and years.

Even better, knowing exactly when and how to take advantage of what could be a huge late-market swing could generate profits.

As Steve told his DailyWealth readers...

- Just because stocks are expensive, it doesn't mean they can't go much higher.

- High valuations are a symptom of a stock market peak... but they are never the cause of a stock market peak.

Steve says the real "Melt Up" in stocks is around the corner. And on October 24, he's going to explain when he expects it to happen and how to take your profits.

You won't want to miss Steve's presentation. Click here to secure your spot.

What We're Reading...

- More on action bias.

- Something different: We'd love to buy our own rhino.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 18, 2018