People tell me all the time that they're a "contrarian"...

I must admit, that makes me laugh.

I know that kind of talk is cheap. A contrarian is someone who opposes popular opinion. As an investor, it's someone who is willing to buy when everyone is selling or sell when everyone else is buying.

As Michael Lewis, bestselling author of Liar's Poker and The Big Short,puts it, "On Wall Street, everybody says he's a contrarian, and nobody is."

Take a minute to seriously think if you have a contrarian mindset or not... Were you eager to buy stocks when they were trading for a mere 12 times earnings in 2009? Or were you brave enough to buy beaten-down tech names after the tech bubble burst? You could have scooped up quality companies like Microsoft (MSFT) for $20 a share or Amazon (AMZN) for just $7 a share.

My guess is there are few out there who did. If you did, good for you – you've earned your contrarian badge. And you've probably made a boatload of money.

You see, being a contrarian is hard. As humans, we tend to adopt a "herd mentality" – which is where we are drawn to think and act in the same way as the majority around us.

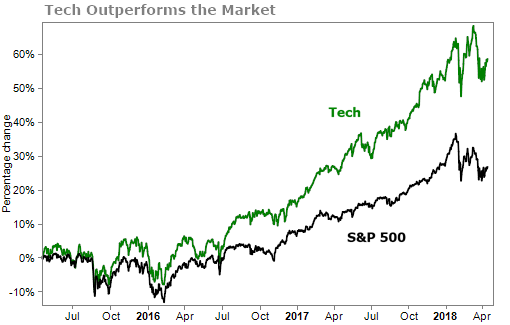

And occasionally, it does pay to follow the crowd... you just need to get out before it's too late. Take the past few years for example... The "tech boom" has made folks a lot of money. Everywhere, you saw talking heads on TV shouting that tech is the sector to own. You couldn't scroll through your channels at home without someone talking about Apple (AAPL) or Netflix (NFLX). Even here in our office, folks kept telling me to jump on the Netflix train.

And as you can see, buying tech has been very profitable...

But how much longer can this last?

The tech trade is getting crowded. Back in late 2017, Bank of America Merrill Lynch (BAC) reported that mutual funds were piling into tech stocks at a record level. It was one of the reasons why managers were able to beat their benchmarks: because tech has dominated every other sector.

This overcrowding is our signal to go against the crowd now. It's time to put on our contrarian hats – contrarian plays will be the ones that make money over the next few years.

But contrarian investing isn't as easy as you think. You can't just find a bunch of hated stocks and buy. Most of the time, hated stocks are hated for good reason.

The key is to understand why they are hated and why the market is wrong.

Sounds easy, right?

Let's consider one of the most hated group of stocks right now – retail. You've probably seen headlines about the death of retail... Some of my colleagues have written pages about it.

And despite retail's recent rally, it's still down over 11% from 2015's highs.

Competition from e-commerce companies like Amazon have permanently damaged the retail sector, leading to slow growth and shrinking margins. Buying retail today is contrarian, but also disastrous.

Instead, we're focusing on another group of stocks that's even more hated than retail... and we think that's an overreaction. It's a group of stocks that you rarely hear about from the media... and unlike traditional retail, this sector's poised for a comeback.

That's where we want to invest...

That's why we're recommending buying one of the best stocks from this sector in my Income Intelligence newsletter tomorrow.

All the pieces are in place for a perfect contrarian play...

This entire sector is trading at its lowest price-to-earnings ratio since 2009, which is almost unheard of considering the raging bull market that's continued through the past few years.

It's a sector that investors left for dead – it's down over 50% since 2014.

So, we can buy the best stocks in this sector for much less than what they're worth. The stock we're recommending tomorrow is one of the best of the sector, but it's down about 17% since January. It's been investing in its growth the past few years and demand for its product will soon skyrocket.

Maybe the best part, the stock yields nearly 7%. As we wait for the sector to rebound – potentially earning 20% if this stock just gets back to where it was trading at in January – we'll still earn 7% just from its yield. It's hard to find that kind of safety anywhere else in the market.

For Income Intelligence subscribers, check your inboxes tomorrow for the issue... It's time to bet against the crowd.

If you're not currently an Income Intelligence subscriber, we have a 100% risk-free trial available. In my opinion, Income Intelligence is the best-kept secret at Stansberry Research, so I urge you to give it a try. Click here to get started.

And tomorrow, you can finally consider yourself a contrarian.

[optin_form id="73"]

- Did you miss it? Chris Mayer on why he's one of the best stock pickers.

- Something different: Can we please get the IRS into this century?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 18, 2018