It has been a week since the annual Stansberry Conference & Alliance Meeting in Las Vegas... And I (Jeff Havenstein) have spent the past few days trying to process all the information from the wonderful speakers we had.

The biggest takeaway from the conference was the simple fact that many of the speakers were pessimistic. They were pointing out red flags in the economy and were mostly bearish on the stock market.

Usually at an investing conference, there is more bullishness. People talk about new technologies that can push our economy higher and make investors rich. But we didn't have much of that last week.

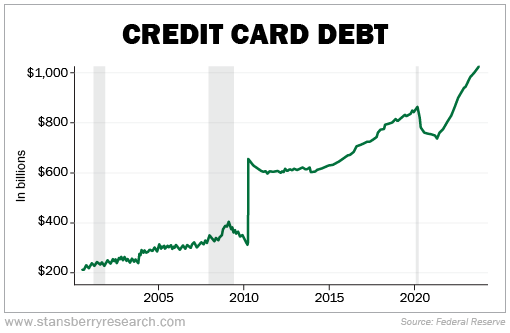

I'll be the first to admit, it makes sense why folks are worried. A lot of speakers pointed out our current debt situation.

Credit card debt has soared in recent months. Take a look (with recessions highlighted in gray)...

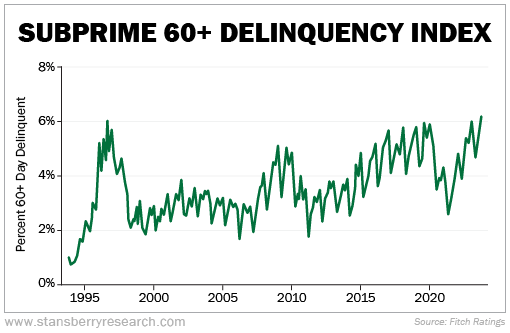

Americans are also struggling more than ever to keep up with car payments. A recent Bloomberg article wrote...

With interest rate hikes making newer loans more expensive, millions of car owners are struggling to afford their payments. It's a clear indication of distress at a time when the economy is sending mixed signals, particularly about the health of consumer spending.

The percent of subprime auto borrowers at least 60 days past due on their loans rose to 6.11% in September, the highest in data going back to 1994, according to Fitch Ratings. In April that figure slipped from a previous high of 5.93% in January. But after burning through tax returns, contending with a shakier job market and grappling with still-elevated inflation, more car owners have become delinquent.

You can see this in the chart below...

Many of the conference speakers believe that we're on the verge of a debt crisis. And if interest rates continue to stay elevated, it's only going to get worse.

But this doesn't mean we're heading for an immediate market collapse... During the conference, a few of the bullish speakers talked about the labor market and how we won't see an economic collapse as long as the labor market is strong.

The U.S. economy added 336,000 jobs in September. That's almost twice what was expected... Put simply, you're not going to see a nasty recession when our economy is adding 300,000-plus jobs every month. No way.

My boss, Dr. David "Doc" Eifrig, has been making this point for some time.

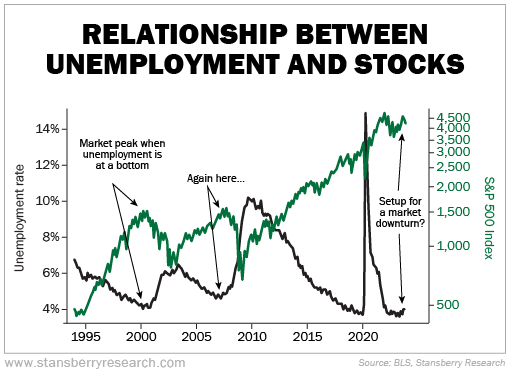

While Doc has turned cautious in recent months, he still knows the labor market has to turn before we see any major market meltdown.

During one of Doc's talks, he showed the chart below. He called it his "No. 1 chart." It shows that market peaks tend to happen when unemployment is at a low.

Today, unemployment is at 3.8%. That's extremely low when you look at the history of the U.S. labor market.

This chart tells me that we need to see unemployment tick higher if the bears are going to be right. But again, with 336,000 jobs added in September, it's hard to justify selling most of my portfolio and hiding in cash.

We'll keep an eye on the labor market in the Health & Wealth Bulletin. If we do see more red flags, it may be time to adjust our portfolios. But I don't think that time is now.

And if you want to hear Stansberry Research founder Porter Stansberry's thoughts about the economy and market... I suggest you sign up for his 100% free presentation tomorrow. This is the first time in more than three years that Porter will be back on camera for Stansberry Research.

Click here to reserve your spot.

What We're Reading...

- Something different: What CNN's Fear & Greed Index shows us.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

October 25, 2023