Doc's note: Many of the best companies in the world are based in the United States. But if your portfolio is stuffed with American companies, you may be in a dangerous position. Far more so than you realize...

That's why I'm sharing an essay from Kim Iskyan, editor of Truewealth Asian Investment Daily. In it, he explains the dangers of "home-country bias" and why an internationally diversified portfolio is essential for investing success.

For many people, there's no place like home. It's familiar and comfortable. But for your portfolio, staying at home means taking on a lot more risk than you might realize.

It's natural to want to invest at home. Investing locally means investing in what you know – which is generally smart.

But everyone is guilty of "home-country bias."

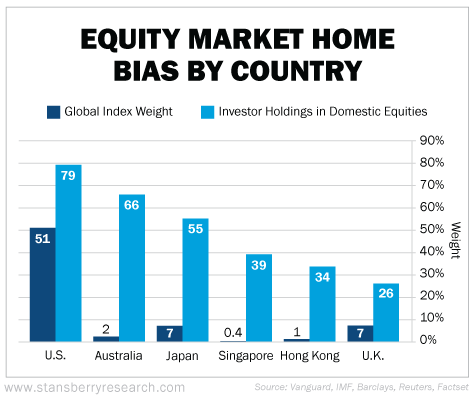

The average American with a stock portfolio has 79% of his money in U.S.-listed stocks. Investors in Japan put about 55% of their money in Japan-listed stocks. People in Australia have two-thirds of their portfolios in local shares.

That might be what they're comfortable with. But from a portfolio-diversification perspective, it's like juggling live dynamite...

As the graph below shows, American stocks account for only 51% of total global market capitalization (that is, the value of all stock markets in the world). So American investors are a lot more exposed to U.S.-listed companies than they should be.

Japanese investors are even more lopsided in their home preference... Japan accounts for only 7% of the world's stock market. And Australians put 66% of their money into their own market, which makes up just 2% of the world's markets.

And Singapore's stock market is only 0.4% of the world total, but Singaporeans invest about 39% in domestic equities. As you can see, investors all over the world tend to have too much exposure to their local markets.

Why do people do this?

Besides investing in what they know, investors tend to be more optimistic about their own economy, studies have shown. Investors also face fewer tax hassles when buying domestic shares and are subjected to less foreign-currency risk. Plus, investors often trust companies and stocks in their own country more than those outside of their borders.

But most investors are making a huge mistake by doing this... without even realizing it. A portfolio that isn't sufficiently diversified is much riskier than one that is well-diversified. Because different markets outperform at different times, having money invested in a range of geographical markets will boost your returns.

Take a look at the home-country bias of your personal portfolio... And consider making a few adjustments to move some of your money elsewhere. Your portfolio will thank you for it.

Regards,

Kim Iskyan

P.S. You won't believe where in the world my colleague Dr. Steve Sjuggerud has found his latest "fat pitch." It's in an area of the market that most investors are terrified of... But it offers triple-digit or larger gains on the table. Steve says it's like having a "second chance" to invest in revolutionary Silicon Valley companies – household names that essentially every U.S. investor knows. In fact, Steve predicts that one of the companies he's recommending will become the largest in the world. Yet most U.S. investors have never even heard of it... Click here to learn more.