Wall Street is starting to make me nervous about stocks.

To find out why, let's consider our ancestors for a moment...

In prehistoric times, if a man saw a group of people running away from something, he could run away as well or hang around and see what all the fuss was about.

If you think for a minute, we can trace our lineage back to the ones who ran. They're the ones who survived.

The ones who hung around were likely eaten by some massive creature or were killed in a natural disaster.

Because of this, over time, we've been conditioned to act as the larger group does.

As longtime Health & Wealth Bulletin subscribers have heard many times, a part of our brain called the amygdala drives our body's natural fear response. The amygdala consists of two tiny structures deep in the brain that connect emotions and fear. Your amygdala gets feedback from your senses, and if you encounter anything out of the ordinary, your amygdala triggers a threat response.

When individuals don't follow the crowd, their amygdalae start firing. This makes them feel nervous... even sick to their stomach. Such a reaction was useful in prehistoric days when mankind's biggest concern was being eaten by wild beasts. But our instincts work against us in the markets.

Following the herd can cause investors to buy at the top, when everyone else is buying... or sell at the bottom, when everyone else is dumping their stocks.

Today, there are signs that we're closer to a top than not. Specifically, we're seeing investment managers starting to use leverage once again.

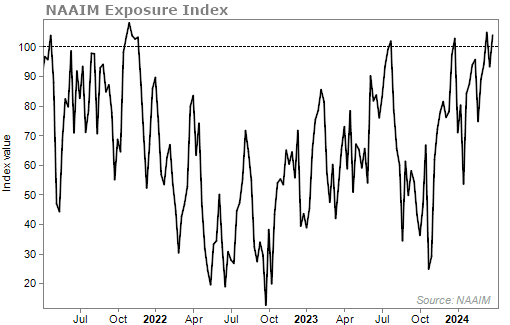

The chart below looks at the National Association of Active Investment Managers ("NAAIM") Exposure Index, which tells us the average exposure to U.S. equity markets. NAAIM members are active money managers who are asked each week to provide a number which represents their overall equity exposure.

If the index shows a value of more than 100, it means these money managers are using leverage. As you can see, NAAIM members are extremely bullish today...

Now, this doesn't mean markets are doomed... far from it. There are a lot of reasons to think this bull market will continue. But this does tell me there is a lot of greed in today's market... and that could lead to a quick pullback.

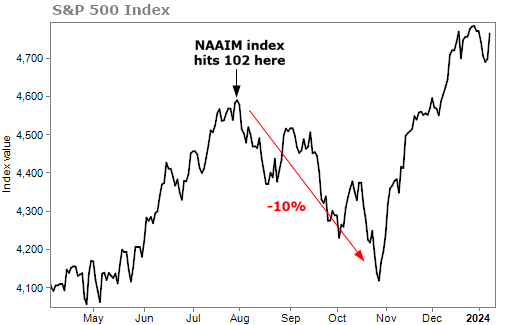

When the NAAIM index was more than 100 back on July 31 of last year, the S&P 500 went on to fall 10%... to today. Take a look...

Before that, the index hit 108 in early November 2021. Stocks went on to fall nearly 8% over the next two months. And if you look further out, they were down by 24% nearly a year later.

Now, it's important to point out that this index isn't perfect at predicting short-term market tops. But it does tell us when things tilt a little too far either bullish or bearish.

Today it's telling us that market managers want to own stocks. It tells us they're loading up on them.

If you've been reading my work for long, you know I like to do the exact opposite of what the herd is doing. So when I see something like this, it makes me get a little cautious on stocks. And I could see a pullback in stocks coming.

Remember, even in bull markets, pullbacks happen. Stocks regularly fall 5% or even a standard correction of 10%. Drops like these are healthy.

I'm not selling all my stocks today. Again, there are a lot of reasons to think this bull market will continue... But I will be a bit more cautious going forward. And this is especially true for short-term traders.

There's one vital lesson in the markets... Don't get sucked into what the herd is doing.

Pay attention to extremes in the market.

Last week, my good friends Joel Litman and Porter Stansberry shared an amazing opportunity in a sector that investors are ignoring. They detailed a market anomaly that could lead to gains we only see once or twice in a lifetime.

This is a presentation you don't want to miss. Click here to learn more.

What We're Reading...

- NAAIM Exposure Index.

- Something different: General Electric completes three-way split, breaking off from its storied past.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 3, 2024