Doc's note: Today, I'm sharing an essay from my friend Matt Badiali. Matt is the editor of Real Wealth Strategist.

Matt is a geologist and natural resource investment specialist... And he's always traveling the world looking for ways to safely invest in resources like gold, timber, and oil. Today, he details his favorite resource investment this year.

***

Back in early May 2017, I (Matt) told readers of my Real Wealth Strategist newsletter about a bull market in zinc.

You see, zinc is one of those critical metals we use in all sorts of things. You probably use it daily and don't even know it. It's a critical nutrient, a primary ingredient in sunscreen, a potent fertilizer, and a major component in cars.

However, after nearly a decade of cheap zinc prices, the mining industry hasn't reinvested in the metal. Massive zinc mines such as the Lisheen Mine in Ireland, the Brunswick Mine in Canada, and the Century Mine in Australia all ran out of ore and closed.

As you can imagine, when major mines close, zinc supply falls. Production from mines fell by 1 million metric tons from 2015 to 2016, and the zinc price began to rise.

The World's Massive Appetite for Zinc

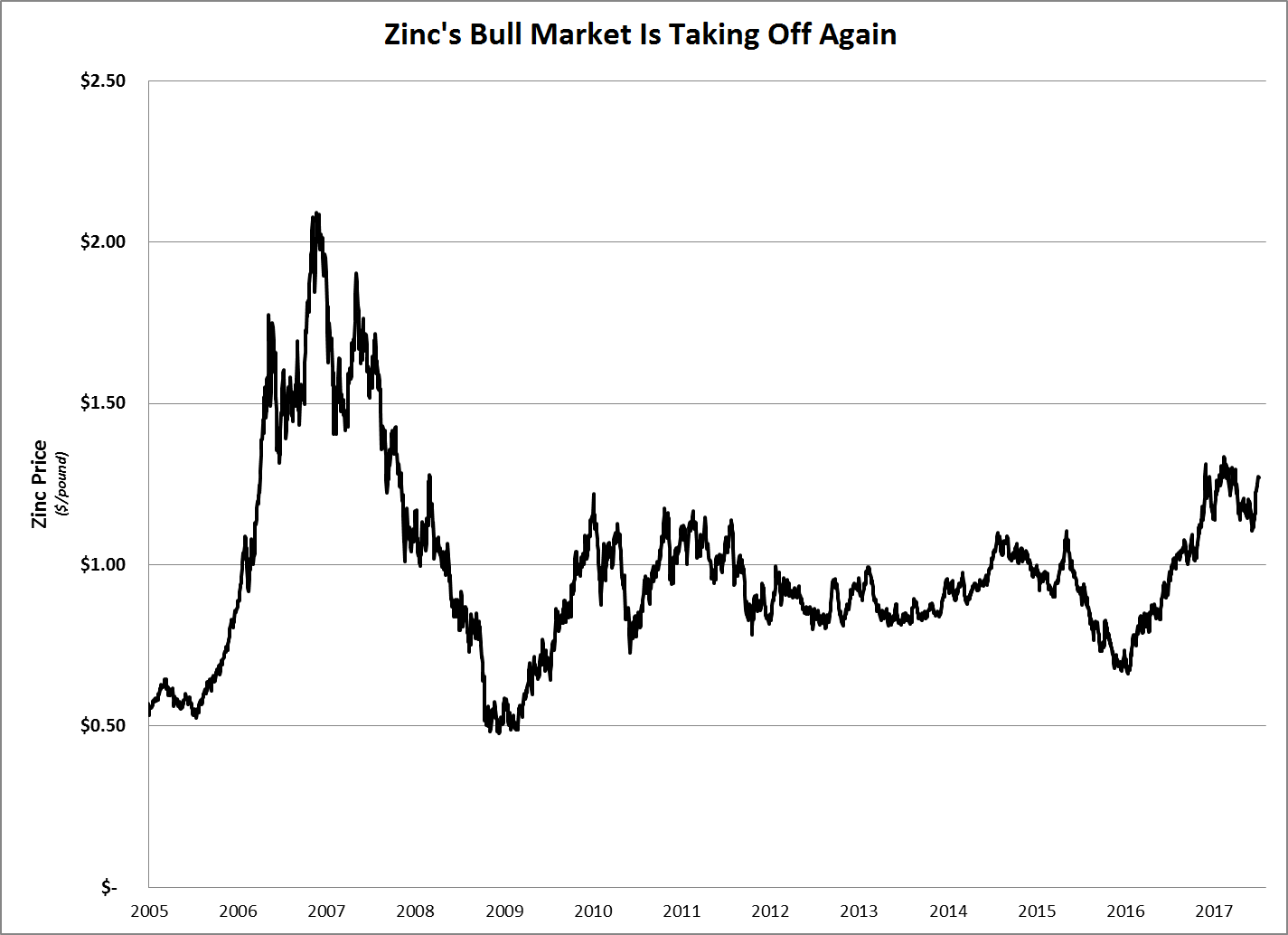

You can see what I mean from the chart below:

The zinc price didn't rise just on falling supply... Demand is up, too. Last year, the world used about 13.9 million metric tons of zinc. Demand is up 3% per year since 2000. Based on that growth, we'll need 15.7 million metric tons of zinc by 2020.

In 2016, the world used 1.4 million tons of zinc beyond what was supplied by mines. That means we tapped into zinc stored in warehouses. The London Metal Exchange ("LME") owns warehouses all over the world that it uses to stores metals.

In 2012, there were about 1.25 million metric tons of zinc stored in LME warehouses. Today there is only about 287,000 metric tons. In other words, the world's massive appetite for zinc is using up the extra supply at a rapid clip.

When the warehouses run out of zinc, the price is going to explode higher. That's what I expect to see this year. The previous high, set in 2006, is nearly double the current price. This shortage could easily send zinc prices that high or higher.

Doing Our Homework First

Unfortunately, investing in pure zinc metal isn't easy. There aren't any zinc funds out there for us to buy. Instead, we have to do it through mining companies.

Soaring zinc prices will be great for producers such as Teck Resources (TECK) and BHP Billiton (BHP), among others.

However, there are lots of small zinc companies making huge claims. Investors need to be careful when buying companies that are exploring for zinc. Look for companies that have an asset that could be in production within a year or two. Stay away from the companies that are still looking for an asset.

It's not too late for investors to make big gains in this bull market, but only if we do our homework on the companies first.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

Doc's P.S. In Real Wealth Strategist, Matt recently told readers about the "magic" metal that's used in everything from airplanes to smartphones to medical tools. Experts are warning that we are about to see the largest shortage in decades... and that the "world is running out." But Matt has uncovered a company that's sitting on a huge supply of this metal. Click here to learn more.