By most people's logic... we should have retired our favorite strategy years ago.

Most people will tell you that you can only make money in options when stock prices are highly volatile.

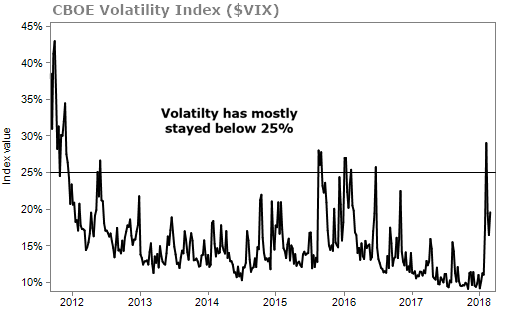

During the 2008-2009 financial crisis, volatility spiked above 80%. But as the economy recovered from the recession, volatility dropped below 40%.

Besides a few jumps, we haven't seen volatility above 25% for the past five years.

What does that mean if you're an option seller?

The CBOE Volatility Index (or "VIX") tracks volatility as a function of options prices.

The higher the VIX goes, the more we get paid for a two-month option. The lower the VIX, the less we get paid.

It's common for the market to move higher with a corresponding drop in volatility, and vice versa.

When stocks start dropping, people start worrying and begin to pay up for protection by bidding up the price of puts. Thus, volatility jumps up in down markets.

The current bull market has meant a long period of low volatility.

Some investors will tell you we can't make money selling options when volatility is low.

Don't believe it.

[optin_form id="73"]

For nearly eight years in my trading service Retirement Trader, we've had incredible success selling options.

We're making steady, solid gains. And we'll keep making them regardless whether option volatility spikes again... ebbs further... or bounces around erratically.

In just the past couple of months, we opened covered call and put-sale trades on railroad-services company CSX (CSX). We closed the covered call for a 4.1% gain, which is 26% annualized. And we closed the put trade for an 18.2% gain on margin. That's 114.4% annualized.

We're officially agnostic about volatility.

It's true, we enjoy periods when high volatility pushes up the premiums we receive for selling options. When volatility is high, premiums get rich... and our profits are even bigger. That's the secret to Retirement Trader.

We can make money no matter what the market is doing.

Our strategy remains profitable regardless.

You see, we start with identifying valuable stocks first. We require a history of shareholder-friendliness – companies that are stable and reward shareholders with dividends and buybacks. To invest in any business, we need to know that management cares about the business and recognizes we're the owners. That means rewarding us along the way.

But we don't want to drain all the cash... So we also look for companies that still have plenty of cash after paying shareholders to also invest in new technology and future business opportunities. We want to see future growth in the business.

If we can find good stewards of capital running a business with a positive future, we'll invest. And we'll use options to lower our risks a bit in exchange for some extra current income.

So even when the market drops – like we saw last month – instead of panicking, we're ready to take the opportunity to make money.

That's why this week I want to teach people how to use my option strategy – the Eifrig Income Method.

I've decided to host a five-day workshop so you can learn the basics of the Eifrig Income Method and put it to work ASAP.

So far I've shown how the Eifrig Income Method lowers your investment risk, helps you get paid time and again on the same stock, and can safely double your wealth every four-and-a-half years.

Tomorrow night at 8 p.m. Eastern time, I'm hosting the final training session where I'll walk you through all the ins and outs of the Eifrig Income Method.

Plus, I'm also going to do a live demonstration of the method with a young woman who has NO experience trading options... so you can see exactly how a real trade works, from a beginner's perspective.

Click here to access the workshop and sign up for my special training session tomorrow night.

I hope to see you there.

What We're Reading...

- Have you checked out my five-day Eifrig Income Method workshop?

- Something different: The oldest message in a bottle ever found.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

Baltimore, Maryland

March 7, 2018