I want to start today's issue with an apology...

I apologize about the rant I'm about to go on.

You see, it really irritates me when people of influence make misleading statements that could harm millions of regular investors. I'm talking about Federal Reserve Chairman Jerome Powell.

I was pleasantly surprised when I read a Wall Street Journal article titled "Fed Chairman Powell Warns of Economic Risks From Rising Business Debt."

For months I've warned about the dangers of rising debt. So I was glad to see the Fed echo my concerns that rising debt should be taken seriously.

Then at an event on Monday, Powell had the following to say about the rise in corporate debt...

In public discussion of this issue, views seem to range from "This is a rerun of the subprime mortgage crisis" to "Nothing to worry about here." At the moment, the truth is likely somewhere in the middle.

Somewhere in the middle?

The data show we're nowhere near the middle. We're already past the debt levels we saw during the subprime mortgage crisis.

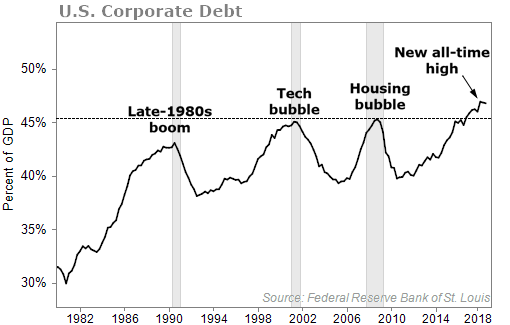

Take a look at the following charts and tell me if we're "somewhere in the middle".

Here's corporate debt over gross domestic product (GDP)...

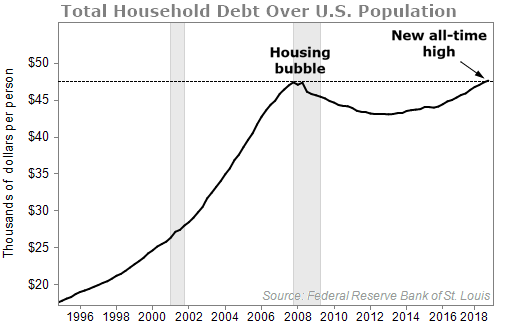

Even though Powell was focusing on business debt, it's important to look at the whole debt picture.

Here's household debt...

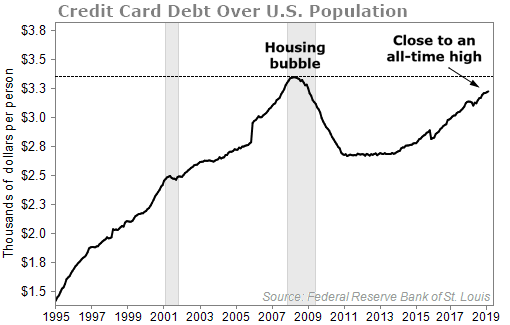

Credit card debt...

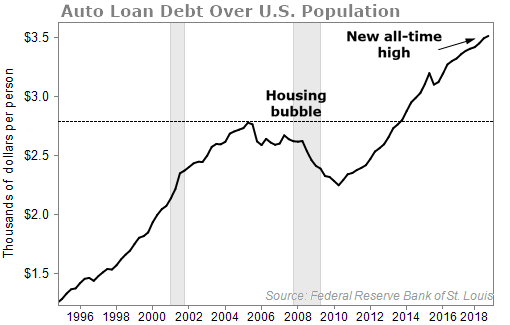

Auto loan debt...

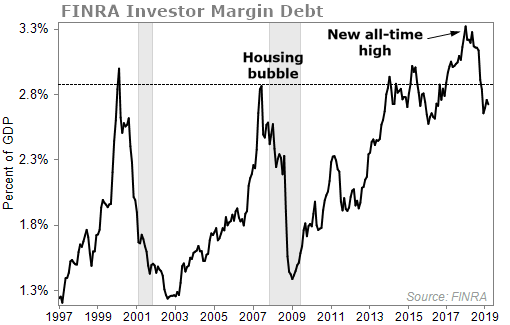

Investor debt...

No matter which kind of debt you look at... today's debt level is worse, or at least just as bad as it was in 2007 and 2008.

We're in a debt bubble. And there's only one way bubbles end...

What really annoyed me with Powell's comments was when he talked about the risks associated with business debt. According to Powell, "business debt does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm to households and businesses should conditions deteriorate."

We're in the late stages of the longest bull market in history – one that has been fueled by a recovering and strong economy, but also propped up by cheap debt and stock buybacks. If GDP growth slows, you bet households and businesses will be harmed.

The access to cheap debt may continue, since we likely won't see a rise in interest rates anytime soon. Raising rates is one of the best ways to tamp down financial excesses, and if rates remain unchanged – or even fall – excessive borrowing will continue.

Here's the real problem, which Powell did mention... debt covenants.

Covenants are basically rules that borrowers and lenders agree upon for debt such as loans or bonds. Covenants are in place to enforce what issuers are required to do (positive covenants) and what they cannot do (negative covenants).

A common example is a restricted payments covenant. These protect the lenders by limiting the borrower's ability to make undesirable distributions and asset transfers that would hinder the borrower's ability to repay the debt. This can include restrictions on stock repurchases, prepaying junior debt, and dividends. Other covenants may require certain debt-to-asset ratios or interest coverage ratios.

Over the past few years, covenant quality has deteriorated dramatically. Those who thought we learned our lesson about loading up on risk in 2007 are wrong. We're taking on record amounts of risk with the rise in "covenant lite" leveraged loans.

Leveraged loans are simply loans issued by firms with below-investment-grade ratings, which typically have quite a few covenants in place to protect the lender. A covenant-lite loan has fewer restrictions and therefore more risk.

About 85% of all leveraged loans are now considered covenant-lite.

Here's a real-world example to understand it better... Let's say I lend money to my grape farmer. In the loan I can collateralize his tractor, his house, and the grape vines. If he defaults on the loan, at least I know I'm protected.

On the other hand, if I just said... "Here's my money... just take it. I don't need any protections."

That's basically what is going on today.

The increase in covenant-lite loans is not going to be a major catalyst to a market downturn. But when the credit cycle does turn, the declining covenant quality will make things ugly. Recoveries on defaulted debt will be severely impacted and investors may not be able to recoup very much money, if any at all, when the defaults start to ramp up.

It's a house of cards.

So when the Powell says that debt "does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm to households and businesses," that ticks me off.

Of course it does.

Retirement portfolios could be cut in half during the next big market drop. And a likely cause of the next market collapse is the record amount of debt everywhere. I'm happy the Fed is admitting that business debt is a real risk, but Powell is not making it out to be as big of a risk as it should be.

That's why, last Wednesday night, we launched Stansberry Research's new Defensive Portfolio.

During our Bear Market Survival Event, Porter Stansberry released all the details of this new product. The 20-position model portfolio contains everything you need to protect your wealth – and even profit – before, during, and after a crash.

This carefully curated model portfolio deploys six proven strategies to help you lock in any profits you made over the past decade... AND take advantage of the rare moneymaking opportunities that arise during a bear market.

The replay won't be online for long, so click here to watch it now.

What We're Reading...

- Something different: U.S. existing-home sales continued to falter in April.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 22, 2019