"Science doesn't care what markets are doing, and science moves forward"...

These bold words are from Robert Nelsen, co-founder and managing director at ARCH Venture Partners. We agree with his statement... to a degree.

The ugly truth is that money must also push science forward. There's always going to be politics involved, at least a little.

Fortunately for Nelsen, he's committed to what he believes in. He's also a bit of a magician...

If you've never heard of ARCH Venture Partners before, it's one of the most aggressive venture-capital ("VC") firms in the biotech and life-sciences space. It was originally spun out of the University of Chicago in 1986 and has backed more than 150 companies since inception... companies like Illumina, Sage Therapeutics, Vir Biotechnology, and many, many more.

ARCH is best known for its early investments in experimental cancer drugmaker Juno Therapeutics. The Seattle-based company was acquired by Celgene in 2018, a deal worth more than $9 billion.

Over the past couple of years, ARCH has been doing the impossible... It has been one of the few VC firms raising money and investing in biotech.

Back in June 2022, ARCH closed a $2.98 billion fund targeted at early-stage biotech companies. This is the ARCH's 12th venture fund. And it was launched even after it raised nearly $2 billion for a fund in January 2021.

If you are a biotech investor, you'll know how impressive this is.

You see, after the COVID-19 pandemic dumped money into the sector, interest dried up.

Higher interest rates pushed investors away from risky startups and saddled firms with hefty borrowing costs. Instead, VC firms have been more focused on helping their existing portfolio of companies survive this period of bloodshed.

The days of biotechs raising cash with the snap of their fingers – even before starting a clinical trial – are gone.

A report from banking giant HSBC shows early investment in biotechnology startups was on pace to fall 40% in 2023 from the year before... and 55% from the 2021 peak.

The bank also said Blockbuster Series A rounds for just-launched companies – defined as those raising $150 million or more – are increasingly rare.

Committed investors like ARCH are still throwing their backing into the space, though... They aren't letting a troubling macro environment get in the way of investing in medical breakthroughs.

ARCH has continued to fund biotechs, even amid the bear market. In fact, ARCH was the most active venture firm in the first half of 2023. It participated in seven deals total.

Here's Nelsen from a press release last year...

All the fundamental innovations in biotechnology are accelerating, with huge promise for new preventive, disease-modifying, and even curative treatments. Science doesn't care what markets are doing, and science moves forward. With over 35 years of venture experience, ARCH has been creating and consolidating companies for the long term.

Like Nelsen, we know that the world of medicine is on the verge of doing incredible things... like cell and gene therapies to treat previously incurable diseases... surgical interventions that are more precise and less invasive... and diagnostics that offer early detection and better patient outcomes.

Across my suite of newsletters, we've been closely tracking the health care and biotech space. And lately, we've seen things turn around for biotech companies. ARCH isn't the only one buying anymore...

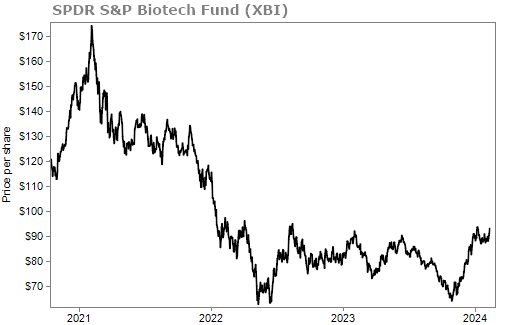

The SPDR S&P Biotech Fund (XBI) has risen by 38% over the past four months. Take a look...

XBI is still well off its 2021 highs. But it's encouraging to see investors beginning to regain interest.

We've said it before, because of new technologies and new medicines, we think health care stocks can really take off in the years to come. We'll keep you updated on the health of this sector in future Health & Wealth Bulletin issues... But we think an allocation to health care makes a lot of sense today.

Finally, before we sign off for the day, you only have until midnight tonight to view our colleague Greg Diamond's latest presentation. In short, he believes that today will be the stock market's biggest day of the year.

This is your last chance to hear Greg's message. Click here to learn more.

What We're Reading...

- 'Science doesn't care' about markets: ARCH raises nearly $3B amid tough times for biotechs.

- Something different: Paramount Global lays off about 800 employees, a day after announcing record Super Bowl ratings.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 14, 2024