Doc's note: "Cryptos are set to thrive over the next year," says our in-house cryptocurrency expert Eric Wade.

In today's issue, Eric explains why now is the time to consider investing in cryptos, how blockchain works, and why 2021 could see even better gains than 2020...

It was one of the fastest-growing investments I've ever seen...

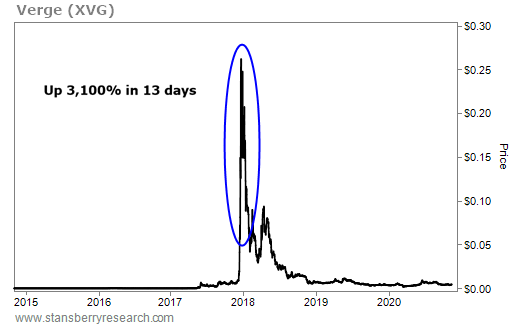

Launched in 2014, a cryptocurrency called Verge (XVG) billed itself as a "privacy coin" that would allow untraceable transactions.

It traded flat for years. But something happened in late 2017.

A big software update called Wraith Protocol was supposedly coming before the end of the year. Finally, XVG would realize its dream of becoming private electronic money. Buyers piled into the coin. The token price doubled every two and a half days for nearly two weeks.

But crypto is unique. It's different from any other kind of technology. And because of that, this situation changed quickly.

This dynamic – and the unique nature of crypto investing – is something you must understand as an investor. So let me share the rest of the story...

Over 13 days, Verge soared around 3,100%. Its market cap shot from around $80 million to almost $4 billion.

But then, Verge's lead developer dropped the ball. The promised software update didn't come out by the end of the year, and Verge prices collapsed nearly as quickly as they'd risen. Take a look...

Its price has never reached those levels again. Today, Verge's homepage doesn't even mention privacy technology. And there are a host of other privacy coins, including Monero, Zcash, and Grin.

I'm telling you this because there's an important lesson in the dramatic rise and fall of Verge...

Crypto moves faster than any new technology I've seen in more than three decades of professional investing.

There are two big reasons for this...

First, crypto is uniquely monetized – there's an economic incentive baked into the technology. If you're a developer who releases a crypto, the market gives you immediate feedback on its value. Your token's either worth something or it's not. So good ideas thrive... and bad ones disappear almost immediately.

Second, many crypto projects are open source. Their source code, or the computer code that makes them work, is given away for free. That means anyone can take existing crypto code and "fork" (or copy) it, change it in some way, and release it. That's why more than 5,000 cryptos exist today.

This ability to build upon existing technology and get immediate feedback on its value has led to something I like to call "idea Darwinism"... where only the fittest survive. Each new idea breeds more new ideas, and the industry's pace of change accelerates.

The pace is now so fast that projects can balloon from the idea stage to $100 million in market cap in just days. Or the reverse can happen just as quickly... where a crypto collapses from millions of dollars to nothing.

In short, this incredible volatility can work to your advantage... but you must understand what you're investing in. That's why it's important to first make sure you know the basics – including blockchain, the powerful technology behind cryptocurrencies.

So today, I want to help you with doing that...

"Blockchain" is one of those words that has the power to confuse even the smartest people. And the media hasn't been at all helpful in explaining how this technology actually works.

The Bitcoin blockchain, for example, allows us to transfer bitcoin person to person (or "peer to peer") without any intermediary. (Bitcoin with a capital "B" refers to the blockchain, whereas bitcoin with a lowercase "b" refers to the cryptocurrency.)

When I transfer U.S. dollars to you, we either have to do it in person – with me handing you cash – or through the banking system, which involves me telling my bank to send money to your bank account.

But how does this actually work?

A good analogy is to think of the Bitcoin blockchain as a giant Excel spreadsheet that shows the complete transaction history and location of every bitcoin.

Every 10 minutes, the spreadsheet gets updated as an additional "block" of new transactions is permanently added to the spreadsheet.

Everyone can have their own copy of the spreadsheet. It's completely transparent.

Let's say Jim sends one bitcoin to Sally. When the transaction is processed by the bitcoin network, the spreadsheet is updated. Jim's balance is decreased by one bitcoin, and Sally's is credited one.

But who updates the spreadsheet? And how do we stop people from trying to make false updates to the spreadsheet? What prevents someone from awarding themselves more bitcoin or trying to "double spend" the bitcoin by sending it to two different people at the same time?

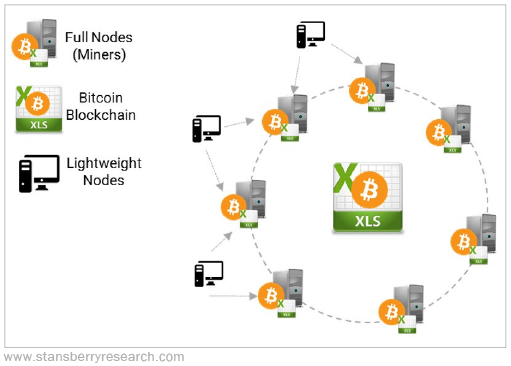

All of that is the job of participants on the network called "nodes," which are also known as miners. Nodes are the computers or large computer systems that support the Bitcoin network and keep it running smoothly. Nodes are run by individuals or groups of people who contribute money toward buying powerful computer systems, known as "mining rigs."

Two types of nodes exist – full nodes and lightweight nodes.

Full nodes keep a complete copy of the blockchain ledger (i.e., the giant Excel spreadsheet). This is a record of every single transaction that has ever occurred. This is currently more than 369 gigabytes in size.

Lightweight nodes, on the other hand, only download a fraction of the blockchain. Lightweight nodes are used by most folks as a "bitcoin wallet" for bitcoin transactions. A lightweight node will communicate to a full node when it wants to transact.

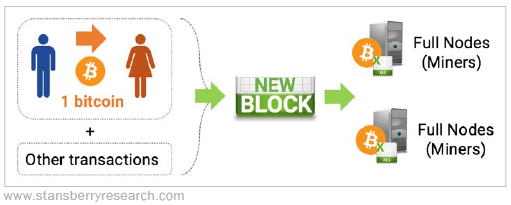

So the full nodes (or miners) run the spreadsheet, but how do they keep the spreadsheet synchronized between them all? This is the key, considering that the number of people who can run their own full node isn't limited. (See the figure below.)

Let's go back to Jim and Sally...

Jim wants to send one bitcoin to Sally.

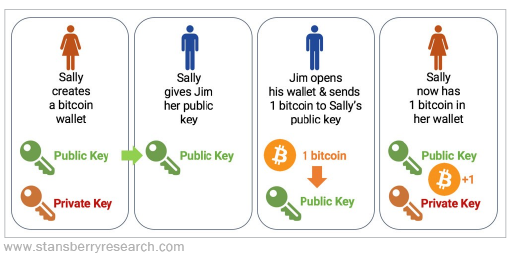

Sally creates a bitcoin wallet. Anyone can do this in a couple of minutes. When you create your wallet, two pieces of information are created for you...

One is your "public key," which is also known as a public address, or your bitcoin address. It's a string of numbers and letters. Think of it as an account username.

The other is your "private key," which is effectively your bitcoin password, and you need to keep it safe. If you lose it, it means you lose access to your bitcoin. (No centralized entity exists that can recover your password for you. It isn't like if you forget your Facebook password and you have instructions e-mailed to you to reset it.) More important, if someone else gets your private key, they can take your bitcoin.

Sally tells Jim her public key. Jim opens his bitcoin wallet, puts in the instruction to send one bitcoin to Sally's public address, enters in his private key (password) to authorize the transaction, and hits send. (See the figure below.)

After a few minutes, Sally checks her wallet again and sees she now has a bitcoin in her wallet. But what's happening behind the scenes?

First, the network (in this case a lightweight node) makes a quick check of the proposed transaction. It checks to see that Jim has enough bitcoin in his account. And it checks if the address Sally provided is a valid bitcoin address.

After the transaction passes those two tests, the transaction gets bundled together by miners with other pending transactions into a "block." The goal of the miners is to verify the block and add it to the blockchain (i.e., update the spreadsheet).

How does a miner get to add a block to the blockchain? This is where brute force mining comes into play. To understand this, we need to touch upon "hashes"...

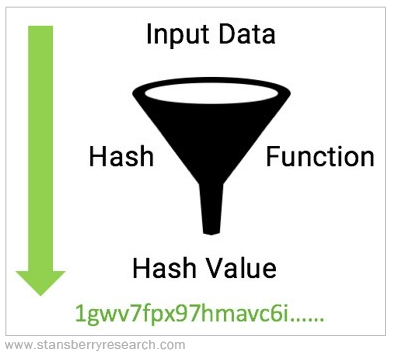

A "hash value" is a series of numbers and letters strung together that looks something like this: 1gwv7fpx97hmavc6inruz36j5h2kfi803jnhg. A hash value is generated by pushing data through a mathematical formula called a "hash function."

Another way to think of this is like the ingredients for a smoothie and a blender. You take your ingredients (your data), put it through a blender (the hash function), and you get your smoothie (the hash value).

Hashing is a one-way process. When you give me a hash value, I can't turn it back into its original input data, in the same way I can't turn my smoothie back into its original ingredients.

When miners are given a block of transactions to try and add to the blockchain, they are using a hash function to try and solve a cryptographic puzzle.

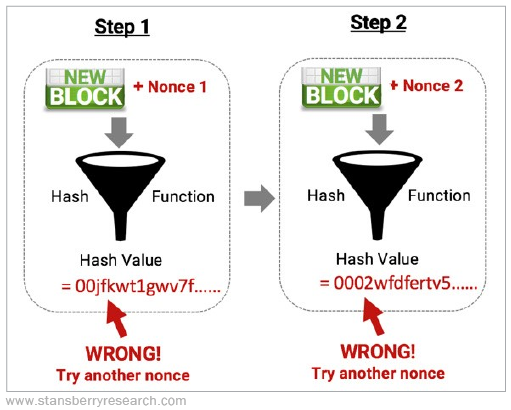

The miners take the new block with all the transactions in it, combine it with a randomly generated string of numbers (called a "nonce"), put it through a hash function, and then get a particular hash value.

The miners are trying to find a hash value that starts with a specific number of zeroes. They will keep trying different nonces until they get the necessary hash value. This trial-and-error computation is shown in Step 1 and Step 2 in the diagram below...

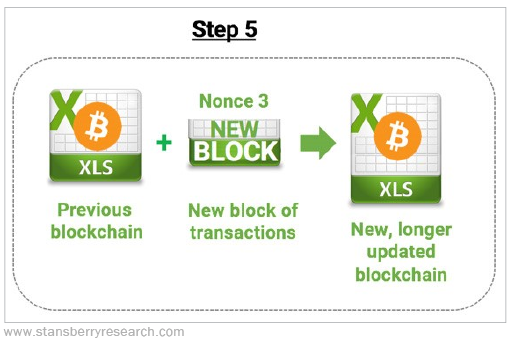

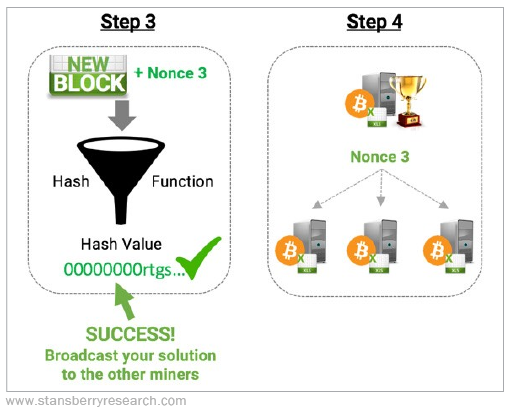

All the miners are in a race to find the correct hash value. This is because the miner who finds it (Step 3) will broadcast the correct solution to the network (Step 4), which will verify it is correct.

The new block then gets added to the blockchain (Step 5), and the winning miner gets awarded bitcoin by the blockchain for his success. (The miner who successfully finds the block also receives all of the fees from bitcoin transactions that were included in that block.)

Sally's bitcoin transaction is now recorded in the blockchain. Her bitcoin wallet is now credited a bitcoin, and Jim's is debited one.

The mining process then starts over again, with a whole new bunch of transactions bundled into a new block, and the miners all compete again to find the correct hash value.

Bitcoin's success has shown the world that it's possible for independent and fragmented entities (miners) to enable strangers to exchange value with no need for an intermediary. And it can be done in a completely transparent, verifiable, and open way.

In the media, bitcoin tends to dominate the headlines when it comes to cryptocurrencies. But in reality, bitcoin itself is just the beginning for blockchain... More than 6,000 cryptos are actively trading. Many will go to zero, but I believe some will grow by hundreds – or even thousands – of percent this year alone.

That's why if you're a crypto investor, now is a good time to make sure you really understand what you're investing in... and that you only have the cryptos that are set to thrive over the next year.

For all the gains we saw in 2020, I believe 2021 will be even more spectacular. That's because crypto has finally reached the point where it's ready for mass adoption...

More than 300 million people can now buy cryptos on PayPal. Massive corporations and even insurance companies are adding bitcoin to their treasuries. And Facebook has plans to launch a crypto soon.

All the fundamentals are aligning for a massive new wave adoption. And you want to be in the right cryptos before that happens.

Good investing,

Eric Wade

Editor's note: Eric believes the popularity of crypto is about to take off... and that the window to make the biggest gains is closing fast. That's why for a limited time, he's revealing the details of an unlikely story that led him to a simple strategy for trading crypto.

It's the same strategy that has helped a small group of his subscribers see gains as high as 273%... 292%... 596%... and a whopping 1,175%. Get started right here.