Like a good friend, this one asset will never let you down...

You can always rely on it. And that's because you'll always know its return.

Almost every single one of us has had it pounded into our heads that we need to get invested and put our money to work. There's no doubt I've stressed that. But not every single dollar you have needs to be in stocks or bonds.

You always need to hold cash.

Think about this... The professional money managers have no choice but to be fully invested in stocks and bonds. When a hedge fund collects 1% or 2% a year to manage someone's money, it can't justify much of a cash holding. An index fund, mutual fund, or exchange-traded fund has to put all its money to work.

If you have to match a benchmark like the S&P 500 Index, holding cash virtually assures that you'll lag behind in a bull market. While cash can smooth returns and pay off over the long term, a professional has to hit annual or even quarterly numbers.

If they don't make their numbers, then they don't get to go to Bora Bora on vacation.

But you don't have to worry about matching an index return or justifying your paycheck. If you're like me, you want to keep your money safe first. Then you want to see it grow at a decent rate.

What's more, at any given time, cash stands a good chance of beating stocks.

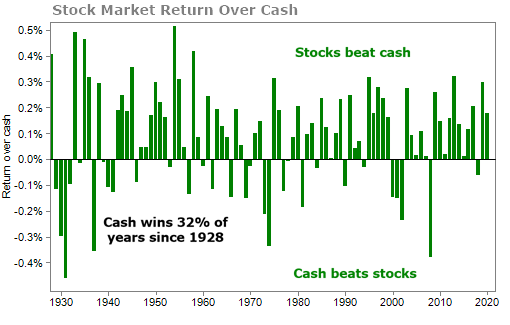

Going all the way back to 1928, cash returns (as measured by the returns on short-term Treasury bills) beat stock returns nearly a third of the time. Take a look...

That means, if you forget the stock market entirely and sit in cash, you've got a nearly 1-in-3 chance of doing better than the white-knuckled stock investor riding the latest momentum play.

Of course, when stocks win, they provide bigger returns than cash. So over the long haul, you definitely want to own stocks. The question is how much...

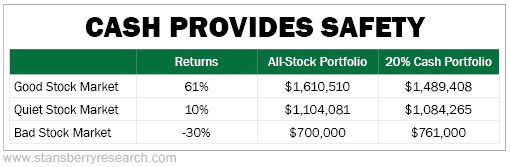

Let's build a hypothetical here. You want to invest $1 million between stocks and cash over the next five years. You want to decide between fully investing in stocks or putting 20% into cash. But you don't know what the market will do in the next five years.

Now, a professional may look at percentage returns, such as "if the market returns 10%, I'll only return 8%." But for an individual, it's much more important to think of how much money you'll actually have.

Take a look at three scenarios – the market returns 10% a year, returns 2% a year, or undergoes a 30% crash. In this hypothetical, our cash account returns 0.5% a year. And we consider investing entirely in stocks or putting 20% in cash and 80% in stocks. Here's how things look over a five-year period...

Now, this isn't a case where the math points you directly to the right answer... This is a personal matter. But, if you're saving for retirement and over the next five years the market returns 61%, should you really care that much about the difference between $1.6 million and $1.49 million?

It's real money, sure. But you don't have to kick yourself about missing those gains.

If things stay quiet and return 10%, it's roughly the same. You gave up about $20,000 in potential profits.

However, if the market crashes, we'd love to have that extra $61,000. That could be a year or two of retirement for many folks, depending on their lifestyle. What's more, while the market crashed, we were sitting on about $200,000 worth of totally safe, never-going-anywhere, always-going-to-have-it cash.

That peace of mind is well worth missing a few percentage points if the market rises. Plus, you could invest some of that cash near the market bottom rather than the market top to amplify your returns in the eventual recovery.

Most people know that having some cash is important. But exactly how much to hold is the tougher question...

In January's issue of Retirement Millionaire, I gave readers the ideal asset allocation... how much a portfolio should be spread across blue-chip stocks, cash, government bonds, gold and other commodities, corporate bonds, international stocks, and even speculative investments.

While I won't give the full allocated portfolio away, I will tell you that the second-largest holding in this conservative hypothetical portfolio was cash. Specifically, 25% of the portfolio was designated to cash.

As always, by cash I mean all the money you have in savings, checking accounts, certificates of deposit ("CDs"), and short-term U.S. Treasury bills. Any investment with one year to maturity or less can be considered cash.

I like to say that cash is king. It will never let you down.

Make sure your portfolio is properly allocated today... and make sure you are holding enough dry powder.

And on that note, my colleague Dan Ferris is issuing a warning about a once-in-a-lifetime financial event that he says will affect nearly every asset you own... stocks, bonds, real estate, even your cash hoard.

As an investor with a diverse portfolio, this is a warning you should pay attention to.

What We're Reading...

- Something different: Florida Governor DeSantis ends "corporate kingdom" of Walt Disney World.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 1, 2023