Senator J. William Fulbright wanted war with Europe.... over a bunch of frozen chicken.

It all started in the late 1950s, when America's agricultural industry was booming. The U.S. had ramped up its production of chicken so much that it was sitting on a surplus of poultry.

Eventually, the U.S. started shipping frozen chicken from southern states like Arkansas across the pond to Western Europe where agriculture was struggling.

The European chicken farmers who had barely been able to meet demand were suddenly facing huge competition from American farmers, crushing their businesses.

These farmers complained to their elected leaders, and in 1962, the European Economic Community imposed tariffs of 13 cents per pound on chicken imports. (Allegedly, European officials even went as far as to claim American chicken was "diseased.")

This, in turn, walloped the U.S. chicken industry, with sales at some companies falling by as much as 30%.

Fulbright, a U.S. senator from Arkansas, was one of the loudest voices in what became known as the "Chicken War." He said that if the European Economic Community didn't reduce the tariffs, the U.S. would retaliate.

As he wrote to chicken magnate Don Tyson of Tyson Foods, the government had done everything it could to solve the chicken problem, "except send a battleship up the Rhine River."

The situation got so bad that Fulbright even interrupted a debate over nuclear weapons in Geneva to protest "hostility to U.S. chickens."

Of course, the U.S. didn't send any battleships to Europe...

Instead, the target of our revenge was European pickup trucks. In 1964, President Lyndon Johnson signed a law placing 25% tariffs on "light utility vehicles."

Among gearheads who long for the small, cheap pickups and vans available in other parts of the world, it's still known as the "chicken tax."

A few automakers have chased loopholes...

In the 1980s, Subaru screwed plastic seats into its Brat pickup's cargo bed to claim it was a passenger vehicle.

Mercedes-Benz used to partially disassemble its commercial vans for delivery to the U.S., send the parts in separate shipments, then put them back together once they arrived.

Ford was particularly brazen... It built low-tariff passenger vans in Turkey, got them through customs, then turned most of them into cargo vans by throwing away the vehicles' brand-new rear seats, seat belts, and rear windows.

In the end, though, Subaru stopped selling pickups in the United States... Mercedes started building vans in South Carolina... Ford paid a $365 million fine for its shenanigans... and many foreign carmakers never even try to sell cargo vans or pickup trucks in the U.S.

So the Europeans don't get cheap chicken. And even to this day, Americans have fewer choices on small utility vehicles.

The whole chicken tax was a big waste of time, creating disruptions in the global economy that just don't make any sense, reducing consumer wealth, and lasting for decades.

And it looks like it's all about to happen again.

After all, President Donald Trump is playing the tariff game now.

On Wednesday, Trump announced a 10% baseline tariff on nearly every import. He also announced reciprocal tariffs on dozens of countries ranging from 10% to 50%... and imposed higher tariffs on certain products, such as cars.

He is waging a trade war with our closest trading partners, our top geopolitical allies, and just about everyone else across the globe.

As we write, the European Union, China, and Canada have all promised to enact "countermeasures" to fight the new tariffs. But several others, like the U.K. and Mexico, have made it clear that they don't want a trade war. (As we write, China has announced a 34% tariff on all U.S. goods.)

Trump may just be waiting to see who blinks first – not truly wanting to institute these big tariffs.

Global markets plunged after Trump's announcement:

- Japan's Nikkei 225 Index fell 4.6% to a near eight-month low

- The U.K.'s FTSE 100 Index fell 1.5%

- The S&P 500 Index opened 3.1% lower on Thursday morning

Investors are worried about a larger trade war breaking out and economic hardship from the tariffs causing a recession in the U.S.

No matter what you think of Trump's policies, you're probably worried about what all the tariffs and uncertainty mean for your portfolio and whether there's a major crash headed our way. As my friend, Marc Chaikin – founder of our corporate affiliate Chaikin Analytics – recently shared...

[The] presidential boom and bust cycle has nothing to do with which person or even party is in power.

No presidents are immune, no matter how beneficial they are for the economy.

So we would be foolish not to prepare for this.

I believe the next crash is most likely to hit in early to mid-2026.

But it could happen in late 2025. We won't know until we're further into the year.

What we know for sure is that the average loss from a postelection year, where we are now... to a midterm election year bottom... over 100 years is 20%.

Last week, Marc came forward with an urgent update on the next market crash. Plus, he detailed a brand-new investing strategy that could more than double your entire portfolio – even if stocks fall from here.

If you want to learn how you can profit – whether the market booms or busts – click here.

Now, let's get into this week's Q&A... As always, keep sending your comments, questions, and topic suggestions to [email protected]. My team and I read every e-mail.

Using Trailing Stops to Protect Your Investments

Q: What type of stop do you recommend following? – C.C.

A: Thanks for your question, C.C.

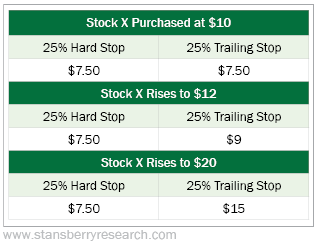

Stops come in two varieties: hard and trailing. Here's a look at how the stop types differ:

As stock X's price rises, the trailing stop follows it up, but the hard stop stays the same... no matter how high the share price rises. (Of course, the trailing stop doesn't follow the stock down. So if shares fall to $8 right after you buy them, your hard stop and your trailing stop both remain at $7.50.)

The kind of stop you should use depends on what you're investing in and what your goals are. Here at Stansberry Research, our editors will recommend different stops for different portfolio holdings – based on a given strategy or risk profile.

For example, I often recommend a 25% hard stop in my Retirement Millionaire newsletter because our strategy is to let our winners ride for the long term, without needing to sell during a period of ordinary market volatility.

However, I recently switched some of my long-held winners to trailing stops to protect our gains. And sometimes I'll recommend a wider 35% stop to give a volatile stock more room to bounce around

What We're Reading...

- Did you miss it? Where to look for value in the market.

- Something different: Explaining the cost of eggs.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 4, 2025