A wave of new money – up to $100 billion – is about to flood one of the best income-producing sectors in the market...

It's one of the most exciting "special situations" I've uncovered in 10 years at Stansberry Research.

The companies that run the S&P 500 Index... the Dow Jones Averages... and a set of global and sector benchmarks you may have heard of, called the MSCI indexes... are breaking out real estate investment trusts ("REITs") from the "financial" industry and into their own slot.

A REIT is a special way to structure real estate holdings. The company serves tenants and maintains buildings... and gets big tax breaks in exchange for agreeing to pass on the vast majority of its annual income to shareholders (allowing it to pay a fat dividend).

This makes REITs a great way to invest in real estate assets without having to deal with the headache of actually managing them.

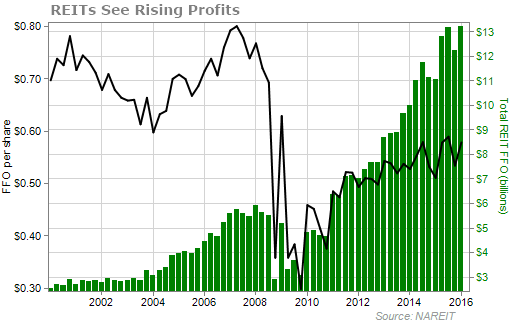

Many businesses in the U.S. are struggling through a "profits recession" right now. Yet, REITs keep growing earnings. Funds from operations ("FFO") is the key measure of REIT profitability. And as you can see in the following chart, the FFO per share rose 19.5% over the last year...

REITs in the S&P 500 have rallied 360% since March 2009 – the bottom of the market – as low interest rates have helped the companies outperform financial-industry components like banks and insurers.

And this adjustment to the S&P indexes will push REITs higher still. Here's why...

Lots of big funds have mandates to reflect the overall composition of the market. A certain percentage of their holdings must be in health care stocks, a certain percentage in energy stocks, and so on.

Right now, they might be hitting their target for "Financials" percentage – where real estate used to reside – by owning millions of shares of Citigroup or Bank of America.

But in August, the S&P 500 Dow Jones and the MSCI indexes broke real estate off into its own category. That means any fund that tracks those indexes must take steps to align with the new sectors. And according to research from JPMorgan and others... equity funds are significantly "underweight" when it comes to real estate.

In plain English, that means the big players simply don't own enough of it.

According to research from JPMorgan, big funds only have about 2.3% of their holdings in real estate. But their benchmark is 4.4%. That means they'll need to nearly double their real estate holdings by September 16.

In some cases, the disparity is even more dramatic. Large-cap value funds currently hold just 0.9% in real estate. But their target is 4.9% – or more than five times higher.

That's an extraordinary setup for investors who own shares.

I think REITs are one of the best opportunities in the market today.

JPMorgan's research suggests that the index change that's about to take place on September 16 could grow the entire U.S. REIT market by 12%.

But all REITs are not created equal...

Some invest in residential apartments, others in single family homes. Some are in office space. Some own strip malls, industrial parks, hotels, data centers, even timberland.

All these different industries have different drivers. They thrive under different economic conditions and in different parts of the business cycle. You could spend a lifetime learning how to rotate in and out of different REIT sectors.

And frankly, some of my colleagues are extremely concerned today about certain areas of the real estate market – areas you should avoid at all costs. One of the biggest mistakes you can possibly make is just going out and buying the REITs with the highest dividend yields.

Right now, there are four REIT opportunities that are especially attractive. I've put the details into a new report, The $100 Billion Windfall...

The only way to access this research is if you're a member of my monthly income-investing letter, Income Intelligence. Current subscribers can view this report right here.

If you're not yet an Income Intelligence subscriber, this is the only letter we publish at Stansberry Research that is 100% focused on finding low-risk, high-upside stocks that pay you to own them.

I think it's one of the most valuable research products we offer. So today... ahead of this major sector shift... I want to make you an offer that's basically impossible to refuse.

My hope is that once you try my research, you'll quickly realize there's nothing out there like it... and you'll become a lifelong customer.

So I'm completely changing the way we offer this research... and drastically changing the entry price. To receive this research, you won't have to pay $1,500 a year. You'll pay much, much less. For the details on this brand-new offer, click here. (This link doesn't go to a long video presentation.)