Each year, Stansberry Research hosts the Stansberry Conference and Alliance Meeting in Las Vegas...

Earlier today, I hosted a segment of the conference for our Alliance members. It's a panel where Stansberry editors and analysts, myself included, pitch their best investment ideas for the year.

It's always a blast for me to host this panel. I love interacting with my colleagues and the attendees. Last year, anyone who invested in my pick made 20%.

But I like to do more than give out investment ideas. I like to present what I'm seeing in the economy and the stock market. I cover everything from potential bubbles that could bring down the economy, to global yields, to consumer confidence. I love laying out all the facts so the attendees can make up their own minds about the health of the economy.

It's not too late to catch up on everything you've missed in Las Vegas...

The Stansberry Conference is over, but you still have time to see all the action. This year, we featured incredible presentations from some of the best folks in financial research like Jim Grant, Dr. Nouriel Roubini, and John Doody.

We also had presentations from Shark Tank investor Kevin O'Leary, political satirist P.J. O'Rourke, and senior editor of digital products at The Economist Kenneth Cukier.

And starting today, you'll have 30 days to watch them all. But your chance to order your streaming pass ends soon.

That's why today, I want to talk to you about the unemployment picture. It's crucial to understand what is going on with the labor market if you want to predict what happens next in the stock market.

Earlier this month, data showed the unemployment rate dropped to 3.5% in September, a rate not seen since December 1969.

You would think with unemployment near all-time lows, stocks have to be at all-time highs, right?

Well, not exactly. Investors are more focused on global growth and what is next for the trade war. The unemployment news gets pushed back to the second page.

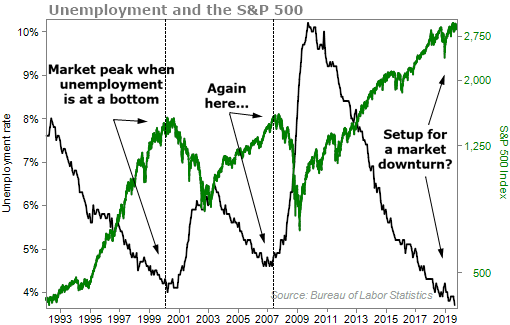

What we need to figure out is when the economy is at full employment. When there's a bottom in unemployment, there's usually a top in the stock market...

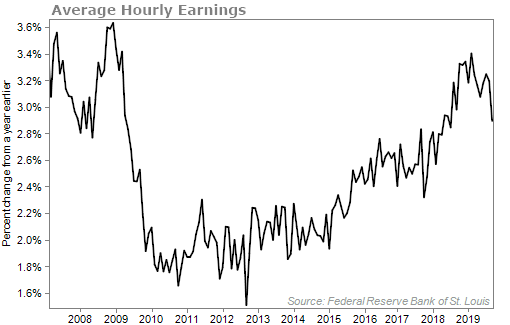

Economic theory tells us that falling unemployment should lead to higher wages and inflation. After all, at full employment, companies have to pony up if they want to hang on to their top employees. A scarcity of available workers means higher salaries. And wage growth is the biggest driver of inflation.

Even though unemployment is at a 50-year low, we haven't seen the surge in earnings or inflation yet. As you can see, wage growth has actually fallen a bit recently.

And inflation is still below the Fed's 2% target.

A decade earlier, many economists estimated the unemployment rate that represented full employment – where almost every American wanting a job can find one – was around 5%. The Fed has since dropped that estimate to 4.2%, according to projections released last month.

Unemployment hit that level two years ago. And it has continued to fall. It's a confusing time for sure. Economists can't seem to agree if the labor market will get any tighter from here or not.

Schmidt Futures economist Martha Gimbel summed it up nicely...

The economics profession has done a lot of rethinking [about full employment] over the past few years... We don't really know how far the labor market can go. There are still a lot of workers employers can hire before they have to raise wages.

It's easy to look at a chart of the unemployment rate and say, "No way this could fall any further"... but the wage-growth and inflation readings say it is possible. And that could be great for stocks. Remember the first chart I showed you... Stocks tend to top when unemployment bottoms.

It's clear we are near the end of this economic cycle. And when we see proof that unemployment is on the rise, it's time to prepare for the worst.

What We're Reading...

• The Fed has a theory. Trouble is, the proof is patchy.

• That 50-year low in unemployment isn't helping worker paychecks.

• Something different: Powell says Fed will expand balance sheet soon.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 9, 2019