The president just got a belly-laugh wake-up call...

During Joe Biden's recent State of the Union address, he did what just about every president does... He talked up all the successes during his time in the White House. And he also railed on the people and institutions destroying the country... only to then say he was the man who could fix those problems.

As longtime readers know, I try not to take sides politically... In my experience, both sides like to talk loudly while spending money they don't have.

A few of President Biden's remarks caught my attention, though. Specifically, Biden took aim at oil companies' record profits.

His frustration was that these oil companies have invested far too little to increase domestic production. Instead, they rewarded shareholders through stock buybacks and dividends.

Whether you agree or not, it's an understandable frustration. While folks have been crushed by higher energy costs, big oil companies have gotten massive paydays.

Here's where Biden lost me...

Last year, they made $200 billion in the midst of a global energy crisis. I think it's outrageous. Why? They invested too little of that profit to increase domestic production. And when I talked to a couple of them, they say, "We were afraid you were going to shut down all the oil wells and all the oil refineries anyway, so why should we invest in them?"

I said, "We're going to need oil for at least another decade."

The folks gathered in the U.S. Capitol's House Chamber erupted in laughter after those last four words.

At least another decade.

To Biden's credit, he was able to read the room. He quickly threw in a "and beyond that" in the midst of the laughter. But this means that the Biden administration really thinks we could be as little as 10 years from eliminating oil.

The folks in the House Chamber were right to laugh at the thought of oil becoming irrelevant after a decade. It's pure fantasy.

Even if the Biden administration's green initiatives are as successful as his team seems to expect, we're not going to stop using oil anytime soon. Only 1% of all cars in the U.S. today are electric vehicles ("EVs"). And they represent only 6% of new-car sales.

Of course, EV adoption could speed up as technologies for EVs advance in years to come. But even with lots of new electric cars, oil demand is still going to be substantial 10 years from now.

To be clear, I have nothing against electric cars. But I have to be realistic about the adoption of EVs here in the U.S. It's not moving as fast as many expected.

Here's another fact... While electric vehicles are achieving greater viability, there's still no real solution in the works to displace jet fuel used in airplanes... or petroleum used in boats.

Finally, the fact remains that we're not drilling for enough oil to keep up with demand.

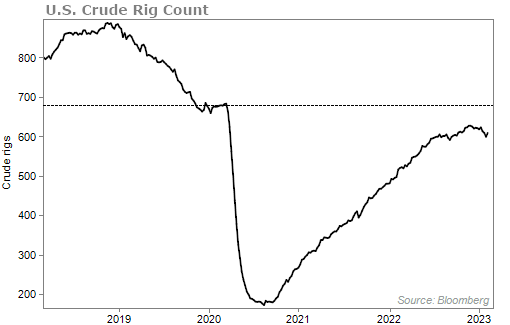

Although rig counts – the number of active drilling rigs throughout the U.S. – have been on the rise the past couple of years, they're still below pre-pandemic levels. They have even been turning lower lately. Take a look...

We don't need oil for "at least another decade." We need it for decades past that.

Oil stocks seem like a good investment to me for the next few years... And Dan Ferris, editor of Extreme Value, is bullish on commodities in general...

Dan is calling the opportunity in commodities the "biggest – and perhaps most obvious – setup I've seen in my entire career." In a short video presentation, Dan explains why now is the time to invest in commodities.

Click here to get all the details.

What We're Reading...

- Something different: The debt ceiling is the risk Wall Street doesn't want to think about.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 8, 2023