Throughout my professional life, I've questioned everything...

Anytime I would hear, "That's just the way things are," I wanted to cringe. You could almost see the steam coming out of my head. This mindset is part of what drove me out of Wall Street and then out of medicine.

Even during board and manager meetings I've attended over the past several years for Stansberry Research's parent company, I've never just accepted the status quo. I question everything and want to see if there's a better way... It's just in my nature to be a contrarian. It's a lesson I've taught everyone on my team.

You don't have much success in life by just doing what everyone else is doing.

Period.

And it's especially true in the markets.

If you've been reading my work for long, you'll know I'm an advocate for going against the herd. Lately, this means that I've gone contrarian on one of the most popular investments in the world right now... Nvidia (NVDA).

Unless you've been living under a rock, Nvidia is on your radar. The company has mostly been known for its computer chips used to support video games. But it's now the world's leading maker of semiconductors tailored for AI, touting a market share of about 85%.

This has made it the poster child for the AI boom.

A few months ago, most folks didn't even know Nvidia existed. And I'd guess most of the investors piling into Nvidia don't actually understand what Nvidia does.

So today, I'm going to take a deep dive into Nvidia to see if it's really worth the hype.

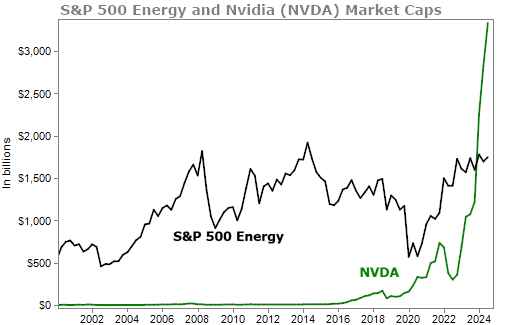

First, let's take a look at this chart, which shows that Nvidia now has a market cap far greater than the S&P 500 Index's entire energy sector...

Now, Nvidia is a fantastic business. With its market share in AI, it's easy to see why folks get so excited to buy the stock.

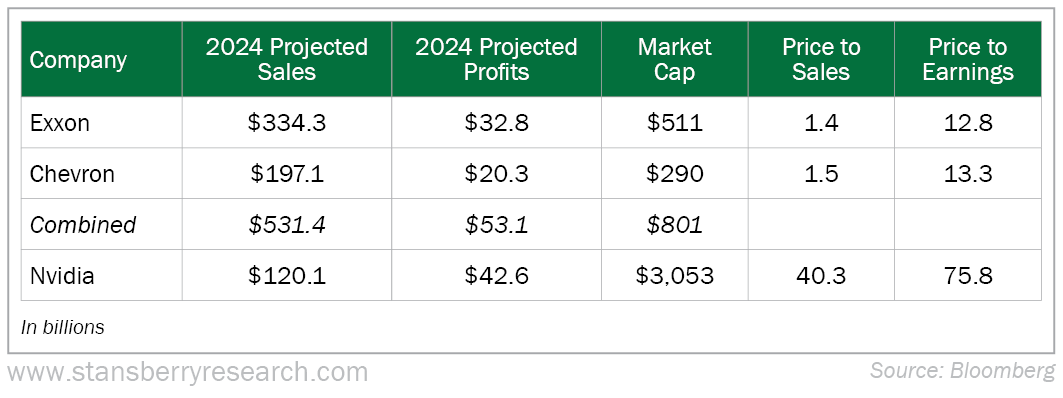

But no reasonable growth projection could justify Nvidia being worth way more than the entire S&P 500 energy sector. To see what I mean, I'll compare it with just the top two energy stocks... ExxonMobil (XOM) and Chevron (CVX).

Projections call for Exxon to bring in $334 billion in sales and $33 billion in profits by the end of 2024.

Chevron's sales are projected to be $197 billion. It should make roughly $20 billion in profits.

Combine these two companies and we're looking at $53 billion in profits, and they have a combined market cap of more $800 billion. Meanwhile, Nvidia hopes to generate slightly less profit ($43 billion) yet has a market cap more than 3 times that of Exxon and Chevron combined.

Also, we only listed two energy stocks in the table above... We haven't even talked about big energy companies like ConocoPhillips (COP), Halliburton (HAL), SLB (SLB), and Occidental Petroleum (OXY), among many others. Most of these companies are also rolling in profits.

Nvidia should not be worth twice as much as the entire energy sector. Shareholders who are buying in today will more than likely be burned... soon.

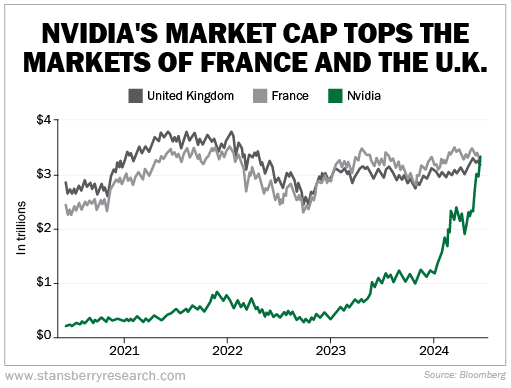

This next chart is also a head-scratcher... Nvidia's market cap has surpassed that of both the U.K. and France.

It's obvious to see the stock is priced to perfection. Any slipup with its hypergrowth story – even if it's minor – could send the stock barreling down in an instant.

Save that ride for your neighbors and investors who only buy what everyone else is buying. Our advice is to stay far away from Nvidia. We've seen far too many hype stories like this end badly for late investors hoping to make a quick buck.

Again, the main point I want to make here is that you won't make a lot of money by doing what everyone else is doing.

I don't think you should buy Nvidia today... or any of the other hype-fueled tech stocks that folks on Reddit are clamoring for.

If you want to make money, you have to look where no one else is looking. Fortunately, my colleague March Chaikin is hosting an event tonight at 8 p.m. Eastern where he talks about stocks that are receiving little Wall Street attention.

This is an area of the market where Warren Buffett famously said that if he were managing only a million dollars instead of billions, he could guarantee a 50% return annually.

It all starts in just a few hours. Click here to make sure you don't miss it.

What We're Reading...

- Analyst revamps Nvidia stock price target as it becomes world's most valuable company.

- Something different: Storm chasers caught a tornado with 300 mph winds.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 26, 2024