Stocks are expensive today. The question is, what do you do about it?

Valuation matters. Buying businesses at cheap prices will always beat buying them when they're expensive.

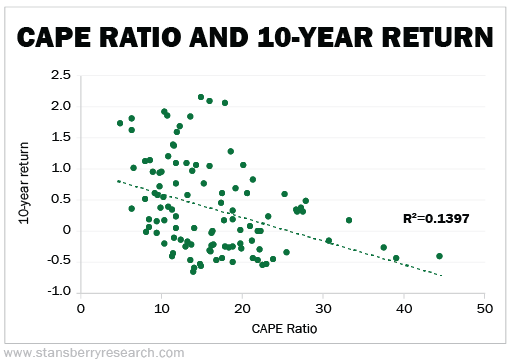

If you consider the cyclically adjusted price-to-earnings ratio (or "CAPE" ratio), it gives you some idea what stocks will return over the next 10 years.

In the chart below, each dot represents a 10-year period, going back to 1910. Its starting CAPE ratio is tracked across the bottom, and its final return is charted along the vertical axis. You can see the downward slope. That shows that as the CAPE ratio gets higher (along the bottom axis), the returns usually get lower. The line shows the "best fit" of an equation that relates the two.

Based on these data alone, we'd expect negative returns on stocks with today's CAPE ratio of 31.3.

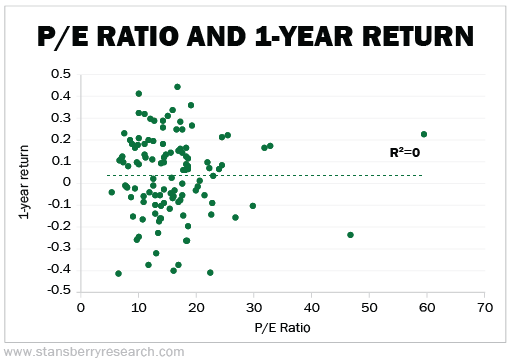

But in the shorter term, valuation means almost nothing. If you're going to try to time the top of the market, you need something better than valuation. (Better yet, don't try at all.)

Just look at what's happened over the past four years...

[optin_form id="73"]

The average price-to-earnings (P/E) ratio for the benchmark S&P 500 Index for the past 50 years has been 16.6 times. Yet, the S&P 500 has been higher than that for the past four years. At any time since 2013, you could have defended a decision to exit stocks because valuations were "too high." Many did... And they lost out on a blazing bull market.

If you try to use valuation to predict one-year returns, rather than 10-year, you'll flop. It's a mess, with no clear pattern...

As author F. Scott Fitzgerald said, "The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function."

That's where we are today. Of course, we prefer to buy at low valuations. We always should. But we also want to own stocks as they ride higher and higher.

We can combine those two opposing ideas into a functioning strategy. We can buy stocks at a 40% discount to the S&P 500 with great growth prospects – better than those of the S&P 500 stocks.

We're talking about emerging markets.

We know no asset class confuses the crowd more than emerging markets. The term conjures images of far-off lands with uncertain economies and banana-republic leaders. It's easy for investors to shun these types of investments.

But that's not what emerging markets are... The exact list of which countries qualify varies, but generally, we're talking about countries with advanced industries, stable laws, and skilled workforces... Walk through the major cities of Taiwan, Mexico, China, South Korea, or even Brazil, and you'll find modern, robust economies.

(The Wild West economies, a step below emerging markets, are called "frontier markets.")

Emerging market countries do have volatile periods. Turkey and Qatar are two recent examples thanks to tenuous political situations. But the growth of strong countries offsets the risks in weaker ones.

Picking which countries will do the best in a given year is difficult. But investing in emerging markets can be lucrative.

Since 1987, U.S. stocks have returned 9.5% a year... while according to the MSCI indexes, emerging markets have returned an average of 12.6% a year.

The U.S. has seen an incredible bull market during the last eight years while emerging markets languished.

But today, the trend is swinging again.

We could be in the early years of the next boom in emerging market stocks. And we want to be along for the ride.

That's why, in a recent issue of Retirement Trader, I told subscribers about the easiest way to get exposure to emerging markets. It's cheap, has great growth potential, and offers instant diversification.

If you're not already a Retirement Trader subscriber, click here to get started.

- These were some of the top emerging market funds of 2017.

- Something different: If you're on the East Coast, get ready for the "bomb cyclone."

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 3, 2018