It always amazes me when folks vastly underestimate just how much they will spend in retirement.

I'm placing an emphasis on "vastly" because it's not by $10 or so every month. It's much more. I'm talking potentially hundreds of dollars or more a month.

And if you don't have enough saved, this overspending can ruin the rest of your retirement. I've seen it too many times where new retirees burn through a good chunk of their nest egg in just a few years.

It puts so much more stress on your golden years – when you should be enjoying them.

Even the best budgeters and Excel sheet wizards fail to estimate the true cost of retirement. That's especially true in the first few years after leaving the workforce.

Most folks think that expenses will go down significantly in retirement. They don't have to commute to work, which will cut down on the gasoline bill... There's no business lunches or new clothes to buy for work... Maybe they downsize or pay off their mortgage... And the kids are out of the house, so no one is nagging them for spending money.

All of that may be true...

But most folks fail to realize how much extra time you will have once you retire. And what do most retirees do with their newfound freedom?

Spend.

They travel, go out to restaurants, start new home projects... you name it. There's only so much sitting on the couch you can take.

According to the international travel agency network Virtuoso, the average retiree spends $11,077 a year on travel. That's a lot, considering half of all Americans aged 65 and older bring in less than $27,398 in yearly income.

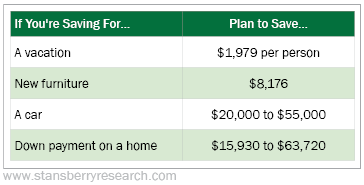

The table below looks at how much you should prepare to save for different things in your retirement. Keep this in mind as you plan your projected expenses...

Of course, not everyone will have all of these expenses. But you can see how a few vacations a year, a home renovation, contributing to a child's wedding, or a new car after your 20-year-old car suddenly dies can add up.

Then you also have to consider higher medical costs. As you age, there's a need for more medical care. And the cost of medical care keeps shooting up...

Fidelity estimates that an average retired couple needs approximately $300,000 saved after taxes to cover health care expenses in retirement. And that's an increase of about 4% from a year ago.

Getting old gets expensive. You need to make sure you're able to afford everything that comes along with retirement.

Because there are so many unforeseen costs when you retire, I can't stress enough the importance of a rainy-day fund. Every retiree needs one. Trust me, there will always be unexpected costs, and you will likely have to spend more than you planned for in retirement.

As a general rule, you should always have about three to six months' worth of expenses in cash.

While you can budget out everything from how many vacations you take per year to how many times you eat out, there will always be expenses that pop up that you just weren't expecting. You have to be prepared for those and have enough money saved.

If you're getting close to your retirement age or already retired, I want you to be able to be comfortable in your retirement and be able to do the things you want to do.

I want you to be financially stable.

And to do that, you have to make your money work for you. You have to be generating a return on your portfolio... and that's scary today with all the threats to the stock and bond market. There's an overvalued stock market, inflation, and historically low bond yields.

That's why this morning, I hosted a Retirement Wake-Up call.

In just the first 10 minutes, I revealed something that could mean the difference of millions in your retirement. Yes, millions. And I showed the numbers to prove it.

I pulled out all the stops for this presentation...

That's because the big lie I exposed may very well define my career. It's the culmination of all my years on Wall Street, in medicine, and working on behalf of the American retiree.

I truly believe this could be what I'm remembered most for.

It has the potential to improve and possibly even save the retirement of thousands of people – hopefully including you.

If you missed this morning's event, click here for all the details.

What We're Reading...

- Something different: Here's what happens when you buy one of those cheap houses in Italy.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 23, 2021