Folks my age love to complain about millennials...

According to stereotypes, they're lazy, entitled, and need constant praise.

You've also probably heard that millennials have been coddled by their parents and therefore rely on them too much.

I won't comment on the first few claims... Though, I will note that nearly every generation of parents has written off their kids as lazy... and in return, the kids have dismissed the older folks as out of touch. Either the human race has constantly gotten lazier over time (a real possibility) or folks do the same dance over and over again.

I'll also admit that millennials have had a rough go. Many joined the workforce at a tough time – the years surrounding the financial crisis. And they did so after a multidecade period of high inflation in education and housing costs.

They've also had to endure this current crisis with over 30 million Americans losing their jobs. It hasn't been an easy start to their careers.

So while I won't discuss the millennial work ethic, I will dive into the stereotype that does have statistical merit – and, for our purposes, plays a big role in our economy...

It's a fact that young adults born between 1981 and 1996 depend on their parents more than previous generations... especially financially.

A November survey from investment firm Merrill Lynch tells it all... Nearly 60% of adult Americans ages 18 to 34 said they could not afford to get by without financial support from their parents.

And 75% of millennials define success as having "financial independence from their parents," rather than building up personal wealth.

That's a much different story than previous generations...

Back in the day, young people were expected to get a job and contribute as soon as they left college (or even once they turned 18). Today, many kids are taking "gap years" and deciding which European country to backpack across. As a result, millennials are entering the workforce much later in life than previous generations.

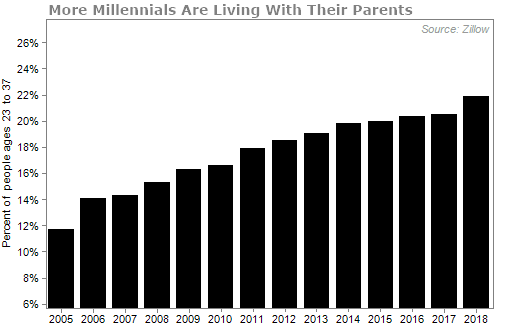

Millennials are also living at home longer. High student debt, skyrocketing costs of living, and stagnant wages have made it hard for some to move out of mom and dad's house.

Almost 1 in 5 young adults are living with their folks now. That's a higher percentage of young adults doing so in the U.S. than at any other point over the past couple decades...

This has led to constant mainstream headlines saying that millennials will never buy homes or have children... and that those developments would lead to a decline in the overall housing market.

But such ominous predictions were premature...

Millennials are growing up. The younger end of their generational bracket only graduated college within the last few years, and the top end is getting close to 40 years old.

And as millennials age, they're having children... building careers... and buying their own houses (even if they still need some financial help from mom and dad).

It's leading to a boom in housing.

Now, for conservative investors, "boom" is a dirty word. A "boom" implies a "bust"... and suggests it's coming soon. When the stock market is booming, it's time to be cautious.

But real-world booms are different.

This isn't a speculative boom. This isn't about house-flipping and investment properties.

Rather, there just isn't enough housing to go around.

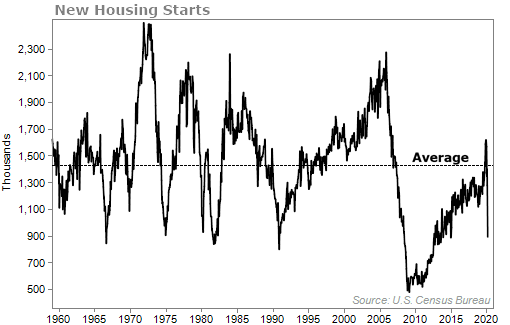

After the housing bust of 2008 and 2009, homebuilders stopped doing their jobs. They stopped building new homes. And over the past several years, they've been trying to play catch-up.

But even still, not enough homes are being built. New housing starts recently plummeted below their long-term average because of the coronavirus...

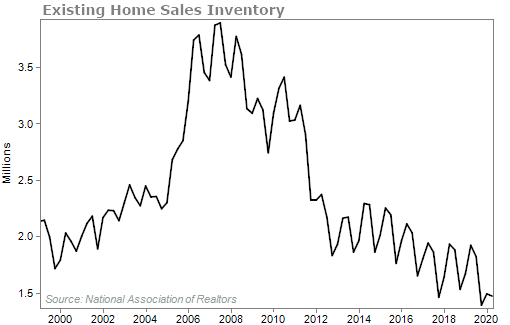

Currently, there are not enough homes on the market. U.S. existing home sales inventory is near an all-time low...

With so few homes on the market, new homes need to be built.

A recent report from real estate broker Redfin also found that new homes are becoming a larger share of the market. One in 5 homes for sale in April were new homes... compared to just 1 in 6 the year before.

It has been a fact for a couple years that demand for housing is greater than supply.

Millennials just recently took over as America's largest generation, and that's going to be a strong tailwind for the housing market. Plus with interest rates likely going to be near-zero for the next couple years, that should attract new buyers to take advantage of low mortgage rates.

My team and I have liked the long-term outlook for housing for a couple years now, and we're not the only ones who are bullish. My colleague Steve Sjuggerud is, too.

For the first time ever on June 24, Steve is going to share ALL the secrets of his No. 1 investment strategy that he still personally uses to profit today.

During this event, Steve will even show you a brand-new kind of investment opportunity that's been off-limits to ordinary investors until recently.

We've never covered anything like this in Stansberry Research's 20-year history... Steve will be joined by a panel of experts, including a former winner of The Apprentice. Click here to sign up now. It's 100% free to attend.

What We're Reading...

- Homebuilder sentiment posts biggest monthly surge ever, a sign housing is rebounding from coronavirus.

- U.S. May retail sales surge 17.7% in the biggest monthly jump ever.

- Something different: Steroid drug hailed as 'breakthrough' in COVID-19 as trial shows it saves lives.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 17, 2020