A warning sign just flashed in the technology sector... And that means the rally in the Nasdaq could fizzle out at any moment.

Now might be the time to take short-term profits.

I (Jeff Havenstein) am certainly not putting any more money into tech stocks because of this red flag.

One of the simplest ways to know a market is healthy is to make sure more stocks are going up versus going down. This is what the advance/decline (A/D) line looks at.

The A/D line takes the number of stocks that went up in a given day and subtracts the number of stocks that went down. If more went up during that day, the line goes up. If more went down, the line goes down.

In a typical bull market, as stocks rise, the A/D line usually goes up, too. When the A/D line moves lower while the market continues to go up, it's time to worry. It means that gains in stocks are concentrated in only a few companies.

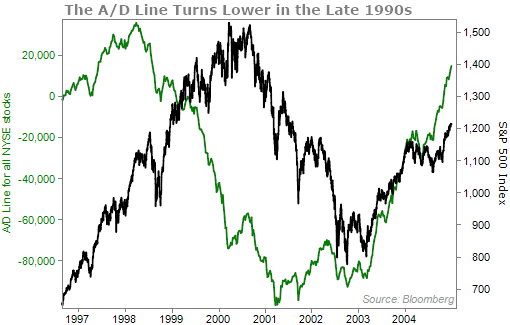

As an example, we saw just that before the dot-com bubble burst.

Take a look at the chart below... The green line, the A/D line, started to head lower at the end of 1998. And it kept dropping through 1999. Meanwhile, stocks kept charging higher. The S&P 500 Index didn't hit its peak until March of 2000.

By then, it was too late for investors...

Folks who paid attention to the A/D line knew that the gains in the market were concentrated in just a few stocks. The majority of stocks were actually taking a bath.

That's just not a sustainable relationship.

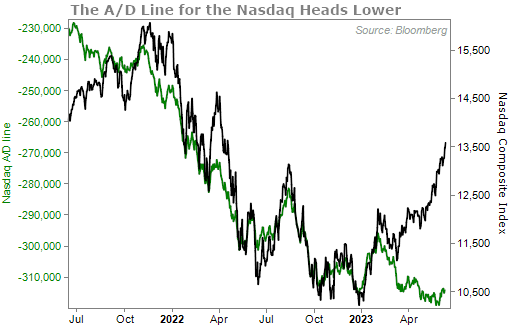

Today, we're seeing a similar setup in the tech sector...

The tech-heavy Nasdaq is up nearly 30% year to date. Tech stocks were crushed in 2022, and they are just starting to make a comeback.

But once again, we're seeing the Nasdaq being pushed up by only a handful of stocks. The Nasdaq is surging, while the Nasdaq A/D line has been heading lower. Take a look...

This divergence is worrisome.

Companies like Nvidia (NVDA) – a stock that now makes up nearly 7% of the Nasdaq 100 Index and has rocketed 170% higher this year – are the ones pushing the index higher. Most of the technology stocks in the index aren't seeing those gains.

This red flag means that a pullback in tech may be coming soon.

Again, it might be time to take short-term profits if you have been riding the Nasdaq for the past few months.

Instead of throwing money into tech stocks, a better idea is to look at the health care sector. I talked about this last week, and Doc has been writing about it since then...

There are no warning signals flashing for the sector. Instead, health care stocks are cheap when you compare them with other sectors. And most important, they have one of the brightest futures...

While technology stocks get all the shine and attention from investors, the health care world is just as exciting. New medicines and treatments are coming out every day that will change the way we live.

I suggest you start profiting from that.

If you haven't already, be sure to check out my colleague Tom Carroll's most recent presentation on the health care sector. Specifically, Tom uncovered the "great white whale" of U.S. Food and Drug Administration approval stories. And Tom believes we're in the early days of a massive shift in the world of health care.

Click here to watch Tom's presentation before it is taken down.

What We're Reading...

- Something different: Nikola Jokic reaches new tier of greatness with Nuggets' NBA championship.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

June 15, 2023