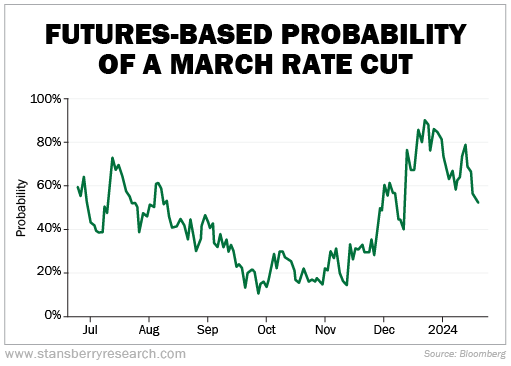

A month ago, nearly everyone was convinced that the Federal Reserve would cut interest rates in March.

But just a few weeks into 2024, they're losing their conviction...

In March 2022, we began to go through one of the most aggressive rate-hiking cycles in recent memory. The Fed had to jack up interest rates to try and tame inflation.

With the latest inflation reading coming in just over 3%, most market watchers are applauding the Fed. With the worst behind us, the expectation is that interest rates will soon fall.

The question on everyone's mind is: When?

The central bank's latest summary of economic projections calls for three cuts this year. Some projections call for a quarter-percentage-point decrease each time.

When exactly the first cut will occur is still up in the air. There's no consensus...

If we turn to the futures market, last month there was a 90% chance of a rate cut in March, as we mentioned earlier. Today, it's a coin flip. Take a look...

No one in Wall Street seems to be on the same page, either. Business newsletter Money recently complied predictions about when rate cuts will occur from some of the top money managers and smartest minds in finance. The results were wide-ranging...

As an example, investment bank UBS predicts rate cuts will begin in March. Bill Ackman, founder of Pershing Square Capital Management, thinks it will happen sometime in the first quarter as well. Comerica Bank is calling for it to happen in June. And Sam Millette of Commonwealth Financial Network projects that rates will start falling in either July or September.

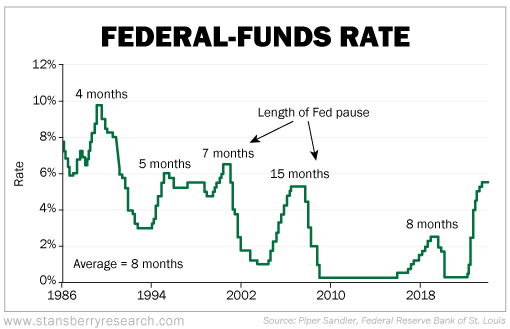

If we look at history, though, the Fed usually cuts rates within eight months of its first pause.

The Fed decided to not raise interest rates back in September. That was roughly four months ago. So it's likely we'll see the first rate cut happen sometime in the late spring or early summer.

This is good for the markets...

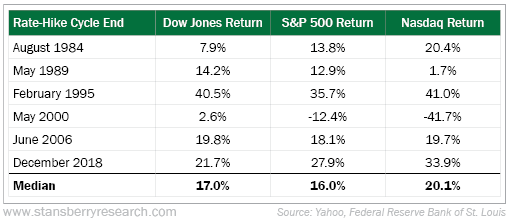

Typically, during the 12 months following the end of a rate-hike cycle, stocks go up. Take a look at the one-year returns of the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite Index after the end of a rate-hike cycle...

The common saying in investing is that the most likely thing to follow new highs is even more new highs. We could very well see the market continue to rise over the next several months.

And if you are looking to do even better than the market over the next several months, we suggest you join tomorrow's 100% free event with Stansberry's Investment Advisory editor Whitney Tilson.

The strategy that Whitney will reveal has been crushing the return of the market and even most of the "Magnificent Seven."

What We're Reading...

- Something different: Market to be short oil from 2025 onwards, Occidental CEO says at Davos.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 24, 2024