Doc's note: Lots of investors think that the only way to reap big profits is to load up on risky investments.

But in today's issue, adapted from the latest module of Stansberry's Financial Survival Program, our director of research, Matt Weinschenk and analyst Alan Gula explain how lower risk stocks can actually lead to higher rewards...

Finance textbooks are boring.

They're filled with formulas, diagrams, and jargon. Even worse, much of the material isn't useful. The problem is that most finance principles and theories in these books rely on unrealistic "in a perfect world" assumptions.

For example, the Capital Asset Pricing Model ("CAPM") is the backbone of pricing theory for securities. One of its creators, William Sharpe, even won the Nobel Memorial Prize in Economic Sciences in 1990 for his work on it.

The CAPM assumes that the financial markets are dominated by rational, risk-averse investors. Of course, there are irrational traders and investors out there. But the CAPM assumes that rational investors counteract the irrationality and eliminate mispricings.

The key insight of the CAPM is that the expected return of a stock is directly proportional to its systematic risk (or "beta"). The higher the risk, the higher the reward. This makes intuitive sense.

However, analysis of securities prices shows a surprising result: Lower risk can still translate into higher long-term returns. This puzzling phenomenon is called the low-volatility anomaly.

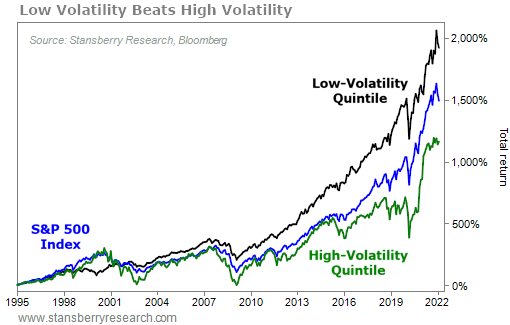

To illustrate the counterintuitive relationship between risk and reward, we ran a "backtest"...

Let's say you invested in an S&P 500 Index fund at the beginning of 1995. (We'll assume the fund had zero tracking errors and no fees or transaction costs.) Through the end of February 2022, your total return (including dividends) would have been around 1,500%. That's nearly an 11% annualized return. To achieve that solid return, you had to withstand some steep losses. October 2008 – near the apex of the credit crisis – was the worst month, with a nearly 17% decline.

We can use William Sharpe's metric, the Sharpe ratio, to measure return per unit of risk. The higher the Sharpe ratio, the better the risk-adjusted returns. And unlike the CAPM, the Sharpe ratio is rooted in statistics rather than theory.

Since 1995, the S&P 500's Sharpe ratio has been 0.71.

Now, let's say you invested in the most volatile stocks. Suppose you ranked the stocks in the S&P 500 by volatility and divided them into five equal buckets (or "quintiles") of 100 stocks. You picked the most volatile quintile each month and held those 100 stocks in equal weights.

The beta of your portfolio would have averaged 1.49, which means it had a systematic risk about 50% higher than that of the market. (The S&P 500 has a beta of 1.) And as is typical when investing in volatile stocks, the drawdowns were severe. Your worst monthly return would have been a 29% decline in March 2020 during the COVID-19 crash. In fact, you'd have suffered through four 20%-plus monthly declines.

However, you wouldn't have been compensated for the increased volatility. In the end, you'd have had a total return of just 1,160%. That's more than 300% less than the return for the S&P 500. And the Sharpe ratio would have been an abysmal 0.42.

Now, let's say you had invested in the least volatile stocks. Suppose you picked the 100 least volatile stocks (bottom quintile) in the S&P 500 each month and held them in equal weights. The volatility of this portfolio would have been much lower than that of the market, with a beta of just 0.66.

The big surprise is that this low-volatility portfolio had a nearly 1,900% total return, outperforming the market by about 400%. And its Sharpe ratio was a superior 0.76.

Lower risk with higher returns. These results fly in the face of the economic theory in textbooks.

Researchers have analyzed the low-volatility anomaly using decades of data. One study found that the market mispricing was likely due to a behavioral bias rather than the compensation for some hidden risk.

It's possible that collective risk-seeking behavior in the market creates these mispricings. Basically, people are overpaying for lottery-type stocks. The highest-volatility stocks – perceived to have the best chance of multiplying – are too expensive. And low-volatility stocks – perceived to be too boring – are too cheap.

Basically, the CAPM's assumptions about market efficiency are dubious. The rational investors who are supposed to dominate the market seem to be unwilling or unable to exploit the mispricings of good companies. If enough investors shunned high-volatility stocks and bought low-volatility stocks, the anomaly would disappear.

Of course, low-volatility stocks don't always outperform. They tend to underperform during powerful bull markets. And that may be one of the reasons why the anomaly persists. Few money managers are willing to underperform during bull markets.

We're not concerned about the causes of the low-volatility anomaly or why it persists. But we can, and do, take advantage of it.

By starting our search for quality stocks with low volatility, we believe we can earn better returns.

That means better returns in bull markets, in bear markets, and in flat markets.

You don't have to be a quantitative investor to benefit from this information. And you don't need to follow specific rules to "only buy stocks with a quality score higher than 80."

Rather, use the knowledge that these investment strategies just work as the basis for building your portfolio.

And if you'd like to put it to work today, in our Financial Survival Program, we've built a portfolio that's not only based on quality and low volatility, but a careful study of how these stocks performed in previous bear markets...

With inflation at its highest level in nearly half a century, commodity prices soaring, uncertainty around the war in Europe, and the unrelenting global pandemic it's no wonder people are worried about surviving the next big bear market. And if you're wondering what to do – you're not alone.

That's why our world-class analysts at Stansberry have created seven defensive strategies designed to weather war... inflation... volatility... even a devastating market crash.

The time to act and prepare is now. Click here for all the details.

Good investing,

Matt Weinschenk and Alan Gula

June 6, 2022