All eyes have been on the 10-year U.S. Treasury yield over the past couple of days.

It recently broke out above 3.2% to a new seven-year high, causing a lot of reaction from the financial media... both positive and negative. The 10-year yield is significant for a couple different reasons...

First, as we talked about back in July, the spread between the 10-year Treasury yield and the two-year Treasury yield are recession predictors.

Second, the 10-year Treasury yield is the benchmark that guides other interest rates. It affects rates on everything from auto loans to home mortgages to consumer and business loans.

Finally, the 10-year yield is a signal of investor confidence. When investors are scared of owning stocks and corporate bonds, they tend to put their money in risk-free assets like government bonds. And as demand increases for government bonds, prices rise – which drives yields lower (bond prices and yields move in opposite directions).

When investors are optimistic about stocks, they don't want to have their money in boring government bonds. Demand for Treasuries falls, and prices fall – which means yields shoot up.

That's what we're seeing today with the 10-year Treasury breaking out to multiyear highs. It shows investors want more risk. They don't want to settle for 2%-3% returns in Treasuries. They want to chase the higher returns they can get in the stock and corporate bond markets.

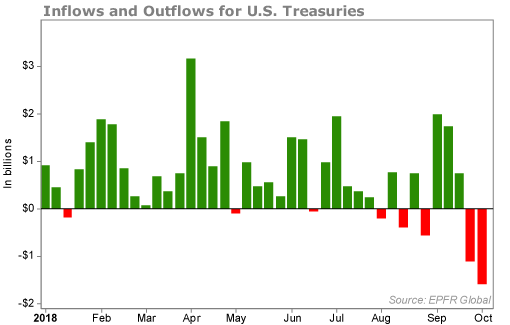

The chart below shows how much money flows in to and out of U.S. Treasuries on a weekly basis...

Last week, investors pulled $1.6 billion from U.S. Treasuries and $1.1 billion the week before. That's nearly $3 billion, by far the largest two-week outflow since the start of 2018. And according to EPFR Global, investors put $1.2 billion into U.S. stocks last week.

The message is clear... Investors don't care about risk-free assets. They want higher returns. And they think the stock market will deliver it to them.

As yields on Treasuries creep higher to 3.5%, 4%, or even 5%, we may start to see some more folks shift their money back in to these assets. Earning 5% risk-free is hard to turn down. But we may be awhile away from that.

For now, folks want to own stocks. That's bad and good...

It's bad because this is what happens at the end of every bull market. Investors see their friends making tons of money in the stock market and can't stand to sit on the sidelines anymore. They pull money from safe assets and from their savings accounts to plow into equities. This of course, creates a bubble... and we all know how it turns out from there. (Not well.)

We start to see headlines from financial-media sites such as CNBC like this...

And this from Bloomberg...

If you've been following Stansberry Research for long, you know that my colleague Steve Sjuggerud has been pounding the table for folks to buy stocks now because of the "Melt Up" that you see above.

The Melt Up is where we'll see one final surge in the market before it collapses. According to Steve, folks who are invested before the market takes off could make 100% to 500%, if not 1,000% gains.

And that's the good news from folks preferring riskier assets like stocks – massive returns in a short period of time.

Since everyone is demanding higher returns, their money goes into the stock market, which pushes stock prices higher and higher.

The even better news... We're getting close to Steve's Melt Up, but we're not there yet.

Folks are getting more bullish, but we're not at an extreme level of bullishness yet. We hear warnings all the time because of high stock valuations... or warnings about rising interest rates.

This isn't typical top-of-the-market or Melt Up behavior.

Steve firmly believes that the real Melt Up has not started yet and there are still incredible gains to come.

That's why, on October 24, Steve will show you how to cash in on the Melt Up, discuss when the bull market will end, and give away his No. 1 recommendation right now.

Don't miss out on this opportunity... Click here to claim your spot.

What We're Reading...

- Melt Up on the mind as the U.S. stock advance hits euphoria.

- Something different: Microsoft expands its cloud service in the push for a $10 billion Pentagon contract.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

Calistoga, California

October 10, 2018