Doc's note: We're obsessed with "keeping up with the Joneses." But today, I'm sharing an essay from my colleague Bill McGilton (originally published in February). Bill shares a secret about those "rich" neighbors.

Most people would call Tom and Kate "rich"...

But as I'll explain today, the married couple of 20 years is just a step away from financial disaster.

Tom and Kate are in the top 15% of U.S. households, bringing home a combined $160,000 per year. Yet like many people, they're deeply in debt... spending everything they make and borrowing even more.

They're in their 40s and live in a Northeast suburb with their three kids. They both hold graduate degrees and work in the insurance industry.

But Tom and Kate owe so much money, they don't even know the exact total – and they're afraid to figure it out.

They know it's at least $600,000. That includes two mortgages on their house, totaling $360,000 (and zero equity in the house)... $60,000 in credit-card bills spread over 10 to 11 cards (eight of which are maxed out)... $18,000 in a private loan... and around $140,000 in student loans (which they're not paying because they've declared hardship status).

Plus, they borrow an additional $15,000 each year to send their kids to private schools... And they lease a car.

Tom and Kate know they have a serious debt problem...

They spend their lives in a constant state of stress – trying to figure out ways to juggle their debt. They consistently live beyond their means. The only thing that limits their spending is the limit on their credit cards.

They live in a big house, send their kids to private schools, buy organic foods, eat sushi regularly, drink gourmet smoothies, and wear nice clothes – even though they can't afford any of it.

They even bought their son an expensive new suit at Nordstrom for his high school prom because, while they didn't have the cash to rent him a tux, they did still have credit available on their Nordstrom card.

Although they're hopelessly buried in debt, certain banks are still willing to extend them even more credit.

Even Kate admits these banks would "have to be slightly crazy to approach us with a loan." But when they apply for one, the banks always seem to say yes. "It's ridiculous," Kate says.

Like so many other Americans, Tom and Kate are stuck in a debt trap...

Tom once cashed out his $70,000 401(k) to pay off three credit cards and a loan. Kate borrowed $40,000 from her parents to pay down her credit-card debt. Her parents thought they solved Kate's financial problems... But little do they know, the couple burned through that money long ago and maxed out their credit cards yet again.

The couple is so ashamed of their situation that they used pseudonyms when they told their story to financial-planning website Wealthsimple late last year.

Kate is pushing Tom to declare bankruptcy, but he worries that will hurt his future job prospects.

The family is just one job loss, personal crisis, or economic downturn away from no longer being able to juggle their debt. And then the house of cards they built will come crumbling down. It's only a matter of time.

But Tom and Kate aren't alone...

Millions of overleveraged consumers – who can't distinguish between a "want" and a "need," refuse to live within their means, require a certain standard of living, and use most of their available credit without knowing when or how they'll pay it off – are a big credit risk. They live on the edge of default. Credit agencies refer to these folks as "subprime."

Certain banks specialize in providing revolving lines of credit to subprime borrowers. They charge these risky borrowers much higher interest rates than prime borrowers. The business is incredibly lucrative so long as the interest rates are high enough that they can generate more money than they inevitably lose in defaults.

In recent years, a strong economy, low unemployment, and low interest rates meant it was easier for people like Tom and Kate to juggle all the debt. So it was a perfect environment for subprime lenders – which thrive off low default rates and a stream of high-interest payments coming in the doors.

Of course, we all know this irresponsible lending can't continue forever...

Inevitably, irresponsible lending always leads to a bust. That's when the Toms and Kates of the world can no longer hang on, defaulting in droves and crashing the stocks of the banks who lent them money.

The next subprime bust is coming... It's a matter of when, not if.

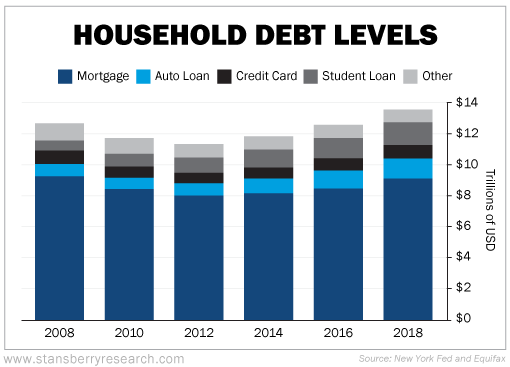

Nearly four in five Americans right now are like Tom and Kate – borrowing like crazy today and sowing their financial downfall tomorrow. As you can see in the following graphic, total household debt continues to climb and is at a new all-time high...

During the last financial crisis, total household debt peaked at $12.7 trillion. At the end of 2018, that figure rose to $13.5 trillion... And half of that increase – $400 billion – has come in the last year alone, according to the New York Federal Reserve.

Mortgage debt is over $9.1 trillion... near the peak reached during the last financial crisis. From 2008 to 2018, auto-loan debt rose 60% – from $810 billion to $1.3 trillion. And student-loan debt increased about 160% – from $580 billion to $1.5 trillion.

Meanwhile, credit-card debt rose to an all-time high of $870 billion, up nearly 20% over the past three years. Credit-card debt is growing so fast, it's even outpacing strong wage growth – which, according to the Atlanta Fed, is around 10-year highs at 3.7%.

Despite a strong economy with historically low unemployment rates, many people are still struggling...

And they're turning to credit cards to fund the difference.

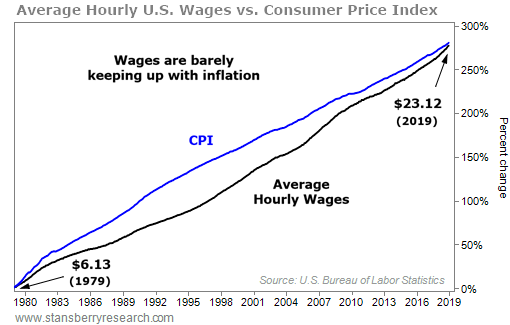

Part of the problem is the disconnect between wage growth and purchasing power, as measured by the Consumer Price Index ("CPI") in the chart below...

Average wages are now around $23 an hour. But in real terms, $23 an hour has the same purchasing power as approximately $6 an hour had 40 years ago. In other words, purchasing power for the average wage earner has not budged in the past 40 years.

Keep in mind that most of the wage increases apply to the top earners. Labor value on the lower end of the spectrum isn't keeping pace with inflation. Many people are getting poorer and are finding it hard to adjust to a lower standard of living.

Like Tom and Kate, millions of Americans are turning to credit cards to fund the gap between income and expenses. These people have no hope of paying off their debts. Many can only afford to make the minimum payments each month.

Nearly half of credit-card account holders maintain a balance every month. They use the cards as debt "revolvers," paying mostly interest each month. Only 30% of credit-card borrowers pay off their debt in full each month.

Using a credit card this way is incredibly expensive. The interest rate on the debt tends to be extremely high – around 16% a year, according to the Federal Reserve. For subprime borrowers, the average is 23%.

If you're getting charged 16% a year and you're only paying the minimum monthly payment, your balance doubles about every 4.5 years. At 23%, the debt doubles every three years, quickly turning small balances into large ones. And as interest rates rise, it becomes even more difficult to make even the minimum payments.

This disturbing trend can only go on for so long.

Eventually, millions of Americans will fall so far behind that they'll just stop paying altogether...

One of the first things people stop paying is unsecured credit cards. There's no immediate consequence, because there's usually nothing of value for a creditor to take.

So far in this credit cycle, nothing has snapped... yet. But the financial strain continues to grow.

Credit-card delinquencies over 30 days are up 10 straight quarters, rising from 5.1% in the second quarter of 2016 to 6.7% in the fourth quarter of 2018. Altogether, $58 billion of credit-card debt is now delinquent over 30 days. And 8% of all credit-card debt is more seriously delinquent – with no payment in more than 90 days.

But the trouble isn't limited to just credit cards...

More than 7 million auto loans outstanding have gone unpaid for 90 days or more – a new record. Trouble is brewing when folks stop making car payments. That's typically one of the last things people stop paying, since they need a car to go to work.

Delinquency on student loans is also at all-time highs. Officially, $166 billion in student loans was delinquent as of the end of 2018. But the actual number is far higher. Borrowers can avoid repaying their loans – using forbearance and deferment, for example.

Even the New York Fed acknowledges the effective delinquency rate is far higher than what's reported. It estimates the real delinquency on student debt is at least double, at $333 billion – or 23% of the total student-loan debt. And it's likely far higher than that, as more than 40% of people who borrowed from government student-loan programs are behind on their payments or have stopped making payments altogether.

A recent study from the Fed found that 40% of adults couldn't come up with $400 for an unexpected expense without selling something or borrowing the money. And just one-third of adults like Tom and Kate either can't pay their bills or are just a minor setback away from being unable to pay.

This combination of rising debt and rising delinquencies can't go on forever...

And this situation is paralleled by even greater extremes in the corporate debt market.

Trouble is brewing... It's only a matter of time before this recklessness blows up. And when it does, it could trigger dramatic consequences for both the markets and the economy.

Not only are we likely to see a severe bear market and one of the biggest credit-default cycles on record... but it could ultimately lead to a complete "reset" of our entire financial system. The vast majority of Americans – even responsible folks who diligently avoided going into debt themselves – could see their standard of living cut in half, virtually overnight.

Stansberry Research founder Porter Stansberry wrote a book, The American Jubilee, that details what's driving this trend... what's likely to happen next... and most important, exactly what you can do to protect yourself and your family from it. If you haven't read it yet, you can still get a hardback copy shipped to your door for just $5. Get all the details right here.

Regards,

Bill McGilton