If you plan to retire in the next few years, the deck is stacked against you.

I hate taking such a pessimistic tone. But I'm not going to sugarcoat things.

The truth is, if you're looking for a decent return on your nest egg, there aren't many ways to do it... at least not without loading up on risk.

Given how expensive retirement can be – and how much those costs will likely grow in the near future – few folks can afford to have their hard-earned cash lying around, earning close to nothing.

Unfortunately, close-to-nothing returns are what you should expect out of most fixed-income investments today... And the closer you get to retirement, the more importance you place on the preservation of your capital.

Conventional wisdom says to own stocks when you're young and bonds as you get older. Over time, stocks will earn you about 7% or so a year. But in any given year, the market might crash.

Stocks are risky. And you accept that risk when you're young because your holding period can run for decades – giving time for problems to correct themselves.

But when you're about to retire, you can't afford even a single bad year in the market. You'll have bills to pay with no paychecks coming in. The "professionals" tell you to exchange potential gains in the stock market for more safety.

That's where fixed-income investments come in...

For the most part, you'll know what returns to expect: about 4% to 5% in bonds. They're far less volatile than stocks. And for a long time, investing in fixed income was more than enough to safely grow your nest egg in retirement.

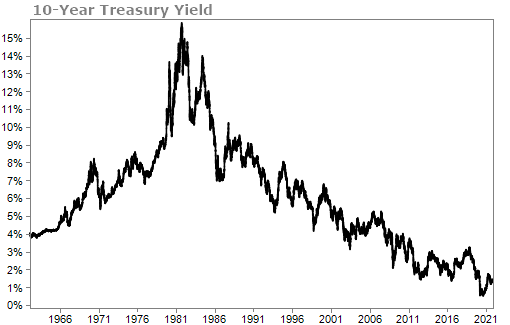

Previous generations had it much easier... All they had to do was lend their money to the government or to a bank, and they would regularly earn a return that beat inflation. Before 2000, the yield on the 10-year Treasury was routinely above 6%.

But things have changed. Fixed-income investments won't keep you afloat like they used to.

Consider that 10-year Treasury yield, for example. Rather than 6%-plus, it's a measly 1.5%...

Since inflation or interest rate hikes are a near certainty, the bond market has a rough road ahead. Plus, their yields don't look as attractive compared with the yield you can get from stocks.

So if you're getting ready to retire, what are you supposed to do? Simply settle for the little-to-nothing yield you can find in bonds?

If you do that, your purchasing power will decline over time. Earning 1.5% in 10-year bonds won't cut it when inflation is 4% a year. That trade would lock in a loss of 2.5% per year.

That's why you need to find a return that will be greater than inflation.

And the best game in town to do that is with is stocks.

But of course, stocks have risk right now. Valuations are beyond stretched. Plus, many corporations have loaded up on debt, making some folks call for a debt bubble.

But since the outlook for bonds is bleak, you need to own some stocks. There are not many other choices.

The hard part is deciding how much of your nest egg you want invested in stocks. A lot of that will depend on your age and what stage in life you're in... But everyone should have some money in stocks.

Look, planning for retirement is difficult. That's why you need all the facts to make your investment decisions. And that's why, if you haven't already, you should watch the replay of our Bull versus Bear Summit that aired last night.

True Wealth editor Steve Sjuggerud, Extreme Value editor Dan Ferris, and I sat down to talk about our outlooks for the market. Our goal for this event was to give viewers all the information possible so they could make their own decisions about where the market will head from here. And based on the feedback we received last night and this morning, I believe we accomplished that.

Some folks became more bullish after this event. Some became more bearish. But that's up to you... You just deserve to hear all sides of the story.

You can click here to watch the replay.

What We're Reading...

- Rising Treasury yields hit tech stocks, and oil is at 3-year highs.

- Something different: Mastercard taps into the buy now, pay later market.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 29, 2021