The financial media doesn't come right out and admit it, but banks fail all the time.

It's just a normal part of the economic cycle.

According to the Federal Deposit Insurance Corporation ("FDIC"), there have been 566 bank failures since October 1, 2000. That comes out to an average of about 25 banks going belly-up every year.

To be fair, a lot of these bank failures occurred during the financial crisis. In total, 165 banks collapsed in 2008 and 2009.

Still, banks fail even in strong economies.

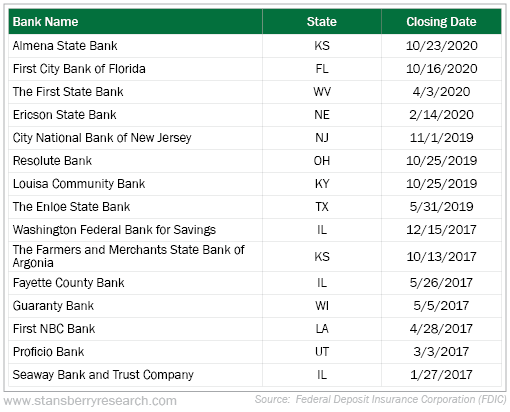

Take a look at the table below. It shows a list of banks that failed in recent years, not counting the three banks that went under this year...

Of course, the COVID-19 pandemic played a role in bank failures in 2020. But in 2019 and 2017, the economy was relatively healthy. Even still, we saw multiple bank failures in those years.

There is one big difference between what's happened so far in 2023 and what is typical, though: size.

The three banks that failed so far in 2023 are much larger than the normal bank that closes its doors.

For instance, when the four banks failed in 2020, they had combined total assets of about $458 million. The two banks that failed earlier this year – Silicon Valley Bank and Signature Bank – had $320 billion in combined assets.

The most recent banking casualty was First Republic Bank. It had assets of about $213 billion.

In fact, Silicon Valley Bank and First Republic Bank were about as big as you could get without being classified as "systemically important" (banks with more than $250 billion in assets) and taking on extra regulations.

It worked for these banks to keep assets under the $250 billion cap. But even though they weren't technically systemically important, the government stepped in and acted like they were.

Whether or not this year's bank failures wreak havoc on the rest of the financial system depends entirely on the confidence of depositors – and not actual facts and numbers on a spreadsheet.

It's a strange time for the banking sector. But we do see areas of strength in the underlying market. Balance sheets look healthy.

For now, we're confident that the worst is behind us for this current banking "crisis."

But according to my friend and colleague Joel Litman, a critical moment in the markets is approaching that will send some stocks soaring... while crushing others by up to 90%.

Tonight, he'll reveal all the details. Plus, he'll give away the name and ticker of a stock he predicts will lose 80% of its value – 100% free – to everyone who signs up to attend.

Click here to reserve your spot now.

What We're Reading...

- Something different: How El Chapo's sons built a fentanyl empire poisoning America.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 10, 2023