We recently went through one of the most aggressive rate-hiking cycles in recent memory.

The effective federal-funds rate went from near 0% at the start of 2022 and it's up to 5.3% today. Rates have not been increased this quickly since the 1970s.

Lately, the Federal Reserve has decided to keep rates steady as inflation has come down from its 2022 highs and cracks in the economy are starting to form.

The question on everyone's mind is... when will the Fed reverse course and cut interest rates?

The central bank's latest summary of economic projections calls for three cuts this year.

When exactly the first cut will occur is still up in the air. There's no consensus...

Earlier this year, many major money managers put out their expectation for rate cuts. Investment bank UBS incorrectly predicted that rate cuts would begin in March. Bill Ackman, founder of Pershing Square Capital Management, also thought it would happen sometime in the first quarter.

Comerica Bank projected that it would happen in June. And Sam Millette of Commonwealth Financial Network projected that rates would start falling in either July or September.

If you've been following me in Retirement Millionaire and Retirement Trader, I've been saying too many "experts" have been predicting that rate cuts will happen too soon. I've been consistently saying the first cut won't happen until the second half of the year.

Lately, that seems about right... Inflation for March came in at 3.5%, much hotter than expected. And 3.5% is just too high for the Fed to start considering cutting rates. The economy has shown to be resilient and seems to be humming along.

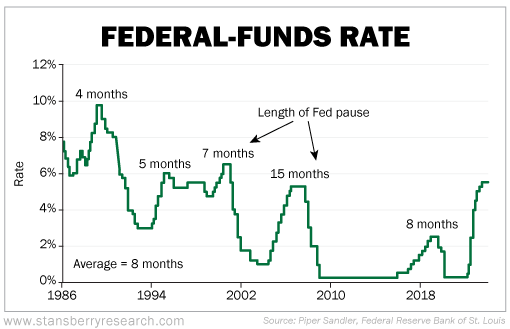

If we look at history, though, the Fed usually cuts rates within eight months of its first pause (the last rate hike was in August 2023).

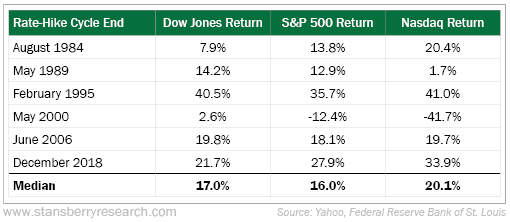

This is good for the markets... Typically, 12 months following the end of a rate-hike cycle, stocks go up. Take a look at the one-year returns of the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite Index after the end of a rate-hike cycle...

We've been seeing just this over the past few months. Ever since the Fed stopped hiking rates, stocks have been higher. The S&P 500 is up about 16%.

While stocks have been on a tear since the Fed stopped hiking rates, other assets have done better... Gold, for example – something we've been writing about a lot recently – is up 25% since August.

Cryptocurrencies have been even hotter. The price of bitcoin has more than doubled since last August.

Now, I've never been a big advocate for owning cryptos. But I do believe in asset allocation and having a small portion of your portfolio in speculations that interest you. And with bitcoin near all-time highs, there's no doubt folks are interested in owning it, along with other cryptocurrencies.

If this is you, then I suggest you listen to my colleague Eric Wade.

Last week, Eric hosted the "2024 Crypto Melt Up." At this event, he explained why a cryptocurrency surge is on its way and how folks can best position themselves for massive gains.

Eric's presentation will only be available for a couple more days. So click here if you want to listen.

What We're Reading...

- Something different: China's economy grows faster than expected in the first quarter.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 17, 2024