Doc's note: Today I'm sharing an essay from TradeStops founder Dr. Richard Smith. Richard shows where the billionaires are putting their money and what it says about the state of the economy.

If you want to hear more about the investment ideas of the world's greatest investors and how Richard's latest technology shows you the best of the best, click here.

Every quarter, we here at TradeStops analyze the SEC filings for a select group of billionaire investors. These billionaires didn't just grow their fortunes any which way… They grew them via money management and investing, which makes them some of the smartest and most successful investors in the world.

The data from the first quarter of 2018 stands out in a particular way. The billionaires are heavily weighted — very, very heavily weighted — toward consumer discretionary stocks.

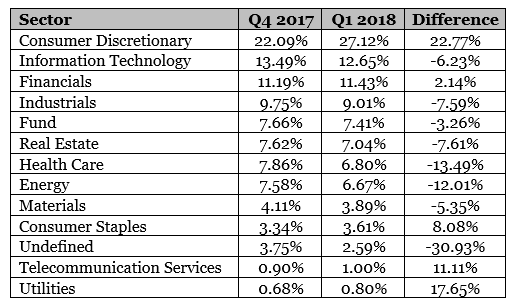

As the table below shows, the consumer discretionary sector now accounts for more than 27% of billionaire holdings. That is their largest allocation by a country mile. It's more than double the second-place group (information technology) and bigger than the second- and third-place groups combined.

Not only that, the billionaires are adding more capital to the consumer discretionary sector at an aggressive clip. Their allocation to consumer discretionary stocks this quarter was almost 23% higher compared to the previous quarter.

This is notable because, when it comes to consumer discretionary names, the billionaires are doing the opposite of rebalancing. Instead they are using what commodity traders call a "Texas Hedge." They are adding more size to their biggest bet.

In most other sectors, the billionaires actually cut back, and then took that money and allocated it to consumer discretionary stocks.

In the only other sectors where quarter-over-quarter allocation increased by double digits – telecom and utilities – the previous allocations were less than 1% and remains at 1% or below.

So the data is clear. The billionaires really, really like the consumer discretionary sector. They're heavily weighted toward consumer discretionary names and cutting back in most other areas to pour yet more capital into consumer discretionary stocks. No other sector comes close.

Why is this happening, and what does it say about the state of markets?

We see four "big" factors driving the billionaires' love of consumer discretionary stocks:

- Big names

- Big gains

- Big strength

- Big moats

First, let's talk about big names…

The consumer discretionary space is dominated by some of the most recognizable brands in the world. We're talking names like Amazon, Disney, McDonald's, Nike, Netflix, and Starbucks.

These names and their products are recognized in hundreds of countries. They are also household names in the United States. This combination is very powerful. Only a select few companies have brand recognition globally while also doing huge volumes of business in the U.S.

As a result of this combination, these "big name" consumer discretionary plays are attracting heavy capital flows. With rising volatility and uncertainty, more investors in the U.S. and abroad are seeking shelter in the shares of dominant companies with dominant brands and business models. The billionaires see this happening, and they agree with the logic.

[optin_form id="73"]

Second, big gains…

Large, dominant consumer discretionary stocks have seen large percentage gains this year, and the charts are trending higher. Amazon is at or near all-time highs. Apple is at or near all-time highs. Netflix is at or near all-time highs. Nike is at or near all-time highs. And so on.

The overall stock market may be softening, but these guys are killing it. The data for markets overall, when considering all industries and all sectors, is somewhere between gloomy and deeply concerning. And yet for these consumer discretionary stars, the trends are up and to the right like never before. The billionaires know the trend is your friend.

The third factor is big strength – and by this we mean financial strength. Most of these big discretionary names have rock-solid balance sheets and mountains of cash. Apple is sitting on a larger cash pile than most small foreign countries. Even Amazon, which was long criticized for its lack of profits, is now gushing cash through the success of Amazon Web Services.

As the economic and geopolitical environments become worrisome, strength matters more. The financial strength of the big consumer discretionary names helps investors sleep at night. Combine that financial strength with global brand recognition, and you've really got something.

And last but not least, these names have big moats. The "moat" is probably Warren Buffett's favorite concept. It represents a built-in edge or competitive advantage that can't be taken away, like a castle moat filled with alligators. It's harder — and sometimes impossible — to attack a castle with a great moat.

The top-tier consumer discretionary names all have fantastic moats.

In some cases, like Amazon and Netflix, the moats are based on technology and growth rather than traditional branding. But in all cases, these companies have big, powerful competitive advantages that are hard to challenge.

In some ways, the billionaires' aggressive embrace of the consumer discretionary sector is a bit of a concern. That is because of what it says about the rest of the market.

The fact that the billionaires are more or less choosing to load up on their consumer discretionary plays, rather than spreading out their capital into other sectors, points to a general state of malaise for the market as a whole. It's not great for markets when there are only one or two big engines firing (even if they are really big engines).

But with that said, there is a reason the billionaires have accumulated large fortunes. And when you look at the four "big" factors — big names, big gains, big strength, and big moats — you can see why their love of consumer discretionary names makes sense in these volatile times.

Tomorrow, July 31, at 8 p.m. Eastern time, I'm hosting a free live event to reveal my latest breakthrough... And as an added bonus just for tuning in, I'll share which stocks are poised to break out.

Click here to reserve your spot.

Best regards,

Richard Smith

July 30, 2018