Have you ever seen a ghost?

Roughly one-third of Americans believe they exist. Many people claim to have seen them... And I believe them.

I don't think they've seen an actual ghost. Rather, I think these people saw something that their brains genuinely interpreted as a ghostly spirit.

Many of our flaws and fears stem from thousands of years of evolution living in a different environment than we do now.

We crave carbohydrates and sugar because in less plentiful times, our hunter-gatherer forebearers needed to stock up on as many calories as possible when the chance was available. In modern times, the threat in most industrialized nations is overeating, not malnourishment.

People fear spiders and snakes because they posed a serious threat. Of course, as people in a modern society – where an Uber a few taps away can get us to a nearby urgent-care center – we face fewer physical dangers. But our brains carry thousands of years of survival imprints.

That's why people see ghosts. Evolutionary psychologists call this our "agency-detection device."

When you hear a rustling in the grass or catch some flickering light out of the corner of your eye, your brain doesn't accept "it's nothing" as an answer. Instead, it attributes that motion to some sort of conscious actor.

Thankfully each of our early ancestors had agency-detection brains – or we wouldn't be here. A needless scare didn't cost our ancestors much, but the early humans whose brains didn't work this way often got eaten by lions (or other predators).

Today, that same mechanism turns unexplained phenomena and curious experiences into ghosts.

Our fears and the scenarios we imagine can lead us to make bad decisions in modern life... and that includes our investments.

Right now, plenty of investors are seeing "ghosts." And that fear is causing them to sit on the sidelines.

I believe they are missing an opportunity.

Let me explain...

There are real reasons to be afraid of today's market. Inflation is no joke. Prices came in 0.1% higher in August compared with July, and that's 8.3% higher than last year. (This should come as no surprise to Health & Wealth Bulletin readers, though, as I've been calling for higher inflation for some time now.)

Consumer sentiment is near an all-time low and that's going to have to reverse if the market is going to sustain any kind of meaningful rally. Plus, there's a full-blown energy crisis in Europe.

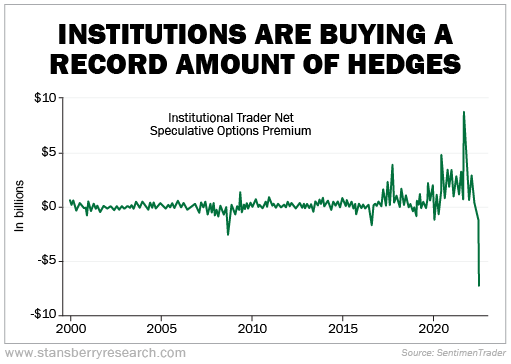

I know there's fear among the institutional traders. Their bonuses are affected if the market tanks, so they want to be prepared in case that happens.

That's why they are buying portfolio protection in droves – in particular, put options. They are buying three times as many hedges as they did in 2008. Take a look...

Here's what I have to say to all of that... Bring it on.

The more fear out there, the better.

If you know how to take advantage of this fear, you can make hundreds and thousands of dollars instantly.

Let other investors sit on the sidelines because they are seeing ghosts. Now is not the time for investors to be afraid. It's time to profit from the chaos in the market.

You see, since my time on the trading desk at Goldman Sachs, I have developed a strategy that thrives when investors are afraid. This strategy, which we use in my trading service, Retirement Trader, harnesses all of the fear and anxiety swirling around and uses it to help us make more money.

The more fear, the more money we make.

Just last Friday, we recommended a trade that would have paid subscribers a minimum of $236. Late last month, we recommended a trade that would have paid subscribers a minimum of $290. Two weeks before that, subscribers made a minimum of $705.

This is valuable income in a time where you might be facing paper losses from your stock holdings.

Times like these – when investors are afraid and unwilling to act – are why I'm at Stansberry Research. And because today is such an incredible opportunity to deploy my strategy of profiting from others' fear, I have put together a special offer for those who want to learn more.

You can click here to watch my brief presentation.

What We're Reading...

- Inflation rose 0.1% in August even with sharp drop in gas prices.

- Something different: How China became big business for Twitter, from blocking to blue checks.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 14, 2022