Americans are making the best of the pandemic...

Earlier this week, the Fair Isaac Corporation announced that credit scores in the U.S. hit a historic high in July. The average credit score rose from 708 in April to 711 in July. That's also up from 706 in July 2019.

The FICO credit score comes from the Fair Isaac Corporation (hence the name FICO). The score looks at your payment history, credit limits, credit utilization, and more.

FICO scores are ranked as Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), and Exceptional (800-850).

The increase in July might surprise you, considering the high unemployment numbers. How can anyone improve their credit during this pandemic?

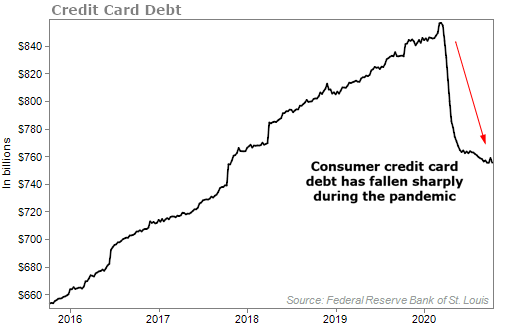

First, let's take a look at consumer credit-card debt...

Due to shutdowns around the country, many of us were forced to stay home. No spending money on movies, dining out, or gassing up your car. These factors have all helped people pay down debt without adding more.

The government stimulus, delayed home foreclosures, and better unemployment benefits have helped a lot of people, at the very least, maintain their financial position.

But here's the problem... All of this could change before the end of the year. As lenders become less forgiving and as we continue to wait for a new stimulus package, FICO scores could fall again.

How much does it matter?

We're skeptical of FICO scores. The Fair Isaac Corporation changes the formula to calculate scores every few years, which can make year-to-year comparisons difficult. And many personal finance experts question exactly what factors impact your score. But lenders are still using FICO scores to determine loan qualifications.

So it's a good time to remember that you need to make a habit of keeping tabs not just on your FICO score, but on your credit reports. This is the best way to get a clear picture of your credit – including old credit cards you might have forgotten about and any possible fraudulent lines of credit.

The three main credit bureaus – Experian, Equifax, and TransUnion – each offer a free report once a year. Your credit report will list out all open lines of credit and debts (all credit cards, mortgages, and loans should be on there).

You can request all three reports at once or spread them out, depending on what works best for you. Get all three at once if you want a full picture of your current credit history, or stagger them every few months for regular monitoring.

It's important to get all three, however, because they don't all report the same data. Some lenders, like banks, might only work with two of the three bureaus.

But clearing up any possible fraud or looking into forgotten credit cards is a great way to improve your credit.

Speaking of cards, you also need to be careful about which cards to close. You might think closing all but one or two cards would boost your score, but it likely won't...

You want to think about the age of your cards, along with something called credit utilization.

Don't close your oldest card – you want a longer credit history to improve your score.

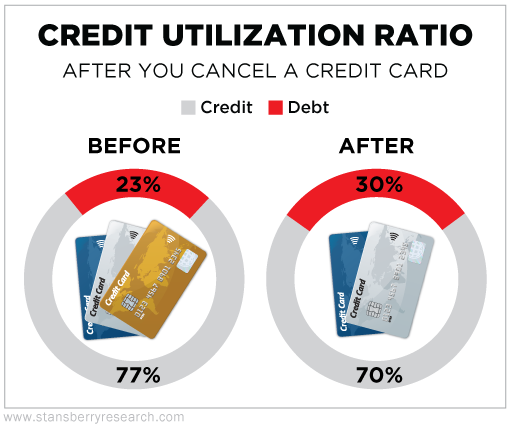

The credit utilization ratio is the measure of how much of your total credit you're using. To calculate the ratio, you divide debt by available credit. If you close the wrong cards, your debt could end up taking up too high a portion of your total credit.

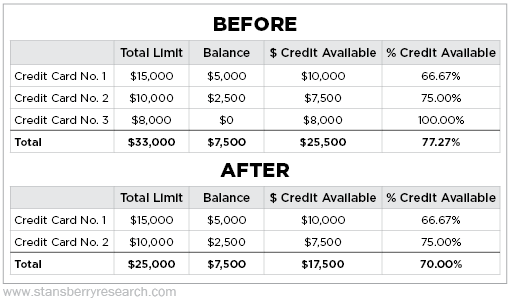

Let's say you have three credit cards. Here's what happens if you close the card without a balance...

You can see that the credit utilization ratio jumps from 23% to 30%. That might not seem like much, but even a ratio that's just a little higher can mean you're stuck with higher interest rates on loans and other credit cards.

Now, if you're paying an annual fee on a zero-balance card, you might want to consider closing it. Especially if you're not anticipating needing any loans in the near future.

Those are two ways to boost your credit. But there's more you should know about credit reporting and how to keep your information secure. Read more in my report, "How to Protect Your Income from Big Banks, Big Pharma, Big Everything." Retirement Millionaire subscribers can access it here.

And if you aren't a subscriber, you can sign up today for just $49. Click here to learn more.

What We're Reading...

- Ten ways to raise your credit score.

- Something different: NASA spacecraft lands on an asteroid.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 22, 2020