For thousands of years, mankind has used gold as money...

It's a good choice, for a lot of reasons...

The world only has a finite amount of gold, and you can't create any more. Further, all the gold ever mined – about 170,000 metric tons – would fit onto a football field piled to about 6.5 feet high. (At today's prices, that pile of gold is worth roughly $7 trillion or so.)

In addition, gold doesn't corrode or deteriorate, it's easily divisible, and... relative to other valuable assets you find in the natural world... it's portable.

Even after the advent of modern currency, the U.S. government initially "backed" its currency with gold (meaning the monetary unit represented a claim on some fraction of the government's gold stash).

Today, that's no longer the case... Our money is no longer backed by gold.

Regardless, investor affinity for gold continues. And I have consistently recommended holding a small position in what I call "chaos hedges" – gold, silver, timber, and even farmland – as protection against a currency collapse and global turmoil.

Think of it like an insurance policy.

These chaos hedges historically provide comfort and protection during rough political and economic times... and can greatly enhance your portfolio returns.

But there are certain times when gold outperforms massively...

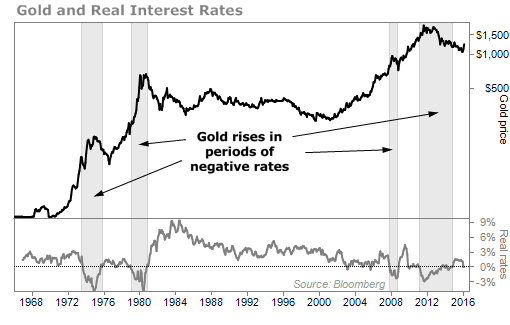

In my investing lifetime, the best time to own gold has been when real returns on fixed-income securities turned negative.

One of the biggest knocks on gold is that it doesn't deliver any yield. So the metal looks a lot more attractive when rates turn negative.

This holds up over the long term. Using 10-year rates on Treasury notes and inflation, negative rates match up with rises in the price of gold.

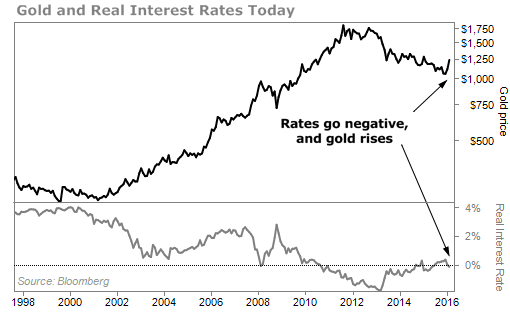

This happens in the short term as well if we use the yield on a five-year Treasury security of 1.2% and the expected inflation rate for the next five years of 1.3% (which we derive from the market price of five-year Treasury Inflation Protected Securities, or "TIPs").

Right now, we have central banks around the globe driving down rates to negative territory and gold trading cheaper than it has for years. That makes it a good time to pick up some gold to balance your portfolio.

I'm confident that knowing the facts about gold will make a huge difference in your wealth over the coming decade...

This is why I'm extending an invitation to join Porter Stansberry, Steve Sjuggerud, and a team of Stansberry analysts to learn more about this major turning point for gold.

If gold continues its recent move higher – and it's already made one of its biggest three-month moves ever in the first quarter of 2016 – any gold investor will do well.

But Porter and his team have identified and put together an entire gold portfolio that they believe can hand investors gains that are much larger than average. Porter said it like this:

I'm confident that even a small allocation into gold and gold stocks of your portfolio (say, 15% to 20%) will be enough, with a few of our best ideas, to hedge your entire portfolio. This will allow you to continue to generate wealth even if the kind of bear market I expect develops.

If you already own a position in precious metals, bullion, or mining companies... or are considering it... I highly recommend tuning in tonight.

Click here to register for this special presentation tonight at 8 p.m. Eastern time.

I guarantee it will be worth your time.