Our Baltimore office is full of interns.

Every summer, we see a new crop of interns – recent high school graduates and college students... While they're here, they learn everything from marketing to accounting to market analysis.

It's a valuable opportunity most students don't get.

That got me thinking about the start of my career and what these young adults should know that no one has told them.

In this essay, I've put together the lessons on success and wealth-building that I've learned in my career. It's not so much about specific investing strategies and tools as it is about how to think about work, money, and success.

You can consider this essay my "Graduate's Guide to Wealth," and I invite you to share it with your kids, grandkids, nieces, and nephews. You have my permission.

The first step is understanding the true value of money...

I went to Goldman Sachs (GS) after grad school and learned I was not a king, but the lowest man on a very tall totem pole. But with hard work, I did climb up a few rungs.

The reason I went to Wall Street was for the challenge. On the Street, the smartest people battled in intense competition for profits, promotions, and headlines. Sure, I wanted to make some money like anyone else, but it wasn't my main motivation.

Only after I had earned some money did I understand what it was worth.

It wasn't for fancy watches or Italian loafers. Instead, the value was that I could do whatever the hell I wanted...

I wanted to go to medical school, so I did. And I paid cash.

I wanted to travel, invest in small businesses, and start a winery. So I did.

I wanted to write and help people with their finances. So I do.

The value of money – or more specifically wealth – is the freedom it grants you. Everything else is nonsense.

For me, that freedom is the ultimate goal of working. And paired with the relationships you build, it's the one thing that can make you truly happy.

I realize, of course, that few get to jump-start their wealth-building with a high-paying career on Wall Street, let alone at Goldman. I've been blessed in that regard.

But every bit of wealth you save earns you more freedom. Most of us have had a time when an unexpected bill or car repair could wreck our entire month. Building a little savings account frees you from that stress. Many have been stuck in a job we'd love to quit... But you've got rent to pay. Building up a bigger nest egg could allow you to job-hunt full-time.

Wealth creates freedom. And you can earn that freedom for yourself.

First, you should spend your 20s, and preferably your whole life, developing valuable skills.

Any sort of skill, from playing the piano to building a fire, can be personally rewarding. But the modern world has deemed some skills to be highly valuable and worth your time to cultivate.

Understanding and making straightforward financial decisions is another such skill. You can learn it. It doesn't take a PhD. And thanks in part to the magic of compounding, learning this skill now will pay off immensely more than it will if you wait five or 10 years.

That goes for your marketable skills as well. If you learn a new skill that will earn you $10,000 a year at age 25, it's a lot more valuable than learning it at 40. Plus, your skills are cumulative. Learning math allows you to learn accounting, which allows you to learn investing and so on.

It may be a tough pill to swallow, but nobody cares about you as much as you do...

It's true. Institutions don't care about you. Your former fifth-grade teacher doesn't, either. Heck, even Mom and Dad may go to court to get you out of the house.

This is the real world. No one gives you a guarantee on anything you've got. Your health, your job, your home... every person on Earth must work and provide to survive.

You may have gotten a few bailouts from your parents or a couple handouts from the government during your early years, but those weren't free. Your parents worked to provide them... or the taxpayers did.

Nothing comes free. Somebody pays. And it's up to you to be a contributor.

Taking responsibility means understanding where your money comes from, where it goes, and how to put it to work. And it means building up the kind of wealth that helps you sleep well at night and have the freedom to make the choices you want to make.

When you get started, things are simple. You may not have a lot of money rolling in, but you don't have complicated tax issues, real estate holdings, or a large number of bills just yet.

You can get a financial head start by doing three simple things...

The first is living your life right. This one is straightforward. You need to spend less than you earn. If you don't save your money, you'll never get anywhere.

This isn't a matter of intelligence or study. It's a matter of discipline.

Everyone knows that saving more will build their wealth. Every January 1, many folks make a resolution to save more money. Yet almost no one does it.

According to a survey from the website Bankrate, 19% of Americans do not save any of their annual income. Another 21% only saves 5% or less. And only 16% of Americans save more than 15%, which is generally accepted as the proper amount to save.

We all overspend for different reasons, and you need to find the mental tricks that work for you. Some folks do well by pricing things in "hours worked" instead of dollars. Others do well by having wages directly deposited into a savings account so they never see them. Some can keep a tighter eye on things by obsessing over a detailed monthly budget.

Once you've got a little extra money, pay off the credit cards and build up a "rainy day" account of at least three months' worth of expenses.

The second step is to secure the best (risk-adjusted) return you can get...

Now that you've cleaned up the basics of your balance sheet, how do you grow your wealth? Should you put it into the stock market? Buy a house? The possibilities are endless.

Every financial decision, whether borrowing or paying, comes down to return and risk. You can put money in a savings account with a 0.1% return and almost zero risk, or you can collect around 7% in stocks with a good deal more risk.

As a recent grad, you can always make one move that beats all others...

Pay off your student debt. Since student debt can't be discharged in bankruptcy, paying it off is a completely risk-free return on your money. You have to pay that money back, no matter what. So paying it now is risk-free.

The reality is, college graduates are drowning in student loans.

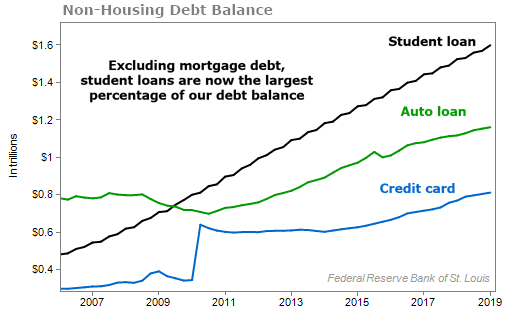

Back in 2004, college graduates carried a total of only $260 billion in student debt. Now the balance adds up to $1.6 trillion... an increase of 515%.

There are three simple ways to make paying them off a little easier. First, take the time to fill out some refinance applications and find out if you can get a better rate.

Second, start paying off loans while you're still in college. If you have a federal student loan, you're allowed to make pre-payments while still in school with no penalties. The lower your balance is by the time the interest kicks in, the less you pay overall.

Third, pay off more than the minimum required. The easiest way to do this is to set up automatic payments (as a bonus, many lenders will offer a discount when you set them up) and add in the ability to make additional payments. If you have a $100,000 loan, a 7% interest rate, and a 10-year repayment plan, if you simply pay an extra $100 a month, you will save nearly $4,700 in interest costs. And you'll pay off the loan more than a year ahead of schedule.

The third step is to start early and go for a long time...

Always contribute to your 401(k) and maximize your employer match. We'd recommend starting your 401(k) even if you've got a little credit-card debt and before really tackling your student loans – at least up to the employer match.

It's free money. And I don't know anyone in his right mind who would turn down free money...

Yet it's becoming more apparent to me that folks entering the workforce have no clue about 401(k)s and seem oblivious to the advantages.

At my company, we match half of an employee's contributions up to 6% of salary. That means you put away 6% but get 9% in savings. Even better, you get to put the money away before taxes. So in the end you could earn something like $1.70 for every $1 reduction in your paycheck. That's simply phenomenal.

Also, when you start earlier, you get the benefit of compounding growth.

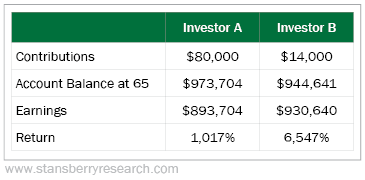

Let's say two investors each deposit $2,000 into an account earning and reinvesting 10% dividends...

Investor A starts at age 26 and makes a $2,000 deposit each year until he retires at 65. Investor B makes his first deposit at age 19, then adds $2,000 for only the next six years.

For simplicity, imagine their stock portfolios show no share-price appreciation. They just crank out 10% dividends each year. On their 65th birthdays, the two investors compare the balances in their accounts.

Even though Investor B only made seven contributions, he made more money than Investor A, who made 40 contributions. The trick is, Investor B started seven years earlier. So on the day Investor A made his first contribution, Investor B had already accumulated more than $20,000, and his portfolio was earning more than $2,000 a year in dividends.

The earlier, the better. For folks looking to help your grandchildren out with college, invest a few thousand dollars when they're born, let it compound for 20 years, and you'll be the world's best grandparents come college time.

What We're Reading...

- Something different: Should we wash our clothes?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 10, 2019