The artificial-intelligence ("AI") craze continues...

Alphabet (owner of Google) CEO Sundar Pichai made a strategic move during a recent call with analysts, reminding them that the search-engine company has been "AI first" since 2016.

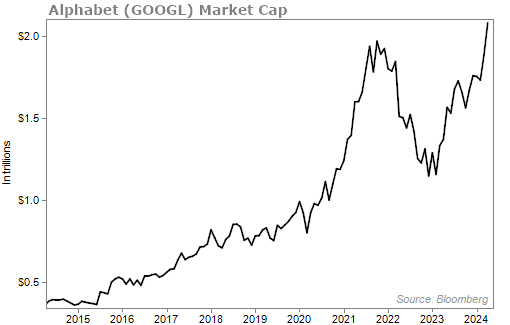

This focus and investment is finally starting to pay off... Alphabet (GOOGL) is now worth more than $2 trillion. It's currently the world's fourth most valuable public company, right behind Nvidia (NVDA), Apple (AAPL), and Microsoft (MSFT).

Take a look at how Alphabet's market cap has shot up recently...

Alphabet reported blockbuster earnings last week. Earnings per share came in nearly 24% higher than analyst projections. Revenue was 2.3% higher than projected. And this is no easy feat as the company has a ton of eyeballs on it.

Most of this growth was due to the success of Google's search engine. But Pichai knows what analysts want to hear... AI.

Pichai highlighted the contributions of Google Cloud, which uses generative AI through Google's AI model, Gemini. Here's what he said...

In Cloud, we have announced more than 1,000 new products and features over the past eight months. At Google Cloud Next, more than 300 customers and partners spoke about their generative AI successes with Google Cloud, including global brands like Bayer, Cintas, Mercedes Benz, Walmart, and many more.

He also claimed Google is "positioned for the next wave of AI innovation and the opportunity ahead."

Executives at tech firms – and just about any type of company nowadays – can take a lesson from Pichai. Investors want to hear about AI. They want to know the company is using AI to boost sales and profits. (Investors also loved to hear that Alphabet will start paying a dividend, something we value as shareholders.)

Alphabet isn't the only company touting its AI offerings... Microsoft also had a big quarter, thanks to AI.

Microsoft's revenue for the third quarter came in 17% higher than a year ago.

You see, about a year ago, Microsoft began to put AI into everything it does. Specifically, it uses generative AI in its flagship cloud-computing product, Azure. Azure cloud revenue gained 31% for the quarter, much higher than expectations.

Chief Financial Officer Amy Hood had this to say...

While of course it's still early in the long-term AI monetization opportunity, we feel good about where we are.

Microsoft's stock is about 8% off its all-time high stock price. It has a market cap of nearly $3 trillion.

It's no secret what investors are clamoring for these days... If your company uses AI and promotes the fact that it uses AI, then the stock is likely near an all-time high.

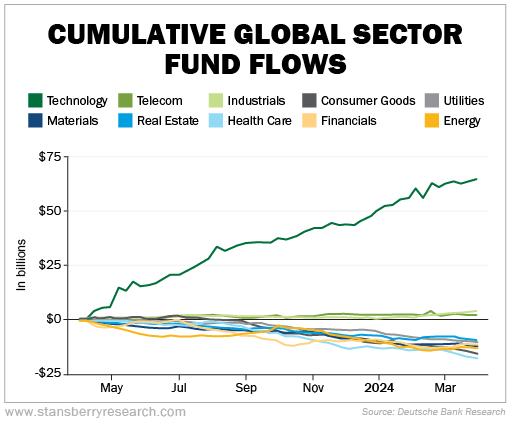

As you'd expect, investors have been piling into AI stocks in droves recently.

The chart below looks at sector fund flows over the past 12 months. Since many companies that use AI are in the tech space, it makes sense that investors are buying tech stocks.

What we're seeing today is an absurd rotation away from other sectors to tech...

It's true that tech profits have been high in recent quarters. But seeing this chart gives me pause... As I've written about many times before, you don't want to be the person doing the exact same thing in the market as everyone else.

While piling into the hottest trend may work for a while, it usually leads you to buy at a top... and ultimately get burned.

I look at a chart like this and find myself getting interested in health care. Fund flows have been negative over the past 12 months. If folks are selling and aren't interested in the sector, that makes me want to be a buyer.

As always, contrarian investing is the best way to get long-term gains in the market.

What We're Reading...

- Something different: 'Not going to answer that': LeBron James quiet on future after Lakers' playoff exit.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 1, 2024