I get asked all the time, "Doc, what's the key to big, wealth-altering gains in the stock market?"

The answer is less complicated than you think...

For me, big gains are all about two things: quality and patience.

Most investors want to buy stocks at the perfect time. They want to buy a stock when it's at an exact bottom and hold on for the recovery up. If a stock falls 50% and you buy, you'll earn 100% if it gets back to the price it fell from.

But timing the market perfectly is unrealistic. It's fantasy.

If your strategy is based off of calling bottoms and tops, you're in for a rough go.

What I do is simple... I buy great businesses and hold them for the long term. As long as my outlook and thesis about the company don't change, I keep on holding.

Obviously, you've heard this before. Every "Investing 101" class will tell you to buy quality stocks and be patient with them. But there's something that always seems to hold investors back...

The sin of investing, and we've all been guilty of it, is selling great stocks too early.

I'll go over three examples with you...

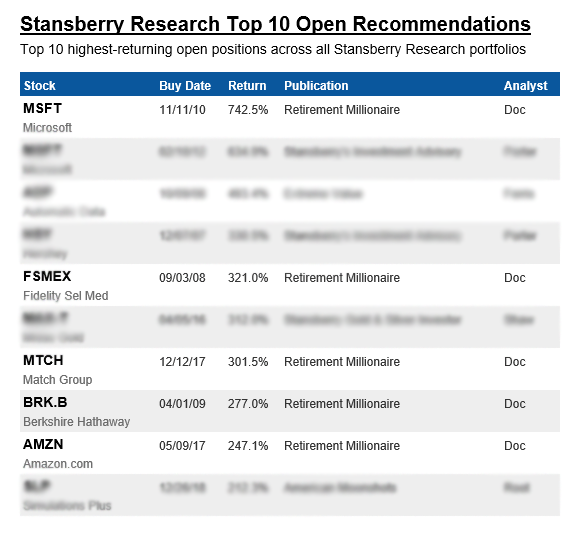

In the Stansberry Digest, we publish the top 10 highest-returning open positions across all Stansberry Research portfolios. If you'll take a look at yesterday's open gains, you'll notice that picks from my Retirement Millionaire newsletter dominate that list...

Getting just one 200%-plus gain can give you plenty more comfort in your retirement. But having five big winners, with one over 700%, can change your retirement in a hurry.

The secret? Buying quality and being patient.

Take a look at Amazon's (AMZN) chart below. We bought shares back in May of 2017 when the stock was trading for a ridiculous 176 times earnings. We certainly didn't try to time our entry...

In fact, we bought Amazon when it was trading at an all-time high. But we knew that Amazon had plenty of growth ahead of it and that it would very likely be a more valuable company in a few years than what it was at the time. We didn't let its valuation deter us from one of the greatest businesses of all time.

New high after new high, we've kept holding shares...

Our subscribers are now sitting on gains of 244% in just over three years. And we think there are more gains to come.

Now take a look at the chart of online-dating giant Match Group (MTCH).

From the time we bought in late 2017 to today, it has been anything but a smooth ride up...

It has been a volatile stock, but through all the ups and downs, we've held on. We didn't sell when we were up 100% because we knew Match Group had plenty more opportunity to grow its business and market share... We didn't sell when we were first up 200% or when it collapsed in March... and that's because our long-term thesis was still intact.

One way to keep us in volatile stocks that we want to own for many years like Match Group is our sell-stop strategy. For most of our Retirement Millionaire recommendations, we use a 25% hard stop. That means if the stock falls 25% from where you bought it, sell it.

So if the stock does move higher and you have big gains, the hard stop allows for some volatility without getting stopped out – compared with something like a trailing stop where you may be forced to sell before you want to.

Basically, a hard stop means we rarely ever sell winners early.

And if a stock does fall 25% from our entry price, it either means we were wrong about the stock or we had horrendous timing.

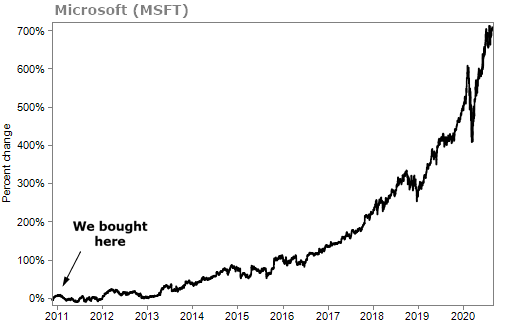

Finally, take a look at Microsoft's (MSFT) chart. We obviously bought at a great time, right after the financial crisis. But for two years after our recommendation, the stock went nowhere.

Still, we held and were patient. It would have been easy to take profits when we were up 300%, 500%, or 600%... But we didn't. Our thesis was still intact. And it still is. We're not selling even after we're up 740%...

We've also re-recommended Microsoft a couple times over the past few years. We were that bullish on the stock even after we made big gains since 2010. And readers who weren't able to buy back in 2010, could have bought in recent years and still been up big.

This is my key to making big, life-altering gains in the stock market...

Buy some of the best businesses in the world and let them run. And every couple of months, review why you originally bought the stock. If the story hasn't changed, keep on holding.

One thing you can do is consider that every day you hold a stock you are deciding to buy it anew.

But I'm not the only one at Stansberry Research who has a track record of making big gains in the stock market...

My colleague Dave Lashmet has one of the best track records in our industry.

In fact, 1 of out every 3 stock picks he makes at least doubles in price.

Dave's been able to recommend huge winners because he's one of the most well-connected men in medical financial research. He has been to over 100 conferences over the past two decades, getting the inside scoop on different drugs and breakthrough technologies.

And just recently, Dave closed out his position on biotech company Inovio Pharmaceuticals (INO) for a 1,139% gain in only one year.

These types of gains normally take years to achieve... But with the type of stocks that Dave targets, gains like these are not unnormal.

Just know that this type of investing can be volatile. There are plenty of ups and downs. But Dave's track record proves that he can give you winners that can truly change your retirement for the better.

Today, Dave is coming forward to call the next major player in the drug industry. He's making the biggest gain prediction of his career – a first-ever 20-bagger call.

Be sure to hear about all of the details by clicking here.

What We're Reading...

- American Airlines to cut 19,000 jobs in October without aid, workforce shrinking 30%.

- Something different: Olympic great Usain Bolt tests positive for the coronavirus.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 26, 2020